Govt may not hike SD on telecom services

Finance Minister AHM Mustafa Kamal may scrap his plans to raise the supplementary duty (SD) on telecom services and double the deposit in VAT-related disputes following criticism and pleas from various quarters.

While unveiling the budget for fiscal year 2020-21 on June 11, the minister has proposed hiking the SD on all kinds of telecom services to 15 per cent from the previous 10 per cent.

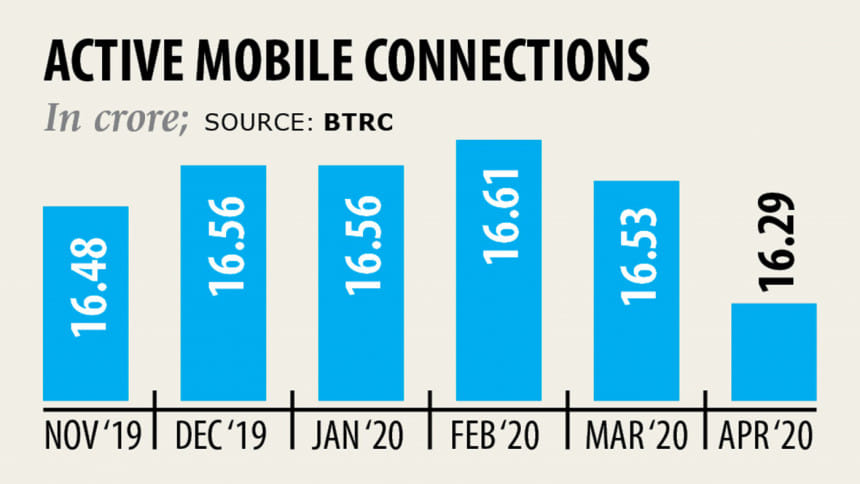

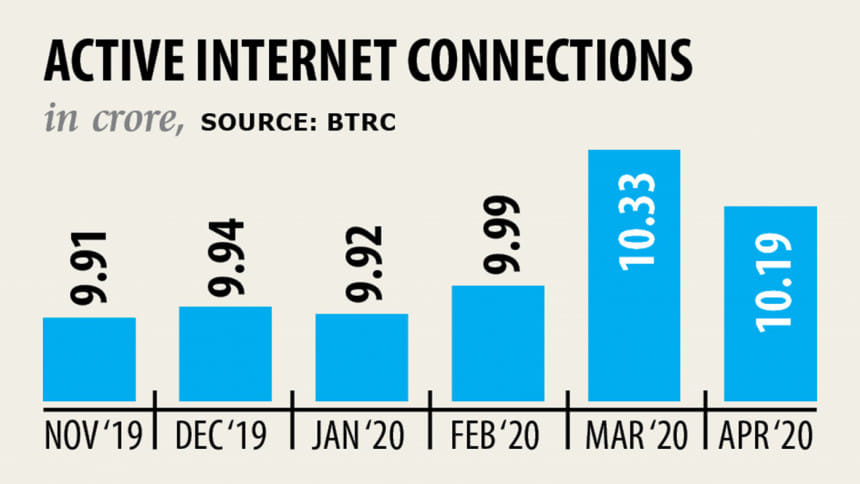

Both operators and users have expressed dissatisfaction at the move and said tax on mobile phone use increased in the last few years, which has negatively affected customers' service-availing trends.

On Wednesday, Telecom Minister Mustafa Jabbar, in a demand letter to the finance minister, called for withdrawal of the additional SD, pointing out that it would thwart the process of digitalisation.

"People are now having a very tough time, so the government should not create any more burden for them," the telecom minister told The Daily Star.

Several other cabinet members and members of the parliament also requested the finance minister to scrap the SD. Apart from the latest hike in the supplementary duty, there is a 15 per cent value-added tax and 1 per cent surcharge on mobile phone bills from before, which make the total tax for mobile phone use 33.25 per cent now.

Kamal may withdraw the proposal while making a statement to parliament on the proposed budget on Monday.

Another area that may see change is the deposit needed for appealing against tax claims before VAT commissioners and appellate tribunals.

Kamal has proposed to increase it from 10 per cent of the disputed amount at present to 20 per cent.

This is one of the VAT-related measures businesses and trade bodies have expressed worry about, saying some of the proposed changes in the VAT law will increase their costs and discourage them from seeking justice against inflated revenue claims by field officials of the National Board of Revenue.

In his budget speech, Kamal said the increase aimed at reducing a tendency of lodging illogical cases against VAT claimed by field officials.

The current practice is that firms file appeals for revision of VAT claims before commissioners by paying 10 per cent of the disputed amount.

Then they can appeal before the VAT Appellate Tribunal of the NBR by paying another 10 per cent of the disputed amount.

If they want to seek revision of appellate tribunal verdicts before the High Court, they have to pay another 10 per cent of the disputed amount.

As per the proposed changes for next fiscal year, businesses will have to deposit a total of 40 per cent of the disputed VAT amount – 20 percent to file appeals before the commissioner of respective field and 20 per cent for VAT Appellate Tribunal, said Md Arshed Ali, convener of the research wing of VAT Professional Forum, recently.

Businesses will have to deposit a further 10 per cent of the disputed tax in order to seek revision against the appellate tribunal's verdicts before the High Court, he said.

The finance minister, however, may go ahead with his plan to widen the scope for investing the untaxed money, also known as black money.

Individual taxpayers will be allowed to disclose any type of undisclosed property by paying a certain tax per square foot, declare undisclosed cash, bank deposits, savings certificates, shares, bonds or any other securities and invest money in the capital market by paying 10 per cent tax on the value of the investment.

Now, black money holders will not face any questions about the sources of their income if they invest in economic zones and hi-tech parks.

The provisions will discourage the honest taxpayers, the Centre for Policy Dialogue said in a paper.

If this type of provisions is to be at all allowed, the rate should be the applicable tax rate plus penalty, it said.

Kamal may keep most of his fiscal measures about income tax unchanged. He has already proposed a lot of concessions in the direct tax segment to ease the burden on the individual and corporate taxpayers amid devastating coronavirus pandemic.

The Tk 568,000-crore budget and the Finance Bill 2020 would be passed in parliament on Tuesday.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments