Local cement makers edge out global giants

Local cement manufacturers have comfortably pummelled their foreign counterparts in their scrap for market share in the past seven years -- in a testament of their nous and industriousness.

By 2018 local cement manufacturers had cornered 86 percent of the market, a reversal in scenario from 15 years earlier, when the multinational companies ruled the roost, according to data from the Bangladesh Cement Manufacturers Association.

Local Abul Khair Group's Shah Cement has the most market share, followed by Bashundhara Group and Meghna Group.

“We have beaten the multinational companies with quality and price,” said Amirul Haque, managing director of Premier Cement.

The Daily Star conducted a market survey last week and found that local brands' cement was selling for Tk 395 to Tk 420 a bag. In contrast, each bag of cement of the multinational brands' cost Tk 418 to Tk 450.

In the past, there was a perception that the local brands' cement quality was inferior to the multinationals', said Masud Khan, chief executive officer of MI Cement.

“But that notion is gone now,” he said, adding that the local brands' strong supply chain has helped them strengthen their market shares.

A handful of intrepid local manufacturers introduced state-of-the-art technology, whereas the multinational cement makers are stuck with their old tools, said Khan, also a former chief financial officer of LafargeHolcim Bangladesh.

Local cement manufacturers import the required raw materials including clinker, gypsum, fly ash and iron slag from abroad and use grinding technology to produce cement.

“The Bangladeshi entrepreneurs took a calculated risk and that paid off,” said Mostafa Kamal, chairman of Meghna Group of Industries that manufactures the 'Fresh' brand cement.

And given the government's huge infrastructure-building plans, cement manufacturers can brace themselves for even better days ahead.

Asked why the multinationals are lagging behind in terms of market share, Rajesh Surana, CEO of LafargeHolcim Bangladesh, said the global cement giant is focused more on value addition and providing innovative solutions and services than in market share. “In addition, we are very happy to be a proud partner in the social development across the communities where we operate,” he added.

Presently, several local cement manufacturers procure clinker from LafargeHolcim, which produces 7 percent of the total clinker requirement for Bangladesh.

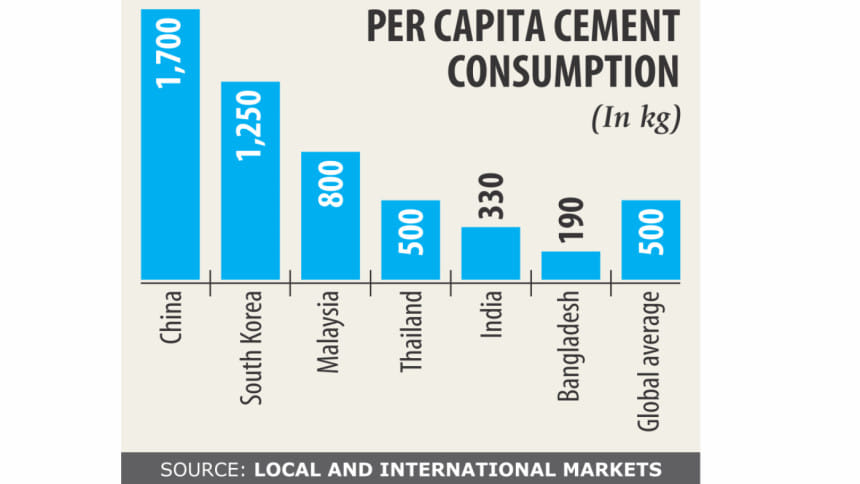

The country's total cement production capacity at present is around 60 million tonnes against the consumption of 32 million tonnes, meaning there is room for exports.

Last fiscal year, cement worth $12.59 million was shipped overseas, up 16.68 percent year-on-year, according to the Export Promotion Bureau.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments