Only 1 in 1,960 small firms got soft loans from govt’s revamp funds

Just a single firm out of 1,960 pandemic-hit cottage, micro and small enterprises mainly in the light engineering sector has received the soft loan from the stimulus package, according to a study.

The disclosure painted a bleak picture as they suffered the most because of the coronavirus pandemic. At the same time, they would also be at the front during the recovery process.

In order to enable them to make a comeback, the government has announced a Tk 20,000-crore stimulus package for the CMSME sector.

However, most of the enterprises could not avail the money from the fund because of stringent conditions, a lack of information, a lack of cooperation from banks and small portfolios of the enterprises, according to the study by the Brac Institute of Governance and Development (BIGD).

The study found that 1,226, or 63 per cent out of 1,960 surveyed enterprises know about the stimulus package. Three per cent of the enterprises applied for the support. But 1,000, or 54 per cent of the firms do not know how to apply.

The rapid response research based on telephone interviews styled "The effects of Covid-19 on small firms: evidence from large-scale surveys of owners and employees" was conducted by Asad Islam, an economics professor at the Monash University, and Atiya Rahman, a senior research associate at the BIGD.

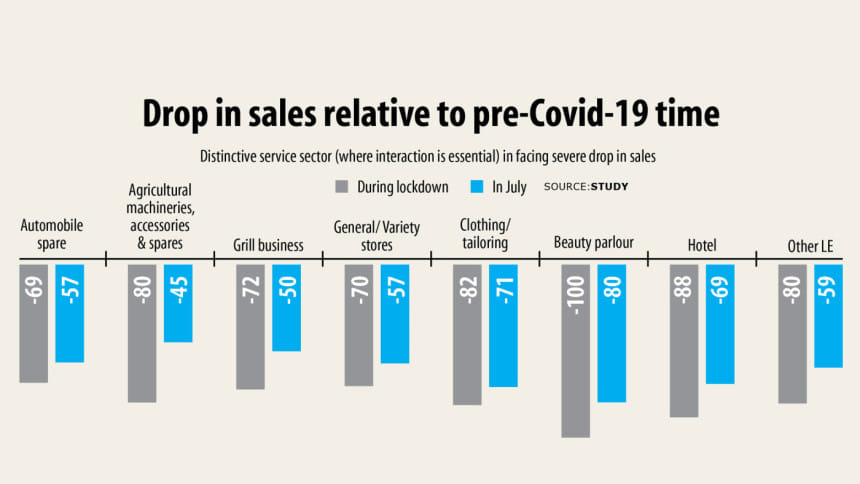

The participants, which included enterprises involved in producing automobile spares, agriculture machinery, accessories as well as general stores, hotels, beauty parlours and tailors, were interviewed between July 14 and July 23.

The researchers presented the findings at a virtual meeting yesterday.

The survey found 60.71 per cent of the enterprises were open in July while 69.13 per cent were closed during the lockdown, which began on March 26 and continued until May 31 before the gradual lifting of restrictions from June.

Poor owners are less likely to operate their business at full capacity, the survey found.

In July, 21.96 per cent owners were unable to clear workshop rent in the past one month and 15.87 per cent during the lockdown period because of a drop in sales, way higher than 1.82 per cent before the Covid-19.

Some 13.37 per cent enterprises in July and 7.6 per cent during the lockdown could not pay utility bills. It was 1.12 per cent before the lockdown was enforced.

Some 98.01 per cent of workers worked for fewer hours or got paid for fewer hours during the lockdown. It was 81.32 per cent in July.

A fourth of the workers were laid off during the lockdown and 11.29 per cent in July, according to the survey.

The study found female workers are at a greater risk because of the limited access to formal financial support and no access to the government's support package.

"Female workers are losing jobs and are less likely to return to work after the lockdown," it said.

Three-fourth of the enterprise owners are highly worried about the future of their business and 46.33 per cent do not know how long it would take before they can resume full operation.

Forty-seven per cent of the enterprises have access to loan or grants to support business recovery while one-fourth enterprises have no access to loan and no plan for business recovery.

"Enterprises are struggling to make a profit after the lockdown," it said.

While moderating the discussion, Imran Matin, executive director of the BIGD, said the recovery of the enterprises from the fallouts of the Covid-19 is still fragile and lower-end enterprises are still struggling a lot.

"The composition of the recovery is unequal," he said.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, said a good number of enterprises are not interested to take loans from the stimulus package because they think that they would face a lot of trouble if they cannot repay.

The CMSME sector represents 13 million business entities in Bangladesh, contributing 25 per cent to the GDP, 35.5 per cent to total employment and 80 per cent to export earnings, according to the Dhaka Chamber of Commerce and Industry.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments