Stimulus loans elude many

Small and medium enterprises, exporters and farmers have experienced their worst-ever crisis because of the coronavirus pandemic. Six months after they received the body blow, they are now going through another crisis -- the shortage of funds -- although they are desperately trying to pull themselves up and the economy along with them.

Despite the government's swift measures in response to the pandemic in April, the disbursement from the stimulus packages for SMEs and farm sectors and pre-shipment credit for exporters is yet to gather momentum because of the absence of the central bank's initiative and the negligence on the part of banks.

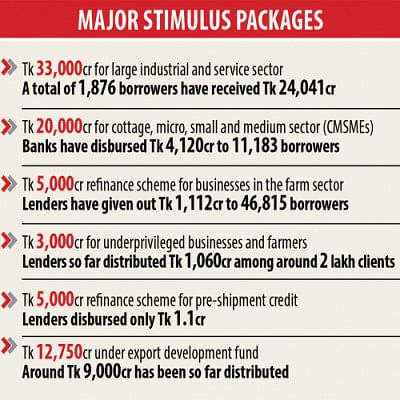

Lenders, however, have given out a major portion of the fiscal lifelines unveiled for the large industries and service sectors as the disbursement process is easier than those put in place for the SME and farm sectors.

Soon after the deadly virus arrived on the shores of the country, the government and the central bank took 19 stimulus packages worth Tk 106,117 crore to tackle the economic fallout brought on by the pandemic.

Banks have been given the responsibility to distribute more than Tk 80,000 crore of the stimulus packages in the form of soft loans.

Experts say that both the government and the central bank should rearrange the tenure of the packages given the slow recovery from the pandemic. Both the agriculture and SME sectors should be addressed properly by implementing the stimulus packages as they are the backbone of the economy.

So far, banks have disbursed about Tk 4,120 crore among 11,183 borrowers under the stimulus package worth Tk 20,000 crore dedicated for the SME sector.

The central bank unveiled the package on April 13 and it later said half of the package's amount would be provided from the BB in the form of the refinance scheme.

The loan will be given at 9 per cent interest rate. Of the interest rate, 4 per cent will be borne by the borrowers and 5 per cent by the government.

But banks are showing reluctance to speed up disbursements as clients in the manufacturing sector is permitted to secure a maximum of 30 per cent of their existing working capital.

The amount is insignificant as a large number of small and medium enterprises usually take loans in the range of Tk 7 lakh to Tk 8 lakh. This prompted the central bank to increase the ceiling to 50 per cent of the working capital.

"The central bank's initiative will encourage clients to take loans from the package," said Syed Abdul Momen, head of SMEs at Brac Bank.

The central bank has recently asked banks and non-bank financial institutions to disburse the fund of the package by October.

It is very difficult to lend SMEs at 9 per cent while maintaining acquisition and maintenance costs, said Rahel Ahmed, managing director of Prime Bank, recently.

He called on the policymakers to reconsider the interest rate cap for the SME clients.

Banks have disbursed Tk 1,112 crore among 46,815 borrowers under the stimulus package for the farming sector, which received Tk 5,000 crore.

The central bank repeatedly asked banks to pay out the loans by this month so that the country's agriculture sector does not face any adverse situation due to the financial meltdown, a Bangladesh Bank official said.

Banks blamed the latest floods for the weak implementation as this has discouraged entrepreneurs to take out loans, he said.

"But banks are also responsible for the lower disbursement as they have not taken adequate initiatives to give out the loans," he said.

The Tk 5,000-crore stimulus package in the form of pre-shipment credit for the export sector made the worst start as only Tk 1.1 crore has so far been disbursed.

Exporters usually avail the loans before shipping products to complete packaging.

The central bank initially asked banks to apply to it for the loan within seven days after shipping exported goods. But this is quite impossible to do so for the exporters and the central bank revised the provision last month.

As per the new condition, banks will apply to the central bank for the loans within seven days after they bankroll clients.

"The latest central bank's move will help implement the package smoothly," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Banks disbursed stimulus package for large industries and the service sector promptly. Some 72.85 per cent of the Tk 33,000-crore package has been given out so far.

The whole fund of the package may be disbursed by September, the BB official said.

Lenders distributed Tk 1,060 crore among around 2 lakh clients under the stimulus package worth Tk 3,000 crore set aside for the underprivileged businesses and farmers.

The entire package could be implemented by December, the central banker said.

The central bank raised its export development fund to $5 billion against the previous amount of $3.5 billion to make available more funds for export-oriented businesses. So far Tk 9,000cr has been distributed.

Clients of all stimulus packages will have to repay the loans within a year, which will create a crisis in the financial sector in the days ahead, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The slow economic recovery has indicated that the financial sector will be unable to pick up fully within seven to eight months, he said.

So, both the central bank and the government should extend the repayment tenure, or else defaulted loans in the banking will escalate, he said.

The government will have to give a subsidy of around Tk 3,500 crore to execute the stimulus packages.

The central bank and the government should immediately address the problems that have created a roadblock for the implementation of the packages, said Zahid Hussain, a former lead economist at the World Bank's Dhaka office.

"In Bangladesh, the SME sector is largely considered as an informal sector. So, proper initiatives are needed to disburse loans to small businesses as they are the growth engines for the country," he said.

In Bangladesh, SMEs account for 20 per cent of the GDP, 80 per cent of the total industrial employment and 25 per cent of the labour force.

The Covid-19 pandemic has threatened the existence of 2.5 million SMEs in Bangladesh, according to the International Labour Organisation.

The central bank has introduced a credit guarantee scheme for the loans going to the SMEs. Now banks hope it would accelerate the credit flow.

The number of clients is higher in the SME segment compared to the large borrower segment, said Emranul Huq, managing director of Dhaka Bank.

For example, Dhaka Bank has been given the task of disbursing Tk 758 crore as large loans. The number of its clients in the segment is 257.

But it has got the job to give Tk 250 crore in SME loans. Some 3,100 clients of the bank are eligible for the loans.

"We are trying to speed up the disbursement," Huq said.

According to Huq, banks face challenges in availing the right information and data from SME clients. In most cases, clients don't have records and now many of them don't have a clear idea about how to make a comeback.

"So, it takes time to process an application. We have to verify the information because, at the end of the day, banks would bear the credit risks. If we don't have proper information about the clients, due diligence would not be maintained."

Dhaka Bank would disburse all large and SME loans by October 31, he said.

A managing director of a private commercial bank said banks are extra cautious in giving out loans this time.

"Although our economy is recovering, there are uncertainties at home and abroad. This additional cautiousness aims at keeping the health of banks sound and ensuring that they get back the loans."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments