NBR may continue prospective tax system till FY28

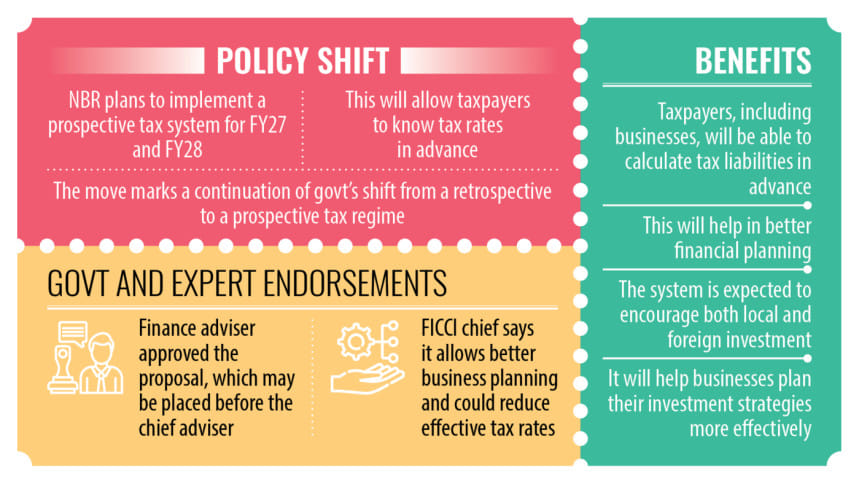

The National Board of Revenue (NBR) is expected to continue the prospective tax system until fiscal year 2027-28, allowing taxpayers and businesses to determine applicable tax rates in advance instead of waiting until the end of the income year.

Starting with the national budget for FY25, the government shifted from a retrospective to a prospective tax regime, aiming to support better investment and tax planning.

Under the traditional retrospective system, the NBR announced tax rates for firms and individuals only after the completion of an income year.

For instance, the current income year runs from July 2024 to June 2025. Under the earlier system, taxpayers would file their income and wealth statements and pay taxes for the assessment year, in this case FY25, in the following year, based on rates announced after the income year ended.

However, under the prospective system, individuals and businesses can calculate their tax liabilities for the income year in advance and pay taxes by the end of the same income year.

The NBR is expected to adopt the prospective system in response to longstanding taxpayer demands, a finance ministry official, requesting anonymity, told The Daily Star recently.

"After FY25 and FY26, we are planning to introduce it for another two years. We are working on it," the official said.

He added that this system would help build confidence among individuals and investors by allowing them to plan their tax management and investment plans.

On May 15, Finance Adviser Salehuddin Ahmed gave the nod to the proposal, which may be presented to Chief Adviser Prof Muhammad Yunus today, the official said.

Investors and tax analysts welcomed the NBR's move, saying it would boost investor confidence and encourage local and foreign investment.

"If it truly happens, this will be wonderful news indeed," said Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry (FICCI).

"It helps businesses plan better and ensure business plans reflect realities," he said.

"There are no sudden surprises. I am hoping that prospective tax visibility also helps in reducing the effective tax rates as well," added Zaved, also the chairman and managing director of Unilever Bangladesh Limited.

According to Zaved, it was previously quite difficult to assess a year's tax using rates announced at the end of the income year, as companies had already closed their books and, in many cases, disbursed dividends.

"Knowing future tax rates reduces uncertainty, enabling more confident decisions about savings, investments, and debt management," said Snehasish Barua, managing director of SMAC Advisory Services.

A clearer understanding of upcoming tax obligations empowers individuals and businesses to plan their long-term finances more effectively, he said.

Barua added that it also allows for proactive planning that can yield significant tax savings.

However, in Bangladesh, simply knowing the rates in advance may not benefit taxpayers if the rates are not rationalised and the effective tax rates remain higher than the statutory rates.

Mohammed Humayun Kabir, vice-president of the South Asian Federation of Accountants, also welcomed the move.

"This policy continuation will work as a positive initiative for attracting local and foreign investors," he said.

If the country can draw investment, it will positively impact employment generation, Kabir added.

Kabir, also a former president of the Institute of Chartered Accountants of Bangladesh, hoped the NBR would continue this policy even after FY28.

Currently, Bangladesh has nearly 1.13 crore Taxpayers' Identification Number (TIN) holders. However, around 60 percent of those taxpayers did not submit returns in the current fiscal year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments