Inflation inches up in March as non-food prices jump

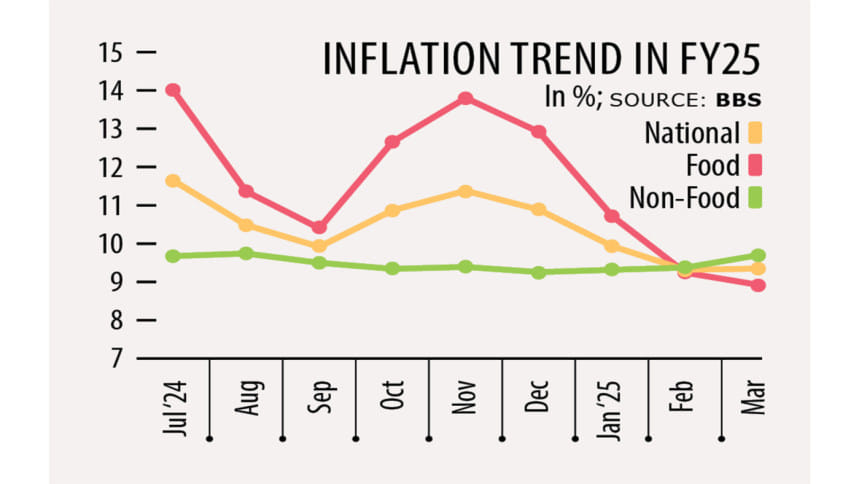

After declining for each of the past three months, overall inflation in Bangladesh increased slightly in March, driven by an uptick in non-food prices, government data shows.

Overall inflation stood at 9.35 percent in March, up from 9.32 percent the month prior, according to data released by the Bangladesh Bureau of Statistics (BBS) yesterday.

Non-food prices spiralled to 9.70 percent in March, up from February's 9.38 percent, indicating rising costs of goods and services such as clothing, healthcare, education, and transport.

On the other hand, food inflation decreased to 8.93 percent in March, down from 9.24 percent the month prior.

Economists expressed optimism about the slow rate of growth, saying the moving average is decreasing.

Between April 2024 and March 2025, the moving average rate of inflation reduced to 10.26 percent from 10.30 percent the month prior.

"The general trend is slightly downward overall, but it takes time for non-food inflation to follow the same pattern," said Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, a think tank.

He added that the government's move to curb inflation by implementing a contractionary monetary policy has had some negative effects as well, particularly on investment.

In line with the contractionary policy, the Bangladesh Bank has hiked the policy rate -- the interest rate at which commercial banks borrow from the central bank -- several times, bringing it to 10 percent.

Rahman added that food prices are already coming down due to seasonal factors along with government efforts to increase supply.

"But this positive impact on non-food inflation typically has a slower response time," he said, opining that overall inflation may decrease further in the future.

However, though the rate of growth might be decreasing, food inflation levels are still quite high, he said.

"So, the social safety net and open market operations should be maintained properly. Also, with the upcoming budget, allocations should be made accordingly."

Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh, said the hike in consumption ahead of Eid-ul-Fitr may have contributed to higher non-food inflation.

"It may have happened mostly due to the pressure of Eid shopping as consumption spikes because people are shopping. This spike in consumption likely caused a slight increase in demand, resulting in an upward trend," he said.

However, inflation is still on a downward trend, he added.

"If you look at the 12-month or 6-month moving average, it's still on a downtrend. I think that's a good sign," he said. "If this trend continues, we may even see a reduction in the policy rate in the future."

Echoing those sentiments, Kazi Iqbal, a research director at the Bangladesh Institute of Development Studies, said, "It seems to be an 'Eid effect'. Record amounts of remittance were pumped into the economy in March -- about $3.3 billion. This had an inflationary impact which has outweighed the measures taken by Bangladesh Bank. The inflation is partly driven by clothes and shoes, which are popular items for Eid."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments