Stocks moribund for far too long. Price curbs are to blame

Key stock indexes in India and Pakistan have surged to record highs despite the persisting fallout of the Russia-Ukraine war whereas the markets in Bangladesh have remained bearish for the last one and a half years owing to the floor price.

The deterioration of macroeconomic indicators fuelled by higher inflation, dwindling foreign exchange reserves, the sharp depreciation of the local currency, and political uncertainty is also responsible for the gloomy market scenario.

"The main reason is the floor price," said Prof Abu Ahmed, an analyst.

He explains that a major characteristic of a stock market is the fluctuation of its index: when an index drops, some people come to invest and this is the beauty of the market.

"In Bangladesh, this rule has been broken by the floor price, so the indexes have remained almost at the same stage for the past 18 months and turnover nosedived."

In July 2022, the Bangladesh Securities and Exchange Commission (BSEC) set the floor prices for every stock to halt their freefall amid global economic uncertainties brought on by the coronavirus pandemic.

In December last year, the regulator lifted the measure for 169 companies as part of measures to withdraw the move in phases. However, the floor price was reintroduced for all stocks in March this year since uncertainty in the economy persisted.

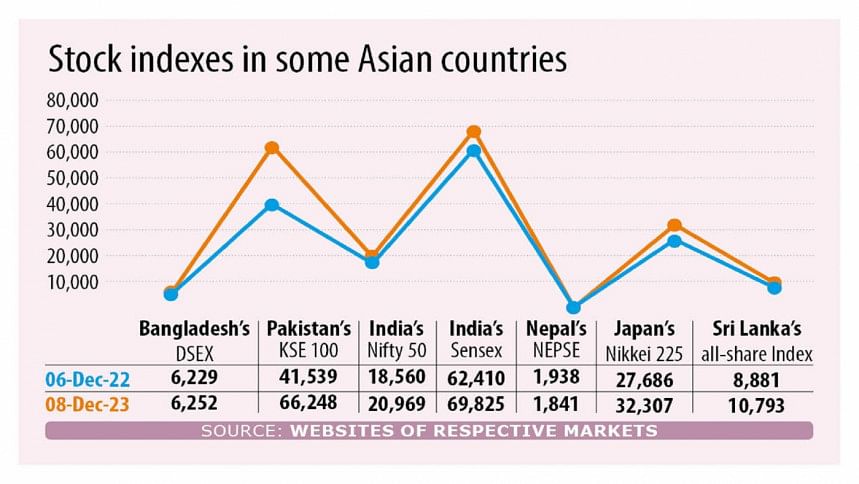

The DSEX, the benchmark index of the Dhaka Stock Exchange, closed at 6,252 points on Thursday, which was 6,233 on the same day the previous year.

The benchmark indexes in India and Pakistan also dropped in the early days of the war, which exacerbated disruptions in the global supply chain and sent commodity prices higher. They, however, bounced back in the last six months and shattered previous records.

For example, in India, the benchmark Nifty jumped to a new high of 20,969 on Friday. The Sensex surged to hit a record high of 69,825.

Pakistan's main index breached the 60,000-point mark to trade at an all-time high of 62,507 on Tuesday. It further climbed to 66,248 on Friday, data on the Pakistan Stock Exchange showed.

Nepal's NEPSE Index rose to its highest level in 2021. After the war broke out, it slipped below 1,800. Last year, the index surged to 2,300 and now it is hovering around 1,950.

Even, the Sri Lankan market soared to a historic high in 2022 after overcoming the deep shock stemming from the island nation's worst economic crisis in history.

Ahmed, a former chairman of the economics department at the University of Dhaka, said the floor is violating the basic rights of investors as they can't sell shares at will.

"Who will come to invest in such a market?"

Ahmed said economic instability is another reason for the current state of the market.

Kazi Ahsan Maruf, managing director of Ekush Wealth Management, also blamed the floor price as well as the ineffective monetary policy for the bearish trend in the market.

"India took proper policies and hiked interest rates on time to tackle higher inflation. Besides, its exchange rate has not been kept at an artificially higher level. On the other hand, Bangladesh did not manage the situation properly."

Last month, the policy rate was hiked to 7.75 percent as the government raised the benchmark rate for the eighth time in 19 months as inflation has kept surging.

But experts said the country had not raised the rate as aggressively as it should have. Besides, the exchange rate is not market-based yet.

As a result, the economy is still struggling to absorb the shocks brought on by the Ukraine war since inflation has stayed at over 9 percent, the forex reserves dropped to a record low level and the taka is staring at a further loss after shedding a value of about 30 percent since January last year.

"The economic pressure has not eased yet," said Maruf.

Therefore, many investors are waiting for an opportunity to buy stocks at far lower prices as they think that the index may plunge after the lifting of the floor price since the economy is not in good shape.

"When such expectations prevail in the market, money will not flow in," said Maruf.

A common nature of a stock market is its moves in line with the health of the economy, so it was obvious that the indexes would drop in Bangladesh when the war erupted since the crisis hit hard the import-dependent country, said a stockbroker.

He says when an index drops, a group of investors invest in the stocks whose value has declined. The investment goes on to support the index. So, intervention in the price mechanism is not required.

"The market should be allowed to operate on its own."

The broker said owing to the floor price, turnover has plummeted and the market has lost its vibrancy.

"Investors' funds are stuck now and market intermediaries are struggling to survive due to a low turnover. This has hit the confidence of institutional and foreign investors."

At the DSE, turnover is currently hovering around Tk 500 crore after rocketing to as high as Tk 1,400 crore in November last year.

Prof Abu Ahmed urged the BSEC to lift the floor price. "The market may plunge in the aftermath of the withdrawal, but it will bounce back ultimately."

A merchant banker said the floor price is hurting the image of the market and this may lead to the downgrade of the regulator.

The International Organization of Securities Commissions, a Madrid-based association of organisations that regulate the world's securities and futures markets, elevated the BSEC's status to the "A" category from the "B" category in 2013.

The merchant banker recommended the regulator lift the floor price in phases.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments