ADB to increase lending by 67%

The Asian Development Bank is likely to increase its loan commitment to Bangladesh by 67 percent to $2 billion this year, up from $1.2 billion in 2024, and offer additional financing by partially canceling funds from long-delayed projects.

The partial fund cancellation is one of several measures that the ADB has been considering for Bangladesh, according to the lender's portfolio review report sent to the government in February.

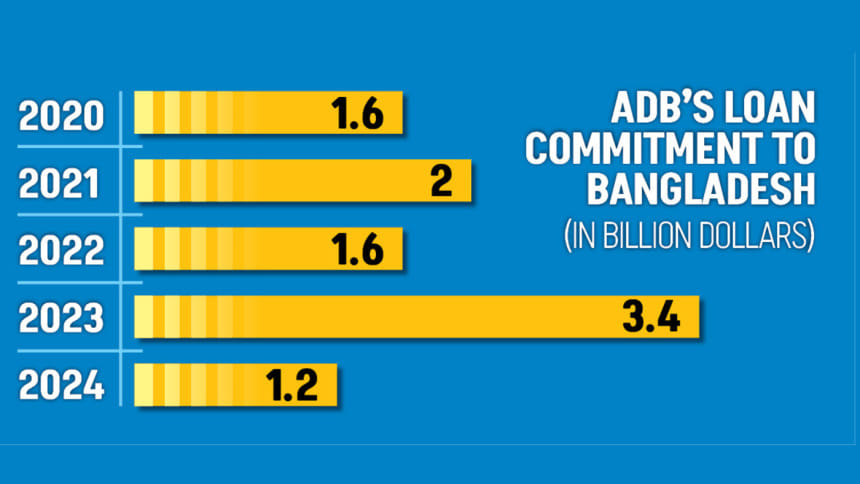

The ADB's loan commitment to Bangladesh dropped to $1.2 billion last year from $3.4 billion the previous year. The lender informed the government this year that it would commit around $2 billion in loans, said a finance ministry official seeking anonymity.

In its portfolio review report, the ADB said, "The year 2025 would be another challenging year considering the expectation of election and continuous shuffling of decision-makers in the government." Disbursement targets were set conservatively, considering "a possible disturbance".

Some projects and programmes faced significant delays in implementation. The situation worsened further due to additional difficulties and challenges, it pointed out.

"Taking into serious consideration the country's risk appetite and risk tolerance under the ADB exposure limits framework, more serious consideration and decisions on partial cancellation of loans with poor performance can create more headroom for new lending opportunities that can support the interim government's priorities."

Such repurposing would also help improve the portfolio management of the ADB-financed projects and programmes that would lead to more effective utilisation of public funds in Bangladesh, it noted.

The ADB usually makes loan commitments for its member countries every calendar year. Once a loan signing is approved by the ADB board, it turns into a loan commitment and becomes ready for disbursement.

At the beginning of this year, Bangladesh's loan portfolio under the ADB stood at $11.79 billion for 52 projects.

If Bangladesh fails to implement a project after the ADB's loan commitment, the country must pay commitment charges to the lender.

According to the ADB report, a commitment charge of 0.15 percent per year is applied to all undisbursed loan balances for ordinary capital resource (OCR) loans, starting 60 days after the loan signing.

For the computation of commitment charges, undisbursed loan balances are calculated daily. Consequently, the timing of disbursements within a year affects the amount of commitment charge.

Based on the analysis of $7.07 billion OCR loans in the present portfolio, the amount of undisbursed loan stands at $2.39 billion, and a total of $30.89 million was paid accumulatively in commitment charges over a decade.

Last year, Bangladesh paid ADB $3.58 million as commitment charges.

The report said the analysis of 15 OCR loans that were closed or scheduled to be closed between January and December last year shows that $23.54 million in commitment charges was paid cumulatively against loans of $3.98 billion.

High commitment charges resulted from long implementation periods and low disbursements during the initial phases of the implementation process, it mentioned.

During a three-day discussion in February, officials of the finance ministry, the planning ministry and other ministries concerned discussed and reviewed the ADB loan portfolio report and Bangladesh's loan performance, said a finance ministry official.

PROJECTS FACING LONG DELAYS

In its report, the ADB cited three projects as examples to demonstrate how long delays and cost escalations affect implementation.

One of the projects, "The Greater Dhaka Sustainable Urban Transport Project," was approved on April 17, 2012, with an estimated cost of $255 million, and a completion deadline of December 31, 2017. The ADB's contribution was $160 million.

However, the deadline was later extended to December 31, 2022, and additional financing was approved to address the cost overrun. The total cost saw a 94-percent increase to $494.39 million from $255 million. Consequently, the ADB raised the loan amount for the project by 63 percent to $260 million from $160 million.

Multiple factors contributed to deadline extension and cost overrun, such as underestimated cost for civil works at appraisal, changes in the scope and design during implementation, delays in land acquisition and relocation of utilities, slow mobilisation and inadequate input of contractors, and also impacts of Covid-19.

Land acquisition and resettlement, scheduled for completion in the fourth quarter of 2013, were delayed by over three years. Similarly, civil work contracts were awarded more than three years behind schedule.

The second example was "The Power System Efficiency Improvement Project" taken up in August 2011, with a completion date of December 30, 2017.

Though the approved loan amount was $300 million, the authorities revised it four times, raising the total cost by 3 percent. The deadline was extended by eight years with the latest completion date set for December 31 this year.

The third example was "Dhaka Environmentally Sustainable Water Supply Project," approved in 2013 with a completion date of June 30, 2020. But the project has yet to be completed, with the ADB raising its loan amount to $328.80 million from $250 million.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments