Bangladesh set to remain world’s top cotton importer in MY26

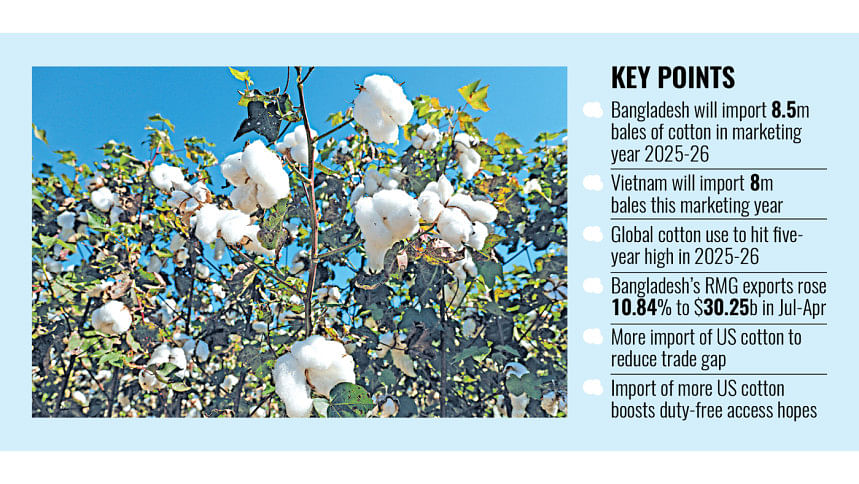

Bangladesh is on track to retain its status as the world's biggest cotton importer in the marketing year (MY) 2025-26, with imports projected to reach 8.5 million bales, according to a record-setting forecast by the United States Department of Agriculture (USDA).

Vietnam is set to follow closely with 8 million bales, marking an all-time high for both countries, as per the USDA's latest Cotton: World Markets and Trade report.

The report highlights a modest rebound in global cotton consumption, which is expected to hit a five-year high of 118.1 million bales. This resurgence is attributed to stable economic activity, particularly in major textile-exporting countries such as Bangladesh and Vietnam.

For Bangladesh, the surge in cotton imports reflects the continued expansion of its ready-made garment (RMG) industry — the backbone of its export economy.

In the first 10 months of FY25, Bangladesh's RMG exports grew 10.86 percent year-on-year to $30.25 billion, according to Export Promotion Bureau (EPB) data.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said Bangladesh's decision to import more cotton from the US is part of a broader strategy to reduce the trade gap between the two countries.

He noted that the record volume of cotton imports would also strengthen Bangladesh's case for securing duty-free access for its RMG products in the US market.

"The government has already taken necessary initiatives in this regard," Hatem said.

He further stated that US cotton is considered the best in the world in terms of quality and consistency, making it the preferred choice for local spinners and manufacturers.

"With global buyers increasingly prioritising sustainable sourcing and natural fibres, cotton remains a vital raw material for Bangladesh's spinners and knitwear producers," Hatem added.

He viewed the USDA's import forecast as a strong endorsement of Bangladesh's capability to maintain and expand its leadership in the global apparel value chain.

The global cotton trade is also forecast to rise by 2.3 million bales to 44.8 million bales in MY26, indicating a broader uptick in demand across textile-producing economies.

China, which imported 15 million bales in MY24, is projected to import only 7 million bales in MY26. The country's shift away has left space for Bangladesh to rise to the top, which analysts say marks a notable structural shift in global cotton trade flows.

The USDA also anticipates stable cotton prices globally, aided by adequate supply, a weakening US dollar, and declining energy costs. These trends may ease cost pressures for Bangladeshi millers, who have grappled with high input costs over the past two years.

On March 17 this year, Foreign Affairs Adviser Md Touhid Hossain said Bangladesh intends to import more cotton from the US, creating mutual benefits for US suppliers and local businesses.

He added that such trade ties could offer Bangladesh protection amid former US President Donald Trump's tariff-centric policies.

Although the Trump administration has levied high tariffs on many countries, Bangladeshi goods have so far remained outside the purview of such punitive measures.

Hossain argued that sourcing more US cotton could further dissuade the administration from targeting Bangladesh, whose products face an average tariff of 15.62 percent in the US market.

He also stressed the need to boost domestic cotton production to meet at least 20 percent of the country's annual demand, amounting to about 9 million bales.

Currently, local production covers just 2 percent of that requirement.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments