Branchless banking gaining ground

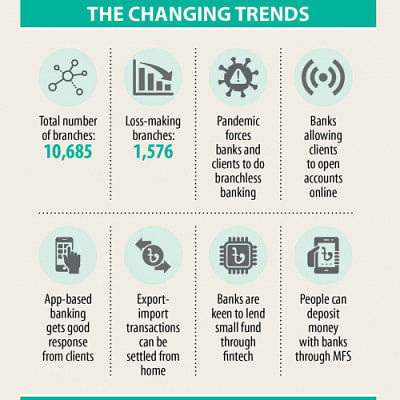

A good number of banks are going towards branchless banking in recent times by way of rolling out different digital products as a part of their efforts to reach out to more people both in rural and urban areas.

This is also helping them decrease the cost of doing business in an efficient manner as the expenditure of digital banking is much less than the manual one, said managing directors of four banks.

People's habit of branch-led banking has also reduced to a great extent as a large number of clients now prefer to settle transactions sitting from their homes by using internet or mobile app-based banking in order to protect themselves from the coronavirus.

Plenty of local banks have already allowed clients to open accounts without visiting branches during the times of the pandemic to expedite branchless banking to push the clients' habit further.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank (MTB), said the lender had opened only one branch in the last two years.

"We do not have any plan to set up excessive branches in the days ahead except in case of an emergency requirement," he said.

The MTB, which has 118 branches across the country, has decided to expand its financial services in the remotest parts of the country riding on the digital means.

The lender will carry out its banking services by collaborating with fintechs, Rahman said.

"We are going to introduce a new method that will allow clients to give instalments of their deposit pension scheme (DPS) through mobile financial services (MFS) providers," he said.

In addition, the bank is trying to roll out lending services for clients from all walks of life through MFS providers, he said.

The central bank should lay emphasis on the matter as well such that branchless banking gains momentum, he said.

The model of branchless banking also helps reduce the cost of doing business as well, Rahman said.

Banks have to spend around Tk 1 crore to set up a branch in the major cities including appointing at least 10 officials to run operations.

If they want to set up such an outlet in rural areas, they must count between Tk 50 lakh and Tk 60 lakh.

Despite that, banks have been forced to expand their branches over the years as people in the country are largely habituated to do banking by going to outlets.

Some banks, which had earlier focused on branchless banking in providing financial services, have struggled to make the method attractive for commoners.

Then came the first wave of the coronavirus pandemic in the country in March last year.

People had been barred from going outside of their homes amidst a lockdown that had also compelled banks to close a good number of branches for the time being, leaving clients with no choice but to use technology to conduct transactions.

The pandemic also created obstacles for banks to set up branches last year. In such a situation, both banks and customers learnt more techniques to do more branchless banking than before.

The country now faces a second wave of the Covid-19 pandemic, which has already given another boost to digital banking.

Although the majority of banks had failed to manage their expected profit for expansion of their businesses by opening new branches last year, they have embraced different digital models to make their services available for people.

Banks set up only 107 branches in 2020 instead of an average figure of 300-400 per year, data from the central bank showed.

Md Arfan Ali, managing director of Bank Asia, said his bank had set up only seven branches in the last two years and it does not have any strong plan to open such outlets in the days ahead.

"But we have a roadmap to open a good number of sub-branches in the days ahead to operate our digital banking activities in rural areas," he said.

Sub-branch offers limited-scale banking services where five-six officials are usually appointed.

Bank Asia has already established the agent banking window in a massive manner and it now works on popularising the retail banking operated by the micro-merchant account holder.

The small businesses, like owners of grocery shops, are allowed to open micro-merchant accounts with banks as per the central banking guidelines.

Customers can pay their bills against their purchased products from the shops through scanning quick response (QR) codes by using their smartphones.

In addition, remittance receivers and the beneficiaries of different safety net programmes run by the government will be able to withdraw money from the shops of micro merchant accountholders.

This will lessen the requirements of branches to a great extent, Ali said.

Dutch Bangla Bank has been taking up initiatives to embrace the branchless model since 2005, said its managing director, Abul Kashem Md Shirin.

"We have 210 branches to serve 3 crore clients. We would have been unable to cater banking services had different models of the branchless banking not been introduced," he said.

The bank has already gained huge popularity by rolling out MFS, agent banking, ATM service and so on.

The bank opened 20 branches in the last two years, but it will set up a maximum of 20 branches in the next five years.

A bank, which manages strong CAMELS rating from the central bank, is supposed to open the highest 12 branches per year.

Banks with lower CAMELS rating are permitted to open a lesser number of branches than the strong ones.

The CAMELS is a recognized international rating system that bank supervisory authorities use in order to rate financial institutions according to six factors represented by its acronym.

The CAMELS acronym stands for "capital adequacy, asset quality, management, earnings, liquidity, and sensitivity".

Dhaka Bank even now allows businesses to open letters of credit sitting from their homes or offices, said Emranul Huq, managing director of the bank.

The bank has recently rolled out a virtual banking product namely "Dhaka Bank Trade Cloud", helping clients to do overseas trade smoothly, he said.

This has helped branchless banking flourish further in the country.

As much as 1,576 branches had become loss-making last year, which was 15 per cent of the total 10,685 outlets, the BB data showed.

The business slowdown deriving from the pandemic fuelled the rise in the number of loss-making branches, encouraging lenders to adopt branchless banking.

In most cases, the requirement of smartphones turned digital banking essential to be carried out by clients, said Atiur Rahman, a former governor of the central bank.

Poor people are still far away from managing such digital devices, so the government should take measures to this end, he said.

The existing tax regime over the import of smartphones can be reduced to make the device available among the marginal people, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments