Treasury bonds finally make stock market debut

The trading of treasury bonds began in the secondary market of the Dhaka Stock Exchange yesterday, ending a wait of more than a decade and creating one more investment tool for the retail investors reliant only on shares and mutual funds.

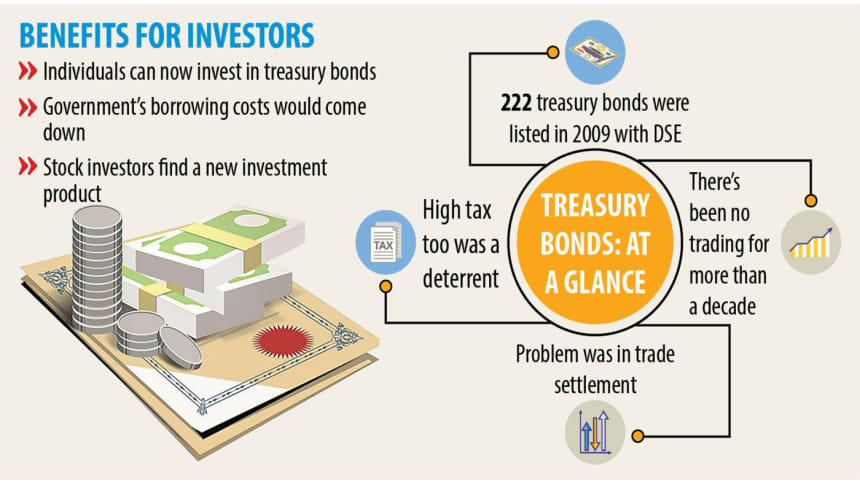

Some 222 government bonds, with a combined value of Tk 55,000 crore, were listed with the premier bourse of the country between 2005 and 2011. But they were not traded like shares and mutual fund units as there was no secondary market.

Problems related to the settlement of the trading of treasury bonds and a higher tax had prevented the government securities from being traded on the exchange. All of the problems have now been solved, paving the way for retail investors to take part in the trading.

A transaction of a 10-year Bangladesh Treasury Bond was executed as a test case yesterday between VIPB Accelerated Income Unit Fund and Alliance MTB Unit Fund.

Both the regulator and institutional investors were elated.

"I have been waiting for the day since I joined the BSEC," said Shaikh Shamsuddin Ahmed, a commissioner of the Bangladesh Securities and Exchange Commission (BSEC).

"There had been many ups and downs, but finally, we made it," he said, while speaking at an event to mark the debut of the stock market trading of treasury bonds.

"Individual investors will now be able to buy and sell the treasury bonds."

At present, there are 264 treasury bonds worth more than Tk 2.5 lakh crore with their tenures ranging from two years to 20 years, data from the central bank showed.

Their trading has so far been concentrated within the interbank ecosystem under the market infrastructure module of Bangladesh Bank. At present, government bonds are traded between institutional shareholders, including banks and financial institutions.

Although an investor was still able to participate in the buying and selling of the securities through treasury bond investment accounts, the process was complex. As a result, the bond market in Bangladesh had largely been dormant until yesterday.

A committee comprising officials of the central bank, the DSE and the BSEC worked to remove all the barriers with a view to introducing the treasury bonds in the stock market.

Prof Mizanur Rahman, a commissioner of the BSEC, said a strong secondary market for treasury bonds would cut the government's borrowing costs in the long term.

"The listing and trading of government bonds in the stock exchanges will attract other institutional investors and high net-worth individuals to invest in this class of securities."

"This will help the government issue bonds with lower yields."

According to Rahman, individual and institutional investors will now be able to avoid overvalued equities and protect their capital by investing in risk-free government bonds. Manipulative stock trading will diminish over time.

A secondary market for government and corporate bonds is an important step towards the development of the market for derivatives and other financial instruments, he added.

"It is surely a great moment for the capital market because it will lead to an increase of the depth of the market," said Shahidul Islam, chief executive officer of VIPB Asset Management Company.

"So far, we have been able to trade treasury bonds through banking operation. Now we can carry out the trade through the stock market."

Existing investors of treasury bonds have their holdings in the depository participant accounts with the Bangladesh Bank. They will now need to transfer the holdings to a BO account to be able to sell them through stock exchanges.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments