Stop sending investors to licensing maze

To attract both local and foreign investment, the Asian Development Bank (ADB) has urged Bangladesh to simplify its business licensing process, which currently requires investors to navigate over two dozen government offices to secure more than 150 regulatory approvals.

In its April edition of the Asian Development Outlook, the Manila-based lender said the greatest regulatory hurdle new businesses in Bangladesh face is securing sector-specific licences – a process the ADB described as "cumbersome and time-consuming".

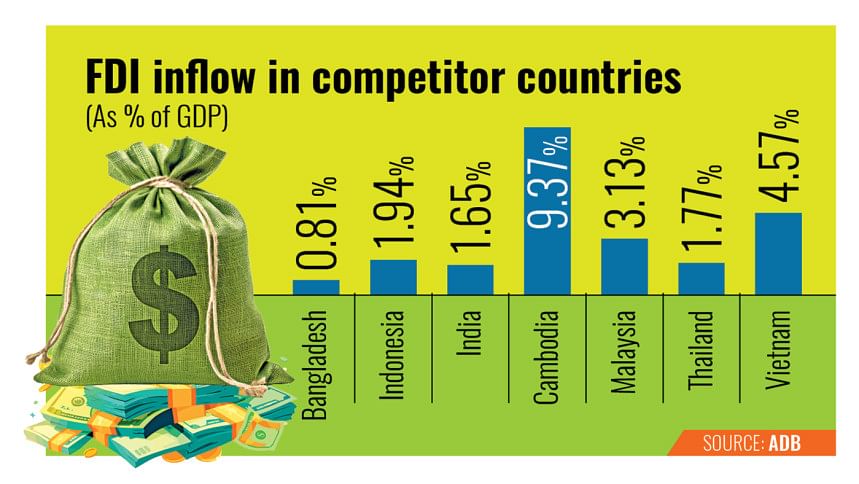

Citing Bangladesh's historically low levels of foreign direct investment (FDI) compared to regional peers, the ADB said, "Bangladesh's complex business regulatory environment is arguably the major challenge to attracting FDI."

With the country set to graduate from the United Nations' list of least developed countries (LDCs) in November 2026, the ADB mapped out six key recommendations to improve the investment climate.

Chief among them is simplifying the licensing process.

Other suggestions include streamlining reforms to attract FDI, reducing bureaucratic red tape, encouraging responsible business practices aligned with international standards, joining the World Trade Organization's (WTO) Investment Facilitation for Development initiative, and empowering the Bangladesh Investment Development Authority (Bida) to lead policy coherence and investment readiness.

"Since graduation typically entails the loss of preferential market access, it is imperative that a predictable and business-friendly environment be established to attract investment, boost competitiveness, and ensure a smooth and sustainable transition," the ADB said.

Chandan Sapkota, ADB's country economist, added that FDI inflows to Bangladesh have remained modest for years, often comprising retained or reinvested earnings rather than fresh equity capital.

Between 2013 and 2023, FDI in Bangladesh averaged just 0.8 percent of the gross domestic product (GDP). In contrast, the figure stood at 9.4 percent in Cambodia, 4.6 percent in Vietnam and 1.9 percent in Indonesia.

Quoting a World Bank survey, Sapkota said lengthy and burdensome licensing and permit procedures create uncertainty and increase the cost of doing business in Bangladesh.

He also noted that strict reporting requirements and the need for prior approval from the Bangladesh Bank for capital repatriation often deter potential investors from entering the market.

The ADB report, referencing the White Paper on the State of the Bangladesh Economy, which was prepared after the formation of the interim government, also identified additional obstacles to FDI.

These include a political economy that favours specific business groups, complex and inconsistent tax policies, and inadequate trade facilitation.

"Efforts to raise FDI are frustrated by a highly protective trade environment and policy inconsistency affecting trade, investment, and incentives," the report added.

In response, Bida has rolled out the Bangladesh Investment Climate Improvement Programme (BICIP), aimed at overhauling business regulations across seven critical areas.

Those are business entry and exit, industrial infrastructure, cross-border trade, dispute resolution, labour laws, taxation, investment incentives, and access to finance.

The ADB urged the government to fully leverage this initiative to cut red tape and enhance transparency.

As of January this year, Bida has also released an FDI heatmap, identifying high-potential sectors offering competitive advantages. This tool is expected to shape future investment roadshows, bilateral treaties, and strategic policy decisions.

According to the ADB, Bangladesh needs a streamlined reform programme to become a more competitive destination for both foreign and domestic investment. The priority should be to fast-track licensing and approvals, simplify business procedures, and improve coordination among government agencies.

To that end, the report advocated for strong political will and sufficient resources to support initiatives like BICIP, which offers a promising platform to improve the regulatory landscape.

The lender also called on the country to uphold international labour, environmental, and human rights standards, thereby promoting responsible business practices.

To steer investment-related reforms, the ADB recommended that Bangladesh join the WTO's Investment Facilitation for Development initiative.

Bida's leadership will be vital in aligning policies, fostering inter-agency coordination, and signalling to investors that Bangladesh is serious about creating a more welcoming investment environment, according to ADB.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments