Accolades for VAT compliance

The National Board of Revenue (NBR) yesterday honoured companies which deposited the highest amount of VAT paid by consumers to the state coffer in fiscal 2018-19 to recognise their exemplary compliance.

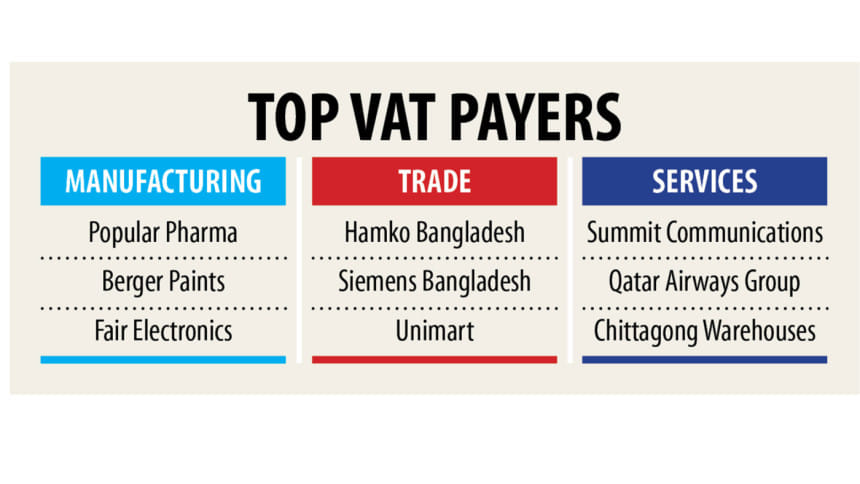

Nine of the awardees topped the national roll while 131 were of their respective district, all listed under manufacturing, trade and service categories.

"This is a moment to rejoice. We are thankful to you for honouring us," Rupali Chowdhury, managing director of Berger Paints Bangladesh, told the NBR officials at a seminar and awards ceremony at the NBR headquarters.

The NBR organised the event to mark VAT Day and VAT week as a part of its initiative to create awareness on paying the indirect tax and helping the state finance development activities and national budget while cutting dependence on domestic and foreign loans.

In its 15th year, the recognition is an effort of the NBR to increase revenue collection from domestic economic activities and reduce evasion.

Berger stood first among manufacturers. Popular Pharmaceuticals and Fair Electronics were also recognised.

"We are very happy to be able to be part of this. We deposited thrice the amount of VAT we paid the first time we became top VAT payers earlier," said Malik Talha Ismail Bari, managing director of Unimart, one of the nation's top three VAT payers in the trading category.

Also termed as consumption tax, VAT is now the biggest source of revenue for the NBR, accounting for nearly 39 per cent of the total Tk 218,400 crore collected in taxes in fiscal 2019-20.

Citing the installation of the Padma bridge's last span yesterday, NBR Chairman Abu Hena Md Rahmatul Muneem said that it is a happy occasion for the country.

"But there are more big projects, such as the metro rail and four-lane highway, under development. So, we will all feel god when those projects become physically visible in the coming days," he added.

The NBR chief also said that the state requires more revenue to carry out development activities and turn the country into a developed economy by 2041.

In regards to tax rates, Muneem said that the NBR could revise them downwards once the tax and VAT net is increased.

"We give our assurance that we are working to ease the process of VAT payment," he said, adding that the NBR was also focusing on automation and some of the projects were under implementation.

Sheikh Fazle Fahim, president of the Federation of Bangladesh Chambers of Commerce and Industry, said properly paying tax and VAT was a national responsibility.

He urged the NBR to collect turnover tax from retails and distribution on the basis of actual value addition instead of the present fixed 5 per cent rate.

Introduced in July 1991, VAT became the biggest contributor to the NBR's revenue collection from fiscal 1995-96 and has maintained the lead ever since.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments