Economy might have been slowing since Feb

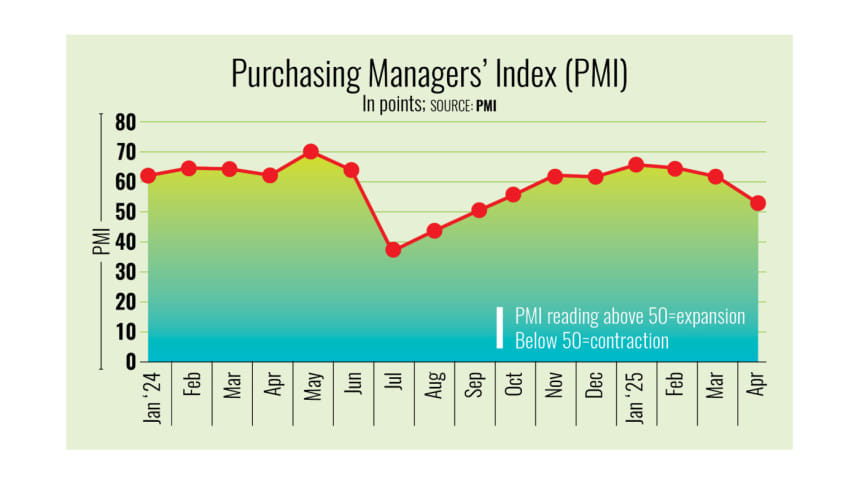

Bangladesh's economy might have been slowing since February, mainly because of sluggish expansion in the manufacturing, construction, and services sectors, according to the latest Purchasing Managers' Index (PMI) released yesterday.

In the last three months, these sectors have been growing at a slower pace.

In April, the PMI—a forward-looking indicator used globally to gauge economic direction—fell to 52.9, the lowest in seven months since the economy rebounded to the expansion track, as the manufacturing, construction, and services sectors grew at a slower rate.

In October 2024, the PMI reading was 55.7, indicating that economic activities broke the phase of contraction that began amid a mass uprising in July, which led to the ouster of then Prime Minister Sheikh Hasina the following month.

A reading above 50 indicates expansion, and below 50 indicates contraction, according to the Metropolitan Chamber of Commerce and Industry (MCCI) and Policy Exchange Bangladesh (PEB), which prepare the index based on data from over 500 private sector firms across agriculture, manufacturing, construction, and services.

"The slow expansion of the economy as recorded in the April PMI, which is also the slowest since October when the current expansion run started, indicates that a number of issues need important consideration and urgent attention," said M Masrur Reaz, chairman and CEO of the PEB.

The Trump tariff is creating uncertainty and has already had some early impact on the overall export scenario, he said.

"A number of export orders, which had been placed before the Trump tariff came into effect and were scheduled to enter the manufacturing process in April, have been deferred pending further clarity or resolution of the Trump tariff issue vis-à-vis Bangladesh's exports to the US," he said.

Secondly, gas disruption has intensified recently.

"This is causing industrial output disruption and is also risking macroeconomic recovery efforts, as many of the textiles, knitwear, and apparel firms are being hit by the gas crisis, reducing their planned outputs," he said.

Thirdly, small and medium enterprises, particularly in agribusiness and construction, are being hard hit by macroeconomic challenges that started two and a half years ago, he added.

"Following the mass uprising of July–August, they also took a hit due to flooding, frequent protests that disrupted the supply chain, and rising costs with regard to interest rates," he said.

As per the latest PMI, the agriculture sector marked its seventh consecutive month of expansion—and at a faster rate.

However, the manufacturing sector expanded at a slower pace in April than in March, marking another month of sluggish growth. In March, the manufacturing sector PMI was 51.8, the lowest in recent months, down from 64.3 the previous month.

The construction and services sectors followed suit in April, as reflected in the sectoral PMI. The reading for construction was 51.8 in April, down from 54.1 in March.

The services sector PMI reading fell to 51.5 in April from 62.5 the previous month.

Reaz said long stretches of public holidays for Eid-ul-Fitr led to the closure of businesses in April.

"Targeted policies and interventions are required for small and medium enterprises in order for dynamism to grow stronger and sustain the expansion mode," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments