National payment switch: both boon and bane

Banks and payment networks have welcomed the national payment switch but also resented the fact that the system is not spurring competition, innovation and efficiency in the field of electronic transaction.

The National Payment Switch Bangladesh or NPSB is a good initiative, but some restrictions have been put on the banks, said Syed Mahbubur Rahman, vice chairman of the Association of Bankers Bangladesh.

Launched in December 2012, the NPSB facilitates interbank electronic payments originating from different channels: automated teller machines, point-of-sales machines, internet banking and mobile financial services.

The main objective of NPSB is to create a common electronic platform for payments in Bangladesh. The system is meant to facilitate the expansion of the card-based payments and promote e-commerce.

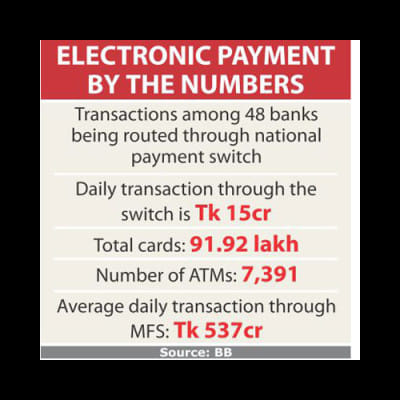

At present, transactions among 48 banks are being routed through the NPSB.

In his keynote presentation, Rahman, also the managing director of Dhaka Bank, said the NPSB framework is restricting the banks' choice of networks, thus limiting competition and innovation.

“You want growth through competition and innovation, which also give advantage to customers. But the NPSB is not helping us in that perspective.”

Rahman's comments came during a roundtable, “Payment Ecosystem in Bangladesh: Challenges and Opportunities”, organised by The Daily Star in Dhaka yesterday.

Security continues to be an issue, as the NPSB can only process data from the magnetic stripe and not from secure chips, he said.

As a result, the acquirer bank is always exposed to loss and fraud; and if there is a fraud they are not going to be compensated.

There is also lack of dispute resolution and fraud management in the NPSB, he said.

Ali Reza Iftekhar, chief executive officer of Eastern Bank, requested the central bank to review its policies on the NPSB and hold discussions with stakeholders in order to sort out some unresolved issues.

The opportunities are limitless in payment solutions and the gap between the number of mobile phone subscribers and people making payments electronically gives a rough idea of the potential, he said.

“To tap the opportunities, positive regulations are required.”

Iftekhar, who is also a former president of ABB, said the regulator should make the framework and let others operate it.

If the regulator becomes the operator, it will hinder the growth prospect of the payment ecosystem, he said. Iftekhar also touched upon the security risks of the NPSB.

The Bangladesh Bank itself is not compliant of the US-based PCI Security Standards Council (PSI-SSC), an open global forum for the storage, dissemination and implementation of security standards for account data protection.

“Then what was the hurry to launch the NPSB? All the operators are running huge risks. If something goes wrong, these institutions will be penalised and the reputation of the country will be dented,” he added.

Vikas Varma, executive director for South Asia at MasterCard, a global payment network, said the two key drivers of the growth of a payment system are ways to pay and places to pay.

The government and the regulator have a large role in laying the foundation for a payment system, and they can do that through policy formulation and incentives for participants.

Growth can be challenging if there are situations in markets such as Bangladesh where the regulator also becomes a player in the payment ecosystem, Varma.

Eight million out of 109 million or less than 10 percent of the adults can transact electronically today, Varma said.

Besides, less than 1 percent of everyday purchase happens electronically in Bangladesh, whereas the global average is 16 percent, and it is more than 60 percent in developed markets such as the US and South Korea.

“In Bangladesh, there is significant room to grow. Besides, cash at the teller is 4 to 6 times more expensive that it is at ATMs,” he added.

Sanjay M Nazareth, head of client support services in India and South Asia for VISA, another global payment network, said: “When we talk about Digital Bangladesh we are talking about the growth of electronic payments.”

He said innovation, safety and security are the keys to the growth of the electronic payment system.

“At the end of the day, it is the customers who need to have the confidence in the payment system for them to pull out the cards and use. Safety and security should never be compromised.”

He said they hope the regulator would come up with decisions that would help build the customers' confidence.

Subhankar Saha, executive director for the payment services department of the BB, said the evolution of the payment system would never stop and it is an unending process.

Bangladesh has made huge strides towards electronic payment system in the last five years by parting away with the manual traditional method.

In its place, automated cheque processing system, electronic fund transfer network, mobile financial service, national payment switch and real time gross settlement system were brought in, he said.

Saha said the NPSB has been introduced to facilitate interoperability of the different payment systems. It also aims to reduce the transaction cost and settlement time.

He also said maybe the national switch has some limitations but the BB can sit with the banks to sort out issues.

The BB has already formed a committee to see how it can move to chip-based cards and comply with the PSI-SSC.

Jeremy King, international director of PCI Security Standards Council, said the challenge Bangladesh faces in payment is a global problem.

“We live in a world of global organised crimes and criminals who are trying to steal money.”

If the criminals can obtain the data contained in the cards with magnetic stripe, they can copy the card and withdraw money from the ATMs, he said.

“So, we are seeing the migration towards chip cards and adoption of the EMV in the US and Europe,” he said, adding that EMV significantly reduces face-to-face fraud.

In Bangladesh, all merchants are using the same process where the data is sent through a single switch.

“Unfortunately, our criminals are much organised. They know about the payment systems as much as we do. That is why they will know where the greatest aggregation of cardholder data is.”

It represents the greatest threat to the payment system as Bangladesh is still in an era of using magnetic stripe data and growing e-commerce data, he added.

Abul Kashem Md Shirin, deputy managing director of Dutch-Bangla Bank, said e-commerce sites are not keen to accept payments through cards because they have to pay a 3-4 percent fee to banks, which do not happen in case of cash-on-delivery.

Omar Faruque Bhuiyan, senior executive vice president of Premier Bank, said if the central bank can provide service in line with the standards of VISA and MasterCard and maintain security features and settle disputes then the BB can act as a service provider.

Anwar Hossain, head of cards at Mutual Trust Bank, said the electronic payment system has to be taken to the larger section of the population.

“To reach them, we have to raise acceptance awareness of the customers,” he added.

Muhammed Shaukat Ali, vice president of Islami Bank Bangladesh, said interoperability is a big challenge for mobile financial services.

Extrapolating from the experiences of the fast growing mobile financial services, Syed Mohammad Kamal, country manager of MasterCard, said when the pay-out points are at the right place people will use the services despite the cost.

Arun Devnath, business editor of The Daily Star, moderated the discussion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments