School banking getting popular

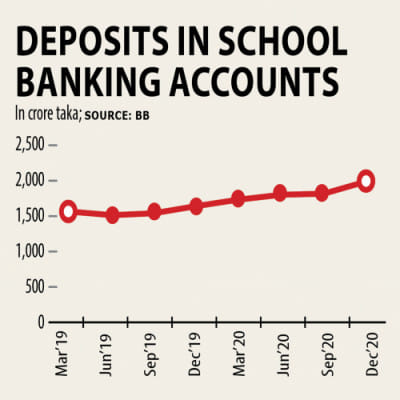

School banking is increasingly gaining popularity among students as the total deposits in such accounts reached around Tk 2,000 crore last year, sidestepping the pandemic-induced economic hardship.

As of December last year, students deposited Tk 1,950 crore in the accounts, up 20 per cent from a year ago and 7 per cent three months earlier, according to data from Bangladesh Bank.

The number of accounts under school banking rose 10 per cent to 26.90 lakh last year.

A number of banks earlier took a set of measures to widen the banking operations as per instructions of the central bank, which mainly gave a boost to financial inclusion among students, said a central bank official having substantial knowledge on the matter.

The number of accounts and the outstanding balance under school banking would have increased manifold had not the coronavirus pandemic hit the economy, he said.

Banks usually organise school banking conferences every year but the event was not held last year due to the pandemic, he said.

In addition, educational institutions remained closed throughout last year in order to keep the pandemic at bay, putting an adverse impact on the school banking programme.

"It is a positive sign that both the outstanding deposits and the number of accounts under the school banking programme rose last year," the official said.

The central bank introduced school banking in 2010 as a part of its efforts to widen financial inclusion and make students financially literate.

The scheme aims to instill the habit of savings into students and make them more efficient in money management.

So far, 55 banks have rolled out school banking operations, allowing students aged 11 years to 17 years to open accounts.

The accounts come with a number of advantages, such as waivers on fees and charges, free internet banking, lower minimum balance requirement and debit card availability at lower costs.

Accounts can be opened with a minimum deposit of Tk 100.

Dutch-Bangla Bank, the lender with the highest number of accounts opened under the school banking programme, has continued to keep its focus on school banking despite the pandemic, said Managing Director Abul Kashem Md Shirin.

As of December last year, the lender had opened 527,397 accounts, which amounts to 20 per cent of the total number of accounts under the school banking programme.

The bank accounted for 27 per cent of total deposits in school banking accounts operated by all lenders.

Guardians deposit funds in the school banking accounts on behalf of their sons and daughters with hopes of safeguarding their future from crisis, said Shirin.

"We have not lessened our focus on school banking despite the pandemic. We have got the guardians to understand that savings in the accounts will help make the future of their children bright," he said.

Such savings are usually used for the purpose of education, medical treatment and marriage of students in the future, he said.

The school banking programme will gain more tempo in the days ahead as the country's per capita income has been on the rise, said Shirin.

Md Moniruzzaman, a school teacher by profession living in Rangpur city, said he had been maintaining two separate accounts with banks for his two children so that they could have a better future.

"I will continue to maintain the accounts until they reach maturity when they will be allowed to operate the accounts," he said.

Dhaka Bank, which earlier took a number of initiatives to popularise school banking, struggled to shine with banking operations during the pandemic, said Managing Director Emranul Huq.

The lender rolled out two savings products -- Students' Ledger and Edu Savings Plan -- to attract students.

Edu Savings Plan is a long-term deposit scheme where students park a certain amount every month and the deposit is insured by MetLife Bangladesh.

Students with such accounts will receive insurance coverage for health treatments along with benefits that come with an insurance product.

Huq said the bank would take up initiatives soon to make the programme vibrant.

Bangladesh Bank earlier requested the National Curriculum and Textbook Board (NCTB) to include some chapters on financial literacy in textbooks of secondary school students, said the central bank official.

"We have already given some contents to the NCTB in order to generate financial literacy among students. Both the central bank and the NCTB earlier arranged three-four meetings to this end," he said.

But, the NCTB is yet to give any final response over when they will include the contents, he said.

The practice of savings will increase among students if the contents get included in the textbooks, said the official.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments