Logistics not yet ready for post-LDC graduation needs

Poor logistical efficiency, compared to Bangladesh's regional peers, is a serious concern for maintaining export competitiveness ahead of the country's graduation from LDC group in November 2026, speakers said at a roundtable yesterday.

The 20 percent fresh tariffs slapped on Bangladesh's exports to the US has complicated things even further, they said.

High transport costs, weak policies, and inefficiencies were flagged as key barriers.

While India moves nearly 20 percent of its freight by rail, Bangladesh transports just 4 percent. Over 80 percent of the freight is carried by road -- the most expensive and least efficient option, said industry stakeholders at the online roundtable titled "Smart Logistics for a Competitive Private Sector" organised by The Daily Star.

This was the second roundtable organised by this newspaper to identify challenges for the private sector related to the LDC graduation, with the aim of devising a roadmap for the economy's future. The first roundtable was on August 12, focusing on energising the private sector.

With LDC benefits set to expire, exporters will face additional tariffs in key markets. In the European Union, duty rates could rise to 9-12 percent.

Without gaining efficiency, participants warned, exporters will struggle to remain competitive in a rules-based global trade environment.

They said logistics reform goes beyond building roads or ports; it requires better governance, simplified customs procedures, investment in technology, and stronger private sector participation.

"Have we progressed? The answer is yes. Do we have room for improvement? The answer is also yes, especially if we compare ourselves against an international standard. Regardless of our graduation from LDC status, logistics will continue to remain crucial for making our businesses competitive," said Md Mahbub ur Rahman, CEO of HSBC Bangladesh.

He, however, said, "As we move toward a level playing field, the real question is whether Bangladesh is truly prepared to compete on equal terms."

Citing an HSBC survey of 5,750 corporates in 13 countries, he said 90 percent of the entities are diversifying supply chains, while nine in 10 are investing in visibility tools and digital logistics platforms. "Buyers today demand transparency, speed, and resilience," he said, questioning Bangladesh's efforts to reduce disruptions at ports like Chattogram.

He said efficiency today depends as much on information and digital tools as on physical infrastructure.

"The private sector is already investing in warehouse automation and digital processes. But competitiveness also depends on national infrastructure -- ports, airports, waterways -- that require reform, selective privatisation, and better multimodal integration."

Rahman argued that LDC graduation should be seen not with fear, but as a reality check. "Whether Bangladesh graduates in 14 months or later, it will have to compete in a more open, rules-based system. What truly matters is having an integrated roadmap, tracking progress periodically, and ensuring accountability through continuous communication with stakeholders."

He called for stronger contingency planning. "If Chattogram Port is closed for two or three days, what is our way out? Global buyers are already asking this."

Rahman also underscored the importance of free trade agreements. "Several competing countries already benefit from FTAs with key markets, giving them a head start. Once GSP ends, Bangladesh will risk falling behind unless it strengthens logistics and actively pursues new trade deals."

He said the logistics reforms should be done smartly. "It is about sharpening our competitive edge. And logistics lies at the very heart of that transformation."

In his welcome remarks, Mahfuz Anam, editor and publisher of The Daily Star, said logistics will play a decisive role in determining Bangladesh's export competitiveness post-LDC graduation.

"Graduation is not the responsibility of the state alone. It is a national transition. And we must make the private sector -- the actual engine of exports -- central to this conversation."

Syed M Tanvir, managing director of Pacific Jeans, flagged twin hurdles: bottlenecks in domestic logistics and strains in global supply chains.

He said lead time and transit time are now as critical as product cost in the RMG sector, but airport delays, customs hurdles, and poor coordination continue to erode competitiveness.

Tanvir called for a joint public-private study to identify inefficiencies and recommended automation and process improvements. Without action, Bangladesh risks falling further behind Vietnam and China, he warned.

"Logistics reform is about systems and execution -- not just infrastructure. The private sector is ready, but government support is essential," he said.

Ziaur Rahman, regional country manager at H&M, said the Dhaka–Chattogram highway currently allows an average speed of around 20 km/h.

"Regarding smart logistics, if we reduce inefficiencies, costs will naturally fall. But beyond automation and paperless systems, we first need to address basic issues."

For example, if it takes 18 hours to move product from Dhaka to Chattogram, it would be more valuable to reduce that time to 6–8 hours than to introduce paperless systems, he said.

"Time is money."

He said waterways are also underused. Chattogram port remains congested while Mongla is underutilised, not just due to infrastructure, but also because of policy.

He said the problem isn't technology, but people and processes, with poorly aligned systems. Unlike Singapore, India, and Sri Lanka, Bangladesh's logistics suffer from weak public-private coordination.

"Logistics is no longer a secondary issue -- it's central to Bangladesh's economic transformation," said M Masrur Reaz, chairman and CEO of Policy Exchange Bangladesh.

Reaz emphasised the urgent need for logistics reform to secure long-term competitiveness. "The Trump-era tariffs and EU compliance requirements like the Green Deal are reshaping global value chains. Without logistics reform, we won't cope with these structural shifts."

He pointed to Bangladesh's poor global rankings: 88th on the World Bank's Logistics Performance Index, 334th for Chattogram Port in the Container Port Performance Index, and 176th in the former Trading Across Borders index. "We're falling behind competitors like India and Vietnam. These impact foreign direct investment, exports, and trade capacity."

Reaz noted that logistics, which spans over 22 subsectors, has been neglected for decades. Although the National Logistics Policy (2024) was a major step, implementation has stalled. "This private-sector-led policy must be revived immediately."

He called for the simultaneous development of hinterland connectivity alongside the development of rail and land ports.

According to him, two areas that often get overlooked are rail logistics and land ports, which are vital for regional cooperation.

The current railway law, which dates back to the British era, doesn't allow for private investment in railway infrastructure or services, an obstacle that needs immediate reform, he said.

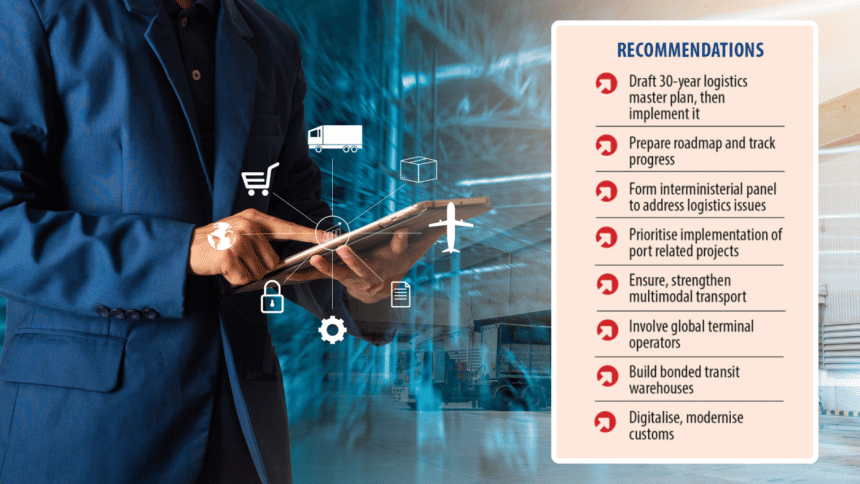

Reaz recommended designating the Ministry of Commerce as the lead coordinator in reforming the logistics sector, and opening port terminal development to global operators such as PSA and DP World. "Bangladesh needs a long-term logistics master plan. Bay Terminal must be prioritised. With reform, logistics can be our top growth enabler," he concluded.

Mohammad Iqbal Chowdhury, CEO of LafargeHolcim Bangladesh, said efficient logistics can be a "game changer" for industrial cost management.

He noted that logistics accounts for 16–17 percent of the cement sector's $3 billion value -- around half a billion dollars.

With heavy raw materials and finished goods, the sector depends heavily on transport. Currently, 80 percent of cement moves by road, while waterways account for just 16–17 percent.

Road transport costs up to Tk 8 per ton per km, compared to Tk 2 by water, meaning logistics costs could be reduced by 75 percent if waterways were scaled up.

Rail remains underutilised at just 4 percent, far behind India's 20 percent. Freight costs Tk 9 per ton per km in Bangladesh, compared to Tk 2 in India. "Strengthening rail could yield immediate and sustainable savings," Chowdhury said.

He also pointed out the road congestion and safety concerns on major highways. He also flagged inefficiencies such as BWTC's monopoly on lighter vessel cargo, which raises costs by 50 percent.

Chowdhury urged the creation of a centralised logistics authority, similar to BIDA, for coherent policy execution. "We must act proactively," he said.

Mahbubul Anam, former president of the Bangladesh Freight Forwarders' Association, said logistics sector needs integrated solutions.

He also called for regulatory reform, decentralisation, and a dedicated logistics unit within a ministry. "A national integrated logistics policy must encourage private investment under government oversight," he said.

Kamrul Islam Mazumdar, director of the Bangladesh Inland Container Depot Association, said the country must prioritise infrastructure upgrades in terminals, inland depots. He also said that multimodal connectivity must be given priority.

Efficient operations at Chattogram and the upcoming Matarbari deep-sea port are critical, but require separating regulation from operations.

"A single authority should oversee policy, while independent operators should manage ports for efficiency and transparency," he argued.

Currently, multiple ministries issue overlapping directives, creating bottlenecks.

He also highlighted container shortages during peak seasons, poor road links, and insufficient workforce training. "Coordinated policymaking and strong public-private partnerships are essential for transformation," he added.

Shakil Meraj, director of Cargo at Biman Bangladesh Airlines, described logistics as the "backbone of economic activity," critical to exports, trade, and jobs.

Hazrat Shahjalal International Airport currently handles 400–500 tonnes of imports and 600–700 tonnes of exports daily, but congestion remains a problem, with backlogs reaching 1,500 tonnes.

To ease pressure, Biman plans to cut free storage time from 72 to 24 hours with the launch of Terminal 3, where new SOPs will reduce cargo dwell time to six hours and aircraft turnaround to two.

"Biman has already activated Sylhet as a second hub and plans to expand the service to Chattogram," he said.

Meraj added that international buyers now expect shipments to reach Europe within 72 hours. "Without timely air cargo solutions, Bangladesh risks losing critical orders to competitors.

In his welcome remarks, Mahfuz Anam, editor and publisher of The Daily Star, said logistics will play a decisive role in determining Bangladesh's export competitiveness post-graduation.

"Graduation is not the responsibility of the state alone. It is a national transition. And we must make the private sector—the actual engine of exports—central to this conversation."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments