Motorcycle demand picks up speed after three-year slump

Motorcycle sales are showing signs of recovery after a slow patch of nearly three years, due mainly to easing consumer prices, lower registration costs, and aggressive marketing by manufacturers.

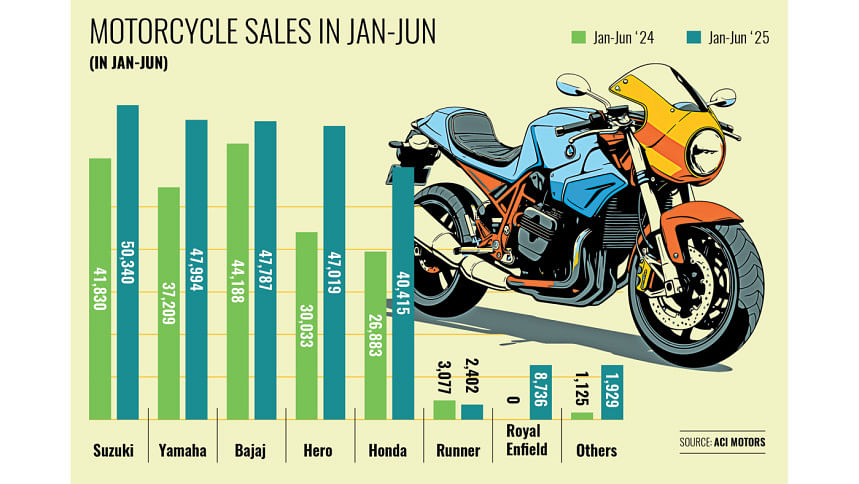

Local bike companies say their sales rose by about 27 percent in the January-June period this year. Higher-capacity models, priced between Tk 2.2 lakh and Tk 4.5 lakh, saw stronger demand than lower-cc (cubic capacity) bikes.

Industry insiders say budget-friendly motorcycles, which usually cost between Tk 1.2 lakh and Tk 2 lakh, have seen slower sales as many low- and middle-income buyers continue to feel the pinch financially.

In the first six months of 2025, total sales reached 257,632 units, up from 202,330 during the same period last year, according to industry data.

In the domestic market, Indian brand Bajaj and Japanese makers Yamaha and Suzuki remain top choices for buyers.

Higher-capacity models, priced between Tk 2.2 lakh and Tk 4.5 lakh, saw stronger demand than lower-cc (cubic capacity) bikes

"Higher-capacity motorcycle sales have been strong over the past six months, driven by stable prices and customers' preference for better riding quality and long-distance travel," said Subrata Ranjan Das, deputy managing director of ACI Motors, which sells Yamaha bikes.

Popular Yamaha models include the R15 series, MT-15 V3, MT-15 V1, FZ-S V3, FZ-S V4, and FZ-S. These bikes cost around Tk 2.30 lakh to Tk 4.50 lakh.

Motorcycles in Bangladesh are mainly used for short- and medium-distance travel, especially in urban and semi-urban areas. Outside the capital, poor road conditions are prompting buyers to opt for more durable and higher-capacity options.

Das said local road conditions are far from ideal, making bikes with engines over 160cc more practical than smaller ones.

Meanwhile, bikes in the 100cc to 150cc range have seen marginal growth, as high prices and a volatile exchange rate continue to make many buyers cautious.

"Many had been waiting for prices to fall, but now they realise significant drops are unlikely. Demand is gradually returning," added Das.

While Japanese brands continue to dominate, Indian Bajaj also maintains a strong position. Competition among the top three has intensified in recent years, putting pressure on profit margins, especially in the entry-level segment.

Industry sources said fewer new models have been launched this year, partly due to a decline in corporate orders. At the same time, many buyers are placing advance bookings due to limited availability in showrooms.

"The motorcycle market has become highly competitive as profit margins are shrinking," said Das. "While the high-end segment is performing well, the market for 100cc to 120cc bikes has slowed somewhat."

Bangladesh's overall motorcycle market expanded by nearly 20 percent in the past six months, according to Biplob Kumar Roy, chief executive officer of TVS Auto Bangladesh.

"There used to be monthly sales of around 24,025 units. Now it has increased to about 30,320 units. That means there has been nearly 20 percent growth. On a per-month basis, the numbers are rising quite well," Roy told The Daily Star.

TVS's popular higher-cc models include the Apache RTR 160 4V Fi, Apache RTR 160 4V, and Apache RTR 160 2V.

Roy said that despite the recent rebound, the lower-end segment continues to face difficulties.

He attributed the recent uptick in sales largely to pent-up demand following a long period of economic uncertainty.

"Many people had postponed buying despite needing a motorcycle. Now they are no longer looking for alternatives. They are making their decisions. You could say there is a certain extent of uncertainty still there," commented Roy.

As for TVS, the CEO said monthly sales have climbed from around 3,500 to nearly 4,000 units in recent months. "Growth has been quite good."

Shah Muhammad Ashequr Rahman, chief marketing officer of Bangladesh Honda Private Limited, said Honda's recent gains reflect its strong focus on customer satisfaction.

Popular higher-end Honda models include the XBlade, SP 160, and Hornet 2.0.

"We prioritise resolving customer issues with urgency," he said. "Our product launches are strategically aligned with customer expectations, offering competitive pricing and true value for money."

"We have introduced advanced technologies such as PGM-FI engines, digital meters, improved fuel efficiency, and low running costs. These make our motorcycles smarter and more economical," he added.

These features, he claimed, have contributed to Honda's growth in sales.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments