Govt courts healthcare FDI as market heads towards $23b by 2030

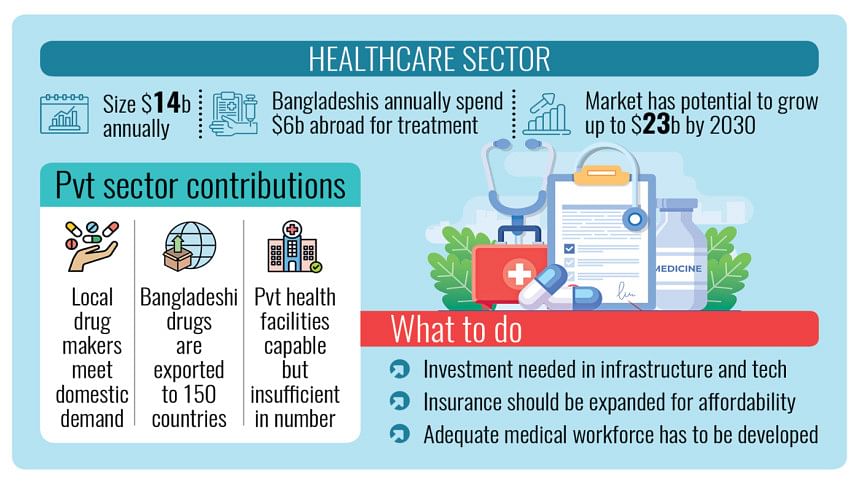

Bangladesh's healthcare sector has the potential to reach $23 billion by 2030, positioning the country as a major destination for foreign direct investment (FDI), according to a presentation shared at the Bangladesh Investment Summit.

The growth of the local healthcare market, according to the presentation, is being fuelled by rising domestic demand, a burgeoning middle class and mounting pressure on the public health system.

The figures were presented during a session titled "Healthcare Breakout" on the final day of the four-day summit in Dhaka yesterday.

As of January this year, Bangladesh's healthcare market stands at $14 billion. This includes hospitals, clinics, diagnostic centres, laboratories, pharmaceutical production -- both drugs and active pharmaceutical ingredients (APIs) -- as well as medical equipment.

"It is not possible for the government alone to ensure healthcare services for the country's 17 crore people," said Md Saidur Rahman, secretary of the Health Services Division, urging greater involvement from private players and foreign investors.

He acknowledged the limitations of public healthcare and advocated for collaborative solutions.

At the seminar, Sylvana Quader Sinha, founder and CEO of Praava Health, also called for both local and international stakeholders to step up.

"This is an incredibly promising time for Bangladesh," she said. "As we aim to become the world's 25th largest economy, investing in healthcare is not just a social imperative -- it's a smart economic strategy."

Sinha referred to a report by Inspira Advisory and Consulting Limited, titled "Bangladesh's Healthcare Sector Coming of Age," which found that the local healthcare market has grown at an average rate of 10.3 percent annually since 2010.

Yet, despite this progress, an estimated $6 billion is spent each year by well-off Bangladeshis seeking treatment abroad -- showing major deficiencies and immense opportunities in the domestic system.

Sinha said that just 37 percent of the population now relies on private hospitals for care.

Bangladesh has only 255 public hospitals, compared with 5,054 private clinics and 9,529 private diagnostic centres. This is clear evidence of the private sector's growing footprint.

Recalling her personal journey, Sinha shared a turning point. In 2011, her mother underwent emergency surgery in Dhaka, which required further treatment abroad.

"That experience made me realise no one should have to leave their country for quality care," she said.

She laid out three key priorities to transform the local healthcare system.

Those are increased investment in pharmaceuticals, biotechnology and digital health; wider adoption of health insurance, which currently covers less than 1 percent of the population; and significant investment in workforce development to tackle the growing burden of non-communicable diseases (NCDs).

With over 11 crore internet users in the country, she also highlighted the rapid expansion of digital health services, such as telemedicine and remote monitoring.

"Healthcare is at the heart of productivity," said Sinha. "To build a prosperous Bangladesh, we must build a strong healthcare system."

AM Shamim, founder and managing director of Labaid Group, said that despite the perception of poor services, many local hospitals are fully capable of providing high-quality treatment.

"Only 10 percent of critically ill patients go abroad for treatment, often citing poor and inefficient services," he said. "But our hospitals are capable. The issue is that there are still not enough high-quality facilities."

The pharmaceutical sector, meanwhile, has made significant headway.

Syed Omor Kabir, general manager of Renata Pharmaceuticals PLC, said, "Bangladesh now meets 98 percent of its domestic medicine needs and exports high-quality generic drugs to over 150 countries, including the United States, Australia and members of the European Union."

Martin Holtmann, country manager for the International Finance Corporation (IFC), praised the pharma sector's achievements but said it remains underrepresented in investment portfolios.

"Today, the country has made notable strides in life expectancy and access to primary care," he said. "But from IFC's perspective, healthcare is still a nascent sector. Out of $9 billion invested across more than 120 projects, only $100 million has gone into healthcare."

Holtmann believes the market is vastly underdeveloped. "Based on demographics and economic growth, we estimate the market could be at least four times larger, reaching between $40 and $50 billion annually."

He highlighted secondary and tertiary care, NCDs, diagnostics, and dental services as key areas of growth.

Despite structural barriers, Holtmann's personal encounters with local healthcare were positive. "I have had to visit hospitals a couple of times and found the care impressive. It shows what's possible when the right investments are made."

Hak Sun Kim, a professor of South Korea's Yonsei University Health System, underlined the importance of understanding local demographics and working closely with government institutions.

He pointed to examples in China and South Korea, where effective coordination with public agencies enabled the rapid completion of healthcare projects, while others faltered due to a lack of alignment.

He also emphasised standardised electronic medical records and better training.

"Sustainable hospital operations depend on efficient systems and well-trained professionals," Kim said.

Futshi Kono, director of Ship International Hospital, part of Japan's Ship Healthcare Holdings, explained why the company sees promise in Bangladesh.

Known in Japan for its hospital development and elderly care services, the group is now focusing on emerging markets.

"As Japan faces an ageing population and declining birth rate, we are turning our attention to dynamic markets like Bangladesh," said Kono. "Our experience in care-mix models, diagnostic innovation, and hospital infrastructure can support the growing demand here."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments