Only one insurer goes public since finance minister’s warning last year

Only one out of the 28 non-listed insurance companies offloaded shares even though Finance Minister AHM Mustafa Kamal in September last year warned that their licences will be cancelled if they fail to go public within three months.

The Bangladesh Securities and Exchange Commission (BSEC) in February approved the initial public offering of Express Insurance, a non-life insurer that raised Tk 26.7 crore from the capital market.

"Some other companies are also trying to get listed. You may see them in the market soon," said Sheikh Kabir Hossain, president of the Bangladesh Insurance Association.

The process has been delayed as the coronavirus pandemic has thrown a spanner in the works, he added.

On its debut on the Dhaka Stock Exchange yesterday, Express Insurance's stock soared 50 per cent to Tk 15 and turnover hit Tk 13 lakh.

However, questions surfaced over its intention of raising funds as the company will utilise the IPO proceeds as deposits for bank fixed deposit receipts and investment in the stock market.

The insurer will invest Tk 20.6 crore in FDR and treasury bonds, Tk 4 crore in the capital market and spend the rest on IPO expenses.

"That means the company didn't need capital at all. It went public only to do the bidding of the minister. If they invest the IPO money in FDR and stock market, why should people go to them rather than asset management companies?" said a top official of a merchant bank asking not to be named.

This type of companies run the risk of turning into junk shares eventually, the official added.

The company's IPO subscription opening was initially scheduled for 13 April but the subscription was suspended temporarily due to the outbreak of coronavirus and market closure.

The revised IPO subscription date was 14 June to 18 June and the IPO was oversubscribed by six times.

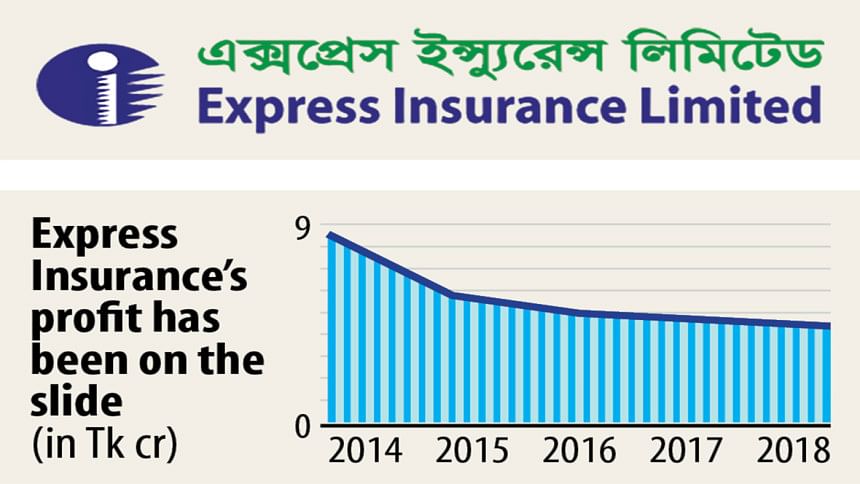

Express Insurance was incorporated in 2000 for carrying out all kinds of general insurance activities.

The company has 20 branches across the country. At present, its paid-up capital is Tk 65 crore.

As per the financial statement for the year that ended on 31 December 2018, the company's net asset value (NAV) was Tk 18.72 per share and earnings per share Tk 1.12.

Currently, 48 life and non-life insurance companies are listed with the Dhaka bourse.

In the last few days, general insurance companies listed with the bourses have been doing better.

The sector grew 41 per cent in July and was second on the top turnover list.

The average daily turnover of the insurance companies was Tk 39.52 crore during the time.

Eastern Insurance topped the gainers' list last month when its price rose 154 per cent, followed by Paramount Insurance, Pioneer Insurance, Dhaka Insurance, Agrani Insurance, Provati Insurance, Asia Insurance and Pragati Insurance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments