Insurance sector under strain as claim settlements drop

The rate of claim settlements in Bangladesh's insurance sector declined last year, deepening concerns over transparency and further eroding the confidence of policyholders in an industry already trailing behind global standards.

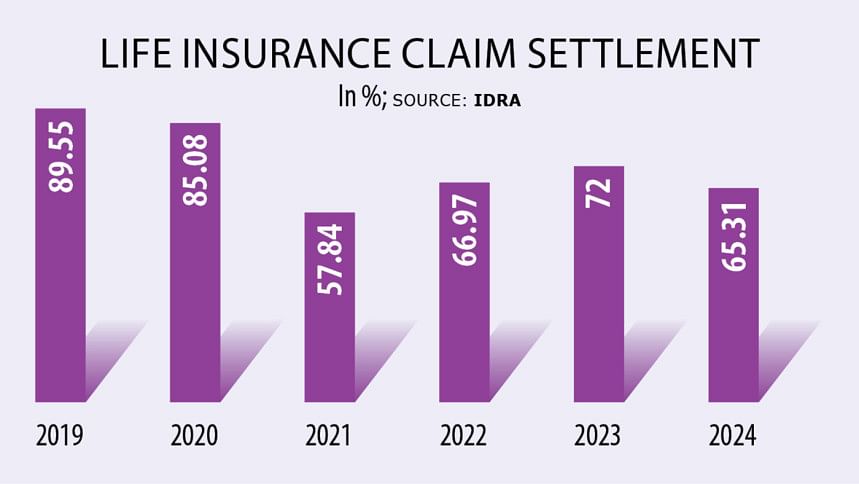

In 2024, only 57 percent of insurance claims were settled, according to the Insurance Development and Regulatory Authority (Idra).

This marks a sharp decline from around 65 percent the previous year.

In monetary terms, insurers paid out Tk 9,476 crore last year against total claims amounting to Tk 16,484 crore.

According to the breakdown, life insurance fared slightly better than its non-life counterpart.

The settlement rate for life insurance policies fell from 72 percent to 65 percent, while non-life insurance dropped from 41 percent to just 32 percent.

Globally, the average claim settlement rate hovers around 97-98 percent. In neighbouring India, it stood at around 98 percent in the fiscal year 2022–23, according to media reports.

At present, Bangladesh has 36 life insurance companies and 46 non-life insurers. One firm, Golden Life Insurance, has yet to submit its data to the regulator.

As per the Insurance Act 2010, insurers must settle claims within 90 days of receiving all necessary documents after a policy has matured.

Md Solaiman, deputy director of Idra's non-life department and the acting spokesperson, said six life insurance firms are currently facing serious challenges due to irregularities and corruption, which have pulled down the overall settlement rate.

"Their claim settlement rate is below 10 percent, which has had a severely negative impact on the life insurance sector. As a result, claim settlements in 2024 have declined," he told The Daily Star.

The Idra has asked these six firms -- Baira Life Insurance, Fareast Islami Life Insurance, Sunlife Insurance, Sunflower Life Insurance, Padma Islami Life Insurance and Golden Life Insurance -- to submit detailed action plans outlining how they intend to improve their subpar claim settlement rates.

In the non-life segment, Solaiman said the regulator recently met senior executives from several companies to resolve ongoing challenges.

He said that while most firms have reinsured their policies with Sadharan Bima Corporation, many claims remain unsettled because the insurers failed to provide the required investigation reports.

"Sadharan Bima Corporation was tasked with formulating a guideline in this regard in November last year, but it failed to deliver," he said.

"The Idra has discussed the matter with Sadharan Bima Corporation, and we remain hopeful that a resolution will be reached soon," he added.

Meanwhile, Golden Life Insurance is in crisis as it struggles with a severe cash crunch, unpaid claims, and operational breakdowns.

Established in 1999, the firm has shuttered its headquarters, with many key officials absent and some 18,000 policyholders still waiting for their dues.

Its troubles intensified following the political changeover in August last year. Since then, the firm's main office at Ambon Complex in Dhaka's Mohakhali area has remained closed for nearly two months.

The closure followed a confrontation between frustrated policyholders and company staff after the firm failed to settle claims worth Tk 34.95 crore.

"Our problem has not been resolved yet," said Amzad Hossain Khan Chowdhury, Golden Life's chief executive officer. "As a result, the company's normal operations have not resumed either,".

"That's why we are unable to provide the regulator with information on claim settlements," he added.

Apart from the six troubled life insurers, only one other company posted a claim settlement rate of 28 percent. The rest managed to settle more than half of their claims.

Among non-life insurers, four companies failed to exceed the 10 percent mark, while 11 crossed 30 percent, and nine surpassed 50 percent.

Md Main Uddin, professor at the Department of Banking and Insurance at the University of Dhaka, said the decline was alarming and undermining the credibility of Bangladesh's insurance industry.

"When only 57.47 percent of claims are being settled, it signals a systemic failure in both governance and operational transparency," he said.

He added that such failings breed mistrust among policyholders, many of whom already view the process with suspicion.

"This is not just a regulatory concern -- it's a consumer rights issue," said the professor.

To restore confidence and encourage sectoral growth, the Idra must tighten enforcement, push for digital claim processing, and penalise undue delays, he said.

Without sweeping reform, the sector could face continued stagnation, deterring potential customers and damaging its long-term prospects, Uddin added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments