Local manufacture of bikes taking shape

Eight firms, including Japan's Honda and Suzuki and India's Bajaj, TVS and Hero, are set to establish facilities to manufacture motorcycles in Bangladesh.

The development comes after the National Board of Revenue at the start of the fiscal year offered 20 percent duty rebate on import of motorcycles in completely knocked down (CKD) format for firms that want to sign up as progressive manufacturers.

As progressive manufacturers, the firms would have two years to build the infrastructure such that from the third year onwards they can manufacture some of the components locally.

In response, Bangladesh Honda Private Ltd (BHL), Speedoz, Uttara Motor Corporation, Menoka Motors, TVS Auto Bangladesh, Aftab Automobiles, Rancon Motorbikes and Niloy Motors applied to the industries ministry for the privilege.

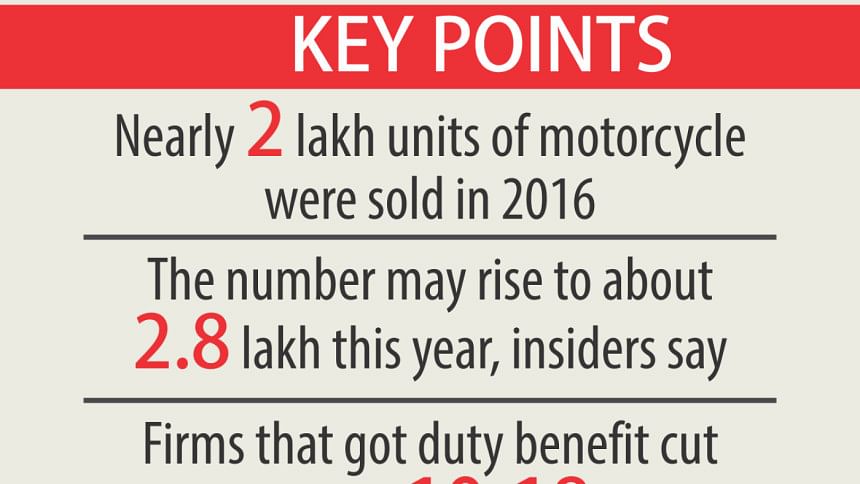

After getting the scope to import motorcycles in CKD form at reduced duty, most of the firms have cut the prices of bikes in the last two months. The price cut has also buoyed demand and contributed to the expansion of the overall market; nearly two lakh units were sold in 2016, according to industry insiders.

TVS has already passed on the benefits of reduced duty to customers, said its Chief Executive Biplob Kumar Roy.

The firms that got the benefit have cut prices by 10-18 percent depending on models, said Shah Muhammad Ashequr Rahman, chief financial officer of BHL, a joint venture between Japan's Honda Motor and Bangladesh Steel & Engineering Corporation. For instance, a 100-110cc bike, which is the most popular version, now costs Tk 1 lakh to Tk 1.20 lakh, down from Tk 1.20 lakh to Tk 1.42 lakh.

“We saw a rise in demand after the price cut. The overall market size has expanded,” he said, adding that a cut in registration fees will attract more buyers.

Roy said the overall motorcycle market will increase to nearly 2.8 lakh units at the end of 2017.

“But the demand for motorcycle will only grow if banks and leasing firms start financing for purchase of the two-wheelers.” He cited India, Pakistan, Sri Lanka and Vietnam as examples, where finance from banks and leasing companies propelled the expansion of motorcycle market.

Without the expansion of the market to five lakh units a year, the investment for manufacturing spare parts and other components of motorcycle will not be viable, said Matiur Rahman, chairman and managing director of Uttara Group of Companies, local assembler and sole distributor of Bajaj Auto.

Uttara Motors is taking preparations to start manufacturing of motorcycles in Bangladesh. Rahman, who is also the president of Bangladesh Motorcycle Assemblers and Manufacturers Association, said the government should impose duty in a way that the prices of bikes come down to Tk 1 lakh each.

Roy said the backward linkage industry should also be developed so that the manufacturers can source components from vendors. “So, vendor development has become vital,” he added. Apart from duty-benefit, the government should frame a policy to facilitate the development of the sector.

“The duty benefit is not all for industrialisation. It is only a part of the whole process,” Roy said.

Industry insiders said a policy will give idea to investors about the government's vision for the sector.

“We want a policy from the government at least for a period of five years,” Rahman said.

He also urged the NBR to impose import duty on basic raw materials at 1 percent and semi-finished and finished components at 5-10 percent so that assemblers can reduce the prices of bikes to attract buyers and expand the market.

On the issue, a senior official of the industries ministry said an automobile policy is on the cards.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments