Scope for investing in stocks has never been so narrow

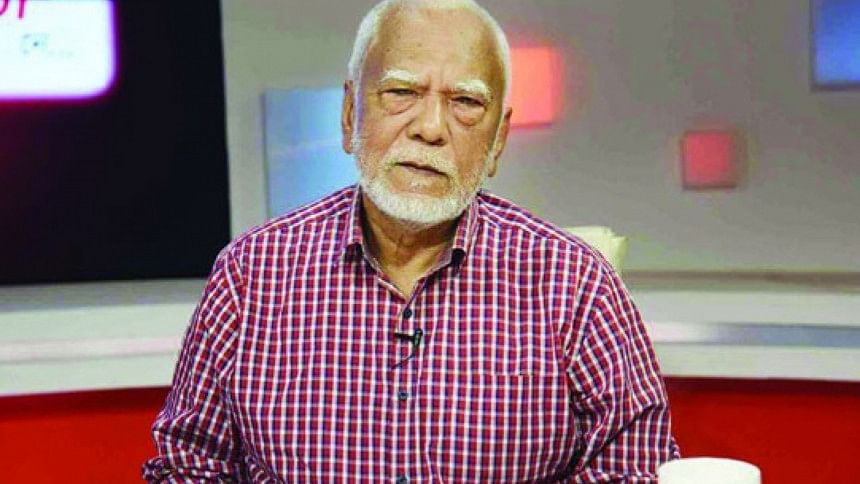

Bangladesh's stock market has never fallen into such a bad situation in terms of the narrowing of investment opportunities in the last 30 years, said Abu Ahmed, a stock market analyst.

Half of the banks, non-bank financial institutions and mutual funds are showcasing a dismal performance by giving out very low dividends, he said.

Power companies are also facing problems when it comes to generating revenue as their agreements with the government are very near to expiring, he said.

Local companies which had earlier staged a strong performance are struggling due to high inflationary pressure, rising energy costs and a massive devaluation of the local currency, which is deteriorating their performance, he added.

Multinational companies (MNCs) were comparatively in a better position in making money but they were declaring very low dividends, said Ahmed, who is a former chairman of the economic department of the University of Dhaka and a stock market investor.

"I have never, in my entire investment period since 1985, seen the MNCs pay such low dividends," he said.

As the country is facing a shortage of the US dollar, these companies did not continue declaring high dividends last year, he said in an interview with The Daily Star yesterday.

"So, where will people invest? I have not seen such a bad situation in the stock market in the past, at least in the last 30 years," he said.

Ahmed initially invested in the primary stock market and later started to trade in the secondary stock market in 1987. Since then, he has been active.

The performance of listed companies is not up to par, for which the stock market index is on a falling trend, he said.

Foreign investors have been making sales on a massive scale for the last couple of years because they knew that the local currency was artificially overvalued and it would certainly fall, he said.

"Now, it is happening, so I will not be surprised if foreign investors' investment slowly reaches zero," said Ahmed.

Institutional investors are also trying to shift their investments into treasury bonds as their yield rates are high, he said.

It is common for investment in the stock market to fall if the interest rate of the money market rises, he said.

Due to the launching of the floor price in the middle of 2022, many investors could not sell shares, said Ahmed.

But they realised that investments in the stock market should be diversified and some of the fund should be transferred to the bond market, he said.

Investors are suffering from a confidence crisis too and the economic situation is having an impact on investors' confidence, he added.

Most of the economic indicators are dismal, so investors are keeping their money tucked away in their pockets.

Poor governance from the regulators also hit investors' confidence, he said.

Limiting a day's fall of a stock through the circuit breaker to 3 percent, launching of the floor price, allowing asset management companies to give stock dividends, and extension of tenures of closed-end mutual funds are the examples of poor governance, he said.

Due to the 3 percent limit, a company needs to wait for several days to see a correction, for which the market's falling trend prevails for a lot more days, Ahmed added.

The regulator has not been held accountable, for which it has been taking such decisions, leaving a negative impact on the market for many years, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments