Higher investment in treasury bills saves the day for Rupali Bank

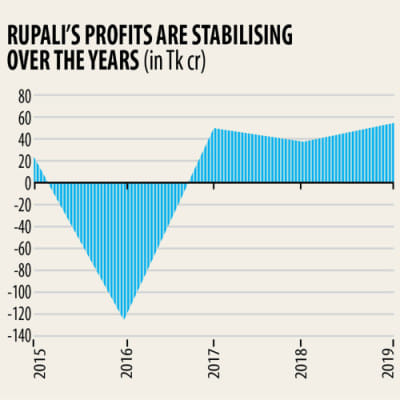

Despite a significant drop in interest income, Rupali Bank's profits jumped last year as higher investment in treasury bills and bonds saved the day.

The lender's profits rose 44 per cent year-on-year to Tk 54.6 crore in 2019, while its net interest income plunged Tk 250 crore, or 99 per cent, to Tk 1.88 crore during the time, according to its annual report.

Investment in treasury bonds and bills helped the bank stay clear of losses as income from the channel rose 35 per cent, to Tk 872 crore.

"As we fell in line with the government's decision to follow the single-digit interest rate from the very beginning, our interest income nosedived," said Md Shawkat Jahan Khan, the chief financial officer of the listed state-run commercial bank.

The government ordered all banks to bring down the interest rate on savings to 6 per cent and on loans to 9 per cent from last year.

Though private banks have started to comply with the decision from 1 April this year, Rupali has been offering reduced interest rate since 1 July last year.

"Due to the decision, our interest income plummeted about Tk 400 crore," Khan added.

To cope with the low-interest regime, the bank decided to increase its investment into treasury bills, bonds and corporate subordinated bonds, and such investment would be 25 to 30 per cent of total lending and investment, said another official of the bank preferring anonymity.

Last year, the bank increased its investment in government securities and other sectors by 26 per cent to Tk 10,364 crore.

"The investment will jack up our profits as the interest rate in these investments is around 8-9 per cent and these are risk-free. Along with it, the investment will help us maintain the statutory liquidity reserve," he added.

Thanks to the lower deposit rate, the state-run bank's deposit growth fell to 6.44 per cent in 2019, which was 21.8 per cent in the previous year, according to the annual report.

Though the bank logged profits in 2019, it was not allowed to provide a dividend to its shareholders due to a provision shortfall.

Earlier on 28 June, the board of directors of the lender had declared 5 per cent stock dividend for its shareholders for the year that ended on 31 December 2019. The bank provided 10 per cent stock dividend in the previous year.

But the central bank did not approve the dividend, the company said yesterday in a piece of price-sensitive information posted on the website of the Dhaka Stock Exchange.

The bank's provision shortfall was Tk 1,168 crore in 2019, which was Tk 1,136 crore in the previous year, according to the annual report of the company.

"Our board declared the dividend considering the situation of stock investors though they knew it might not be approved by the Bangladesh Bank," the official said.

"The stock market was bearish and if we don't pay any dividend then the company will be downgraded to Z category," he said.

When a company does not provide a dividend, it is downgraded to Z category shares as per listing regulations.

Rupali Bank, where the government has 90 per cent shares, closed at Tk 30.8 on the DSE yesterday, up 6.21 per cent from the previous day.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments