Social Islami Bank now offers digital experience

Social Islami Bank has moved fast to transform its traditional banking services into digital ones amidst the ongoing economic hardship caused by the coronavirus pandemic, said its top executive.

"In the past, many of our clients had to come to branches to avail retail banking services," said Managing Director Quazi Osman Ali.

"Now they can enjoy a good number of financial services sitting back at their homes thanks to our latest digital initiatives."

On the occasion of its 25th founding anniversary, the Shariah-based lender has decided to digitalise its banking activities on a broad scale to cater financial services to tech-savvy clients in keeping pace with times.

As part of its initiatives to create a vibrant digital banking sphere, Social Islami Bank, which started its banking operations in November 1995, introduced e-account opening services in October such that clients can smoothly open accounts with the bank.

Anyone from anywhere in the country can now open an account through "SIBL NOW"--a mobile application of the lender that offers internet banking services at all times, said Ali in an exclusive interview with The Daily Star last week.

Clients do not even have to come into a branch to ink their signatures for opening accounts as they are allowed to place it through the digital app.

They are also able to settle both intra- and inter-bank retail transactions in real-time through the app, which was rolled out last year.

"We have been working towards developing another software which will allow clients to withdraw funds from branches without necessitating the submission of a cheque," said Ali, who joined the lender as managing director in October 2017.

Under the upcoming system, a client will have to scan a QR (quick response) code by using the lender's mobile app to withdraw funds from the desired account.

The digital system will be launched within December, Ali said.

In order to smoothly provide banking services to clients during the ongoing coronavirus pandemic, the lender launched a full-fledged call centre in September.

This helps clients keep the deadly flu at bay by sidestepping the need to come to branches.

The call centre now responds to all types of queries placed by clients, round the clock.

In addition, Social Islami Bank has taken several initiatives to give a boost to paperless banking.

Approval processes for opening and settling of letters of credit are being conveyed using digital means.

For instance, once clients submit their applications, every branch now sends the documents required for opening of LCs to the head office through the digital mode.

The senior management then gives a decision on it and sends the instructions to the branch for the required measures to be taken. All of these procedures are now being carried out through the online platform without the use of any paper.

The online process for settling foreign trade has also commenced in August.

Social Islami Bank has recently introduced a dual prepaid card, helping clients purchase products from domestic and global markets by making use of both local and foreign currency.

The lender has recently rolled out two loan products titled "Probashi Agrojatra" and "Probasi Uddog" in an attempt to come to the aid of migrant workers, who have been forced to return on being terminated from their jobs due to the ongoing economic hardship.

Under the products, such workers will be allowed to get loans of Tk 5 lakh without having to produce collateral and, with a mortgage, Tk 20 lakh.

The two products are expected to help generate employment in the country and alleviate the woes of the unemployed expatriate Bangladeshis.

The bank, which operates its business through 161 branches, 54 sub-branches and 140 ATMs across the country, has placed the utmost importance on speeding up financial inclusion to bring unbanked people under the formal financial system.

"But we will do it not by opening branches as the branch-led banking model is not effective anymore, given the high establishment cost of the outlets," said Ali, who started his banking career in 1984.

The lender will set up more and more sub-branches instead of establishing branches.

Clients of sub-branches can now enjoy nearly the full range of banking services, all except for foreign exchange related businesses.

The Shariah-based lender has so far set up 54 sub-branches, and 20 more will be opened within December.

The initiative will almost eliminate the necessity for opening more full-fledged branches.

"The bank will only open a limited number of branches in the remotest parts of the country in the days ahead," said Ali, who served as the additional managing director at First Security Islami Bank before joining Social Islami Bank.

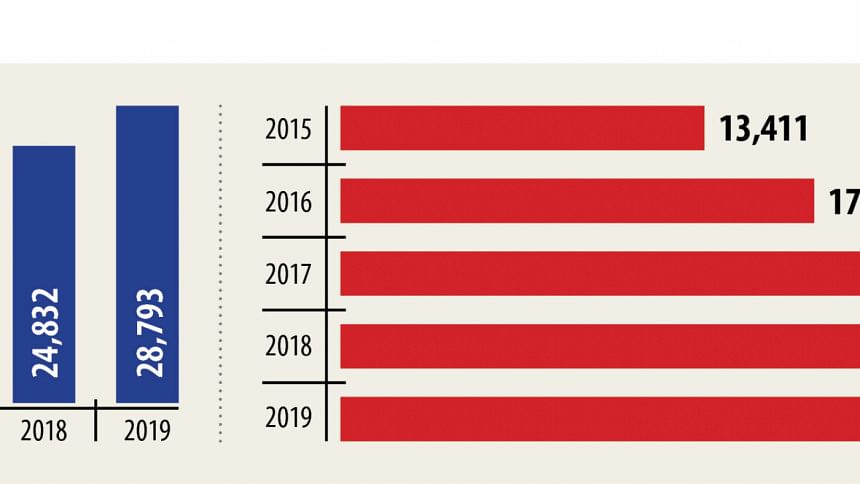

Three years ago Social Islami Bank had only 49 agent outlets and a collective deposit of Tk 1.80 crore under the agent banking programme of the central bank.

But the number of agent outlets of the bank is now around 150 and it has mobilised more than Tk 200 crore in deposits by using the window.

"We will open more agent outlets."

The bank also plays a vital role in the field of education, medicine, sports, disaster management and rehabilitation under its corporate social responsibility programme, Ali said.

The lender has taken up a joint programme with UCEP (Underprivileged Children's Educational Programmes) Bangladesh to provide skill development training to physically challenged and underprivileged youth.

Under the SIBL-UCEP Skill Training Project, 100 students are getting training in Dhaka and Chattogram, which includes job placement opportunities in different institutions.

Twenty-fivestudents have already joined various industries, Ali said.

The lender had earlier rolled out a number of Shariah-based loan and deposit products, which gave a jumpstart to it, turning it into one of the most reputed Islamic lenders in the country, Ali said.

Among all Islamic lenders in the country, Social Islami Bank pioneered cash waqf.

By opening a cash waqf deposit account, clients can get an opportunity to bring about welfare for humanity through Sadaka-e-Jariah.

Social Islami Bank urges all religious and affluent persons of society to come forward to mobilise cash waqf deposits so that the profit may be utilised for the well-being of humanity.

The amount deposited in the cash waqf account will be invested as per the bank's own decision in conformity with the Shariah laws.

The cash waqf amount will earn profit at the highest rate offered by the bank from time to time.

The waqf amount will remain intact, and only the profit amount will be spent for the purposes specified by the depositors.

The bank has introduced another savings product, namely "Sonali Kabin – Mudaraba Mohorana Savings Scheme" – in order to help unmarried people, Ali said.

"Denmohor", or money or possessions paid by the groom to the bride at the time of marriage, is considered one of the rights of the wives which is enforceable by the Shariah laws.

This product is aimed at creating consciousness among married as well as unmarried men over the need to pay "Denmohor".

The scheme holders can operate the account based on Mudaraba policy of Islamic Shariah.

By depositing monthly instalments, the beneficiaries can pay "Denmohor" to their wives after a certain period.

"Proshanti – Mudaraba Zakat Savings Account", another deposit product, has been rolled out by the bank to help clients such that they can pay zakat smoothly, said Ali, who attained both his graduate and postgraduate degrees in management from the University of Chittagong.

Zakat is the most important foundation of a Shariah-based economy, which is Farz for every capable Muslim as well, he said.

In some cases, those intending to pay zakat face difficulties in calculating the exact amount.

Keeping this in mind, the savings account has been introduced like a special deposit scheme, Ali said.

The depositors will get a profit at a rate of 10 per cent on the daily balance.

Those paying the zakat or the bank on their behalf can withdraw the zakat amount from the total savings, including profit, after the month of December and spend it on select sectors as per the directions of Al Quran.

The bank has also decided to expand its business in the global arena.

It has already got approval from Bangladesh Bank to set up a branch in the Kingdom of Saudi Arabia.

An application was submitted last year with the Saudi Arabian Monetary Authority (SAMA), the central bank of the KSA, to set up the branch.

If the SAMA approves, the migrant workers in the Gulf country will be able to send remittance and take loans from the branch in an effortless manner.

"We are also thinking of establishing representative offices in different countries to strengthen our global presence."

Ali also touched upon some pressing issues in the banking sector.

The cap of 9 per cent interest rate on lending has put an adverse impact on the profitability of the bank as it had earlier mobilised funds offering high-interest rates on long-term deposits.

"Banks now keep lower provisioning than the required amount set by the central bank due to the moratorium facility offered by the central bank," Ali said.

But Social Islami Bank will take up initiatives to strengthen its provisioning base such that its balance sheet is capable of fighting difficulties in case any crisis stemming from the ongoing business slowdown.

"In addition, we will restructure the loans to help borrowers after December when the moratorium facility will not be available such that our clients will be able to operate their businesses sweeping aside the business slowdown," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments