Policy rate hiked again as inflation stays high

The central bank yesterday raised the repo rate by 50 basis points to step up its fight against the persisting higher inflation and increased rates that will make loans costlier and give better returns to savers.

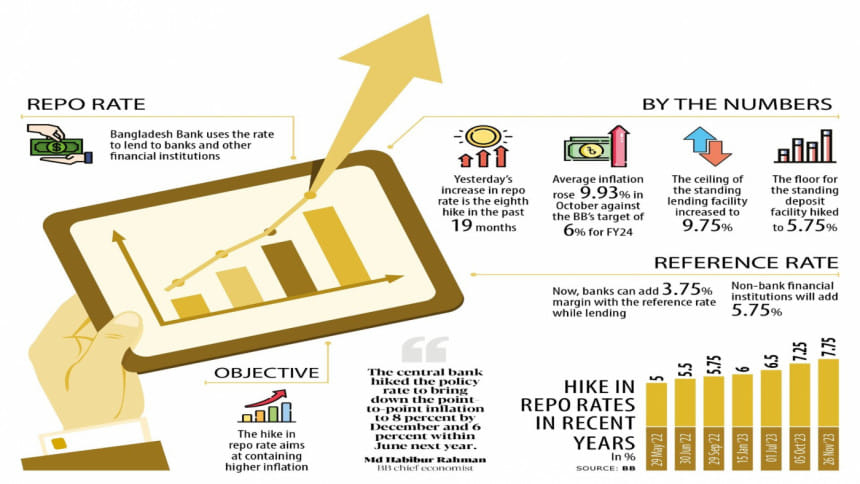

Now, the policy rate will be 7.75 percent, which will be effective from today. Yesterday's increase in the repo rate is the eighth hike in the past 19 months as inflation has kept surging.

The repo rate is the rate at which the Bangladesh Bank lends money to commercial banks and financial institutions.

The banking regulator also increased the margin by 25 basis points to 3.75 percent that banks can add to the SMART (Six Months Moving Average Rate of Treasury Bills) rate when extending loans.

Thus, the maximum lending rate of banks will be 11.18 percent from today because the SMART rate stands at 7.43 percent.

The BB announced the new rates at a press briefing at its headquarters in the capital. The decision was taken at the first meeting of the restructured monetary policy committee on November 22.

It comes as the BB struggles to contain the record inflation, driven by higher commodity prices in the global markets, ineffective market monitoring on the part of the government, collusion among market players, and the sharp decline in the taka's value against the US dollar.

Average inflation rose 9.93 percent in October, way above the central bank's target of 6 percent for the current fiscal year, which ends in June.

At the press briefing, Bangladesh Bank Chief Economist Md Habibur Rahman said the central bank hiked the rates to bring down the point-to-point inflation to 8 percent by December this year and 6 percent within June next year.

"If needed, the central bank will raise the policy and the lending rates further. We also want to stabilise the exchange rate through strengthening of the central bank initiatives."

The central bank increased the ceiling of the standing lending facility to 9.75 percent and the floor of the standing deposit facility to 5.75 percent.

The move is aimed at raising the cost of funds for banks with a view to tightening the money supply to rein in consumer prices. Until July this year, the central bank had resisted calls for lifting the 9 percent lending rate, depriving the country of using a key monetary tool that has been successfully used by many countries to combat persistently higher inflation.

"Controlling inflation is our main target and we will continue with our contractionary monetary stance if it does not decline," Rahman said.

Replaying to a question, the BB chief economist said the government has also stopped borrowing from the central bank and is cutting back on its expenditures.

Amid criticisms over the delay in squeezing money supply, the central bank has started to make borrowing costlier by increasing the policy rate.

The margin of the SMART, which is used to determine the interest rate on loans, will go up by 25 basis points. Currently, banks can add a 3.50 percent margin to the reference rate, while the rate is 5.5 percent for non-bank financial institutions.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, told The Daily Star that the central bank would have to raise the policy rate aggressively under the current circumstances.

"The policy rate in the US is more than 5 percent, so we need more hikes in line with the international interest rate."

The federal reserve's benchmark funds rate, which sets short-term borrowing costs, is currently targeted in a range between 5.25 percent and 5.5 percent, the highest level in 22 years, according to CNBC.

"The banking regulator will have to increase the lending rate further and it will be better to withdraw the lending rate cap entirely," said Mansur, adding that the lending rate margin should be increased by 60 basis points.

The central bank maintained the lending rate cap between April 2020 and June this year. Although it has since lifted the ceiling, the rate is still controlled to a large extent since it is based on the interest rates of treasury bills and bonds.

Mansur, a former official of the International Monetary Fund, sees two major challenges facing the economy: higher inflation and the volatility in the dollar market.

"The central bank should focus on tackling them."

Mansur said the exchange rate should be floated and the BB will have to continue its policy on not to print any new money.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said the hike in the repo rate will increase the cost of borrowing and drive up the deposit rates.

"As a result, there will be pressure on liquidity in the market."

He said the government's bank borrowing and its rates will increase in the coming days.

"We are seeing a trend that savers are diverting funds from banks to government treasury bills and bonds."

The monetary policy committee has also decided to bolster efforts to make the exchange rate market-oriented, said the BB in a statement.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments