Insurance policy lapses decline

The number of policyholders failing to pay their insurance premiums on time declined in 2024 from the previous year, but the rate of discontinued policies remains high -- reflecting fragile customer confidence in the local insurance sector.

In 2024, 12.49 lakh policies were discontinued -- a 19 percent drop from 15.42 lakh across 36 life insurance companies in the previous year, according to the Insurance Development and Regulatory Authority (Idra).

Astha Life Insurance reported no lapsed policies last year.

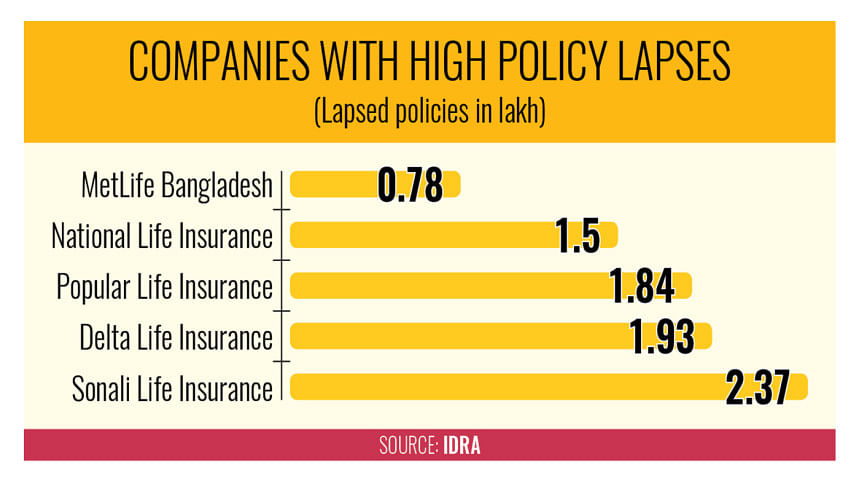

In contrast, Sonali Life Insurance recorded the highest number of policy lapses, with 2.37 lakh customers abandoning their coverage.

Delta Life Insurance Company, Popular Life Insurance, National Life Insurance, and MetLife Bangladesh followed closely behind, according to Idra.

Golden Life Insurance has yet to submit its complete figures for the year. However, 294 policies lapsed by the end of the third quarter.

A lapse usually occurs when a policyholder fails to pay premiums on time, resulting in the termination of coverage.

The reasons, according to sector people, are often tied to affordability, misleading advice from agents, and broader regulatory issues.

Besides, when a company's condition deteriorates due to corruption or irregularities, customers lose confidence, according to Md Solaiman, deputy director of Idra's non-life department and the regulator's acting spokesperson.

"As a result, many choose not to continue their policies."

Solaiman told The Daily Star that customers often forget to pay their premiums on time, while companies also do not send timely reminders. "Because of this, many policies become void."

FRAGILE CONFIDENCE

On average, nearly half of life insurance policyholders in Bangladesh stop paying premiums after the first year, according to Idra data.

This contrasts sharply with global figures, where 96 to 98 percent of policyholders maintain coverage. Neighbouring India's lapse rate stands at around 10 percent.

Experts and sector insiders attribute the disparity to stronger oversight and enforcement in developed markets.

"Lapsed policies are harmful to both customers and insurers," said SM Ibrahim Hossain, director of the state-run Bangladesh Insurance Academy. "Customers lose a financial safety net, and insurers suffer revenue losses along with damage to trust and stability."

Md Rafiqul Islam, chief executive officer of Sonali Life Insurance, said the company faced internal turmoil last year that shook customer confidence and hampered field-level staff performance.

He said this led to widespread lapses. "We are working to resolve these issues," said Islam.

Delta Life Insurance saw 1.93 lakh policies lapse in 2024, down from 2.46 lakh the year before.

However, 1.85 lakh of the discontinued policies in 2023 were reinstated the following year, said CEO Uttam Kumar Sadhu.

According to him, micro-insurance policies, which require monthly payments, are more vulnerable to lapses.

"Many customers make bulk payments every few months, allowing them to reinstate their coverage," he said. "That's why we don't panic. We have systems in place to bring lapsed policies back to life."

CUSTOMER ENGAGEMENT CAN REDUCE LAPSES

Guardian Life Insurance reported 18,579 lapses in 2024. In a statement, the company said the country's prolonged economic turmoil, which peaked last year, made it difficult for many families to keep up with premium payments.

But Guardian Life says that lapses are not always permanent. The company offers grace periods, policy loans, and outreach support.

"More than 14,500 policyholders reactivated their policies in 2024," it said in the statement. "We also recorded a 33 percent reduction in lapses compared to the previous year."

Ala Ahmad, CEO of MetLife Bangladesh, echoed the need for customer engagement.

"We proactively remind customers via SMS, phone calls, and our app," he said. "Our surveys found financial hardship and shifting priorities as the main reasons behind lapses. We try to offer flexible solutions that allow customers to retain their coverage."

At National Life Insurance, many policyholders faced delays in receiving payments after their policies matured, due to a liquidity crunch in some banks.

"This created a trust deficit," said Managing Director Md Kazim Uddin. "That has discouraged customers from making premium payments, resulting in more lapses."

Idra Spokesperson Solaiman said the regulator is concerned about policy discontinuation. "Rising policy lapse rates are eroding public trust and dragging down insurance penetration in Bangladesh," he said.

From 2009 to 2023, over 26 lakh life insurance policies lapsed, according to Idra figures. The total number of active policies fell from nearly 1.12 crore in 2009 to just 85.88 lakh by 2023.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments