Planning adviser stresses need for structural reforms

Despite facing past challenges such as corruption, money laundering, and financial mismanagement, the government is now making strides through significant reforms and enhanced regulatory measures, fostering a positive outlook for economic stability and recovery.

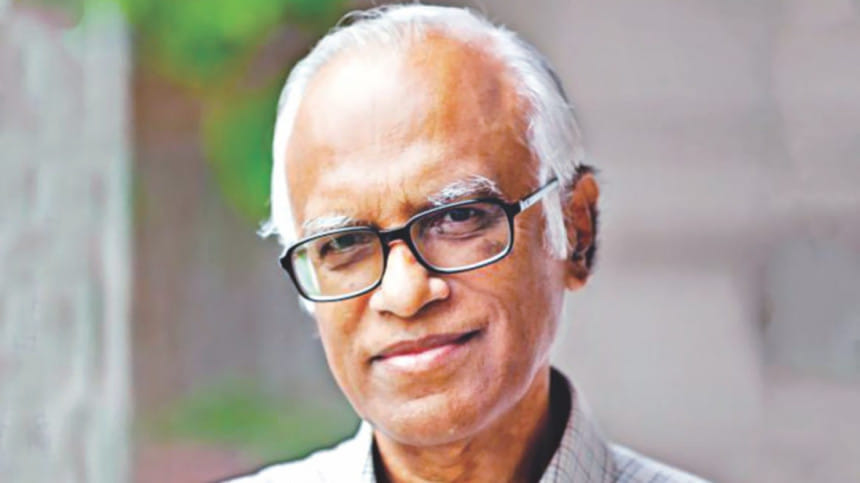

Planning Adviser Wahiduddin Mahmud made these remarks as he underscored the urgent need for structural reforms at an Iftar event hosted by the Development Journalist Forum of Bangladesh at the NEC conference room today.

He pointed out that while some economic indicators suggest resilience, persistent governance failures, particularly in the banking sector, remain a major concern.

He stated that the ousted Awami League government could not sustain itself based solely on economic indicators and the direction in which the economy was heading.

"As an economist, I—and perhaps many others—felt that, based solely on economic indicators and the trajectory of the economy, it was inevitable that at some point, the government would not be able to sustain itself," Mahmud said.

He also highlighted previous warnings regarding Bangladesh Bank's actions.

"I pointed out to Bangladesh Bank that they were continuously printing money, but this approach would not work for long," he explained, saying that the central bank had failed to carry out its regulatory functions, rendering itself ineffective.

"Banks were being emptied, and money was being siphoned abroad, often without even seeking permission from the authorities. Transactions were bypassing the central bank entirely," Mahmud remarked.

As a result, the central bank had become irrelevant and unable to take corrective measures.

Mahmud also explained that the economy could not have sustained itself much longer for two reasons.

First, the large-scale siphoning of wealth, especially in the final years of the Awami League's regime, was evident. Estimates suggest that $2–4 billion was illicitly transferred abroad each year.

"If this outflow had continued, and given how rapidly foreign exchange reserves were depleting, it would have become unsustainable," he said.

Although reserves still stand at around $20 billion today—lower than before but not entirely depleted—the pace at which they were shrinking would have led to a crisis, he added.

Had this continued, foreign transactions would not have held up, and the country would have faced bankruptcy.

He added that debt servicing obligations were already increasing and would continue to rise, making repayment impossible at some point, saying, "A crisis similar to what happened in Sri Lanka could have emerged."

Secondly, the way banks were being emptied was another critical issue. The founders, entrepreneurs, and directors of these banks, who were supposed to safeguard their institutions, were draining them instead.

"They were expected to care about the profitability of their banks, as they were the rightful recipients of dividends. But at that time, such concerns were nowhere in their minds," Mahmud remarked.

"Instead, they were siphoning off funds—by any means, legal or illegal—and transferring them abroad."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments