Rise and fall of Elias Brothers

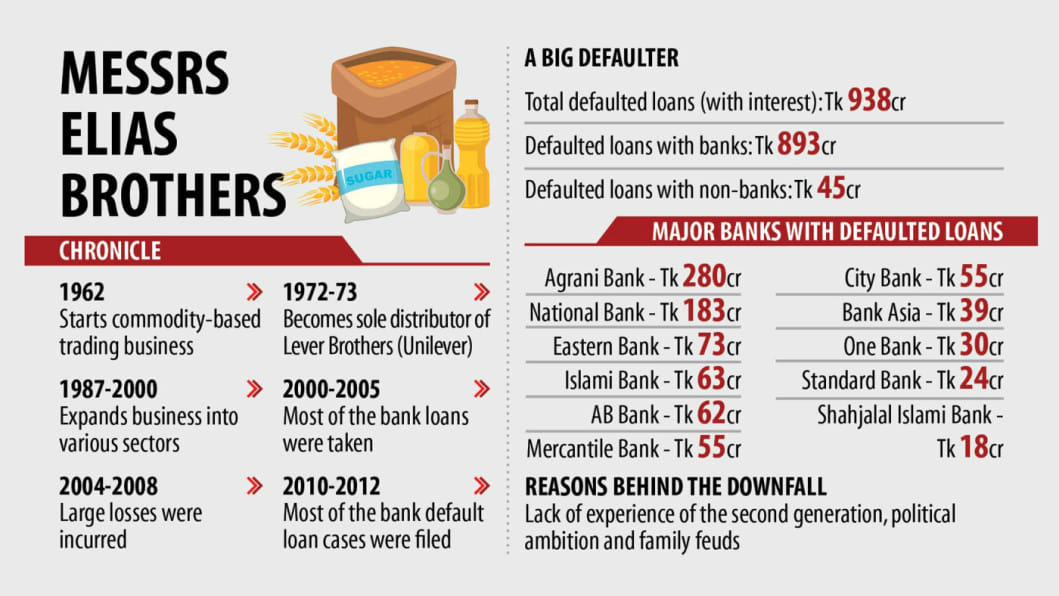

Messrs Elias Brothers, popularly known as MEB, grew into one of the leading industrial conglomerates in Bangladesh in 1990s and was a darling of banks and financial institutions.

But its fall from the grace was equally noteworthy, which provides an example how a sound business can sink because of a lack of farsightedness of its owners, futile political ambitions, and a pile of debts.

The journey of the company began after Mohammad Elias started commodity trading in 1950s, a decade after passing his eighth grade.

He gained primary knowledge about business by running the firm in the Chaktai-Khatunganj market in Chattogram city, the largest wholesale hub for consumer goods in Bangladesh that is located near his home town in Bakolia.

In 1962, when he was 25, he set up trading company MEB, along with his elder brother Ahmed Hussain.

Initially, MEB's concentration was in consumer goods. Gradually, it expanded into areas such as galvanised plain sheets, ship-breaking, agro-industry, glass sheet, soybean oil, beverages, paper, board, garments, and brickfields.

The investment into the businesses came from the profits it made as Elias always preferred cash transactions to bank loans in order to import goods and expand.

Its footprint grew massively: MEB alone controlled about 15-20 per cent of the country's commodity market in the 1990s. It had also been the sole distributor of British manufacturing company Lever Brothers for almost three decades after independence.

But the course of the group took a turn in the wrong direction when Elias died on April 29, 1997.

His son Shamsul Alam and niece Nurul Absar, also the son of Ahmed Hussain, took over as the managing director and the chairman of the group, respectively.

The companies were divided among the heirs. The third-generation got involved after 2005. But they have not been able to get back the market position MEB once held.

The involvement of Alam in politics in 2008 took a toll on the family business.

After failing to get the nomination from the Awami League in the 2008 parliamentary elections, he joined BNP and became the vice-president of the city unit.

This was when the condition of the group started deteriorating as the owners lost focus, according to traders. It even retreated from commodity trading, its core business until 2009-10.

Elias had set up one and half a dozen companies, but only three are now in operations today. The rest were either shut or are non-operative because of financial constraints, lack of experience among the successors and family feuds.

MEB, whose founder did not rely on loans to power growth in its early stages, is currently on the list of the top 100 loan defaulters.

At present, the group's bad loans amounted to Tk 938 crore with 17 banks and financial institutions.

It owes Tk 280 crore to Agrani Bank, Tk 183 crore to National Bank, Tk 83 crore to Southeast Bank, Tk 73 crore to Eastern Bank, and Tk 63 crore to Islami Bank.

Another Tk 62 crore is owed to AB Bank, Tk 55 crore to Mercantile Bank, Tk 55 crore to City Bank, Tk 39 crore to Bank Asia, Tk 30 crore to One Bank, Tk 24 crore to Standard Bank, and Tk 18 crore to Shahjalal Islami Bank.

Once a highly sought-after client has now become the bane of the banking industry.

More than 20 cases were filed in the Chattogram Money Loan Court by several banks against the top management of the group.

In three of these cases, arrest warrants have been issued in the name of five top officials of the company.

Several banks and financial institutions were used to provide large sums of money as loans against nominal collaterals because of its reputation. The loans have created significant problems for the banks.

The third-generation has been trying to invest in new fields for the last few years, but no lender is ready to extend any more loans.

On September 20, a Chattogram court issued arrest warrants against five owners of MEB Group in a case filed over embezzling of Tk 183 crore from the Khatunganj branch of National Bank.

They are Alam, Absar, directors Mohammad Nurul Alam, Kamrun Nahar Begum, wife of Shamsul Alam, and Tahmina Begum, wife of Absar.

On June 23, the court issued arrest warrants against the five in a case lodged by Southeast Bank.

Shafiqul Islam Chowdhury, a legal adviser to National Bank, said the private commercial bank lent Tk 102 crore in 2008, although 50 kathas of land worth Tk 1 crore were put up as collateral, thanks to its business reputation.

The company paid a few instalments. In 2014, National Bank filed a case in the Money Loan Court against the owners after it stopped paying installments.

According to Chowdhury, the managing director and a director of MEB met with the top officials of the bank and requested them to extend the term of the loans for 15 years. But they did not agree to pay 5 per cent of the loans as down payment as per laws.

"So, it was not possible for us to reschedule the loans."

Shamsul Alam and Absar could not be reached for comments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments