BO accounts drop amid poor IPO return

The number of beneficiary owner's (BO) accounts, which are needed to trade stocks, has fallen over the past seven months due to the thin profits earned from initial public offerings (IPO) and a continuous bear run in the market, analysts say.

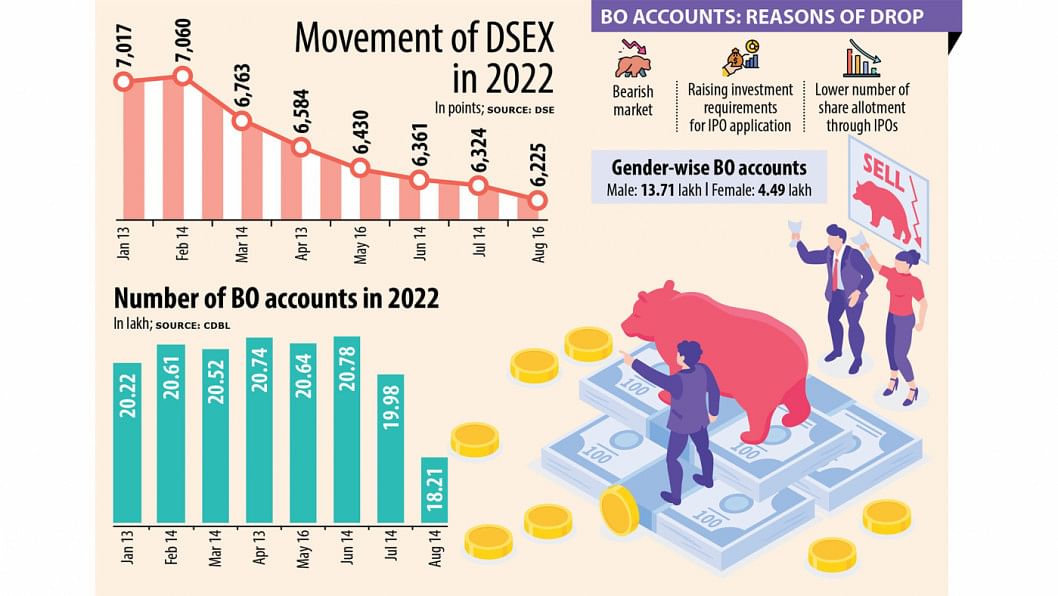

The number of BO accounts in the country stood at 18.36 lakh on August 14, down 9.7 per cent from 20.34 lakh in early January, according to data from Central Depository Bangladesh Limited.

"The number of BO accounts dropped as IPO hunters are giving up on trading considering the low profits in the primary market," said Richard D Rozario, president of DSE Brokers Association of Bangladesh.

The profits fell as investors get a very small number of shares through IPOs but still have to keep an investment of at least Tk 50,000.

"The number of BO accounts dropped as IPO hunters are giving up on trading considering the low profits in the primary market," said Richard D Rozario, president of DSE Brokers Association of Bangladesh

The Bangladesh Securities and Exchange Commission (BSEC) introduced a pro-rata share allocation system instead of a lottery system in 2020 so that everyone who subscribes to an IPO are given shares no matter how less.

"Many small investors do not have enough funds to maintain the required investment for their BO account and so, they are pressing the off button," he added.

The BSEC had raised the minimum investment required to participate in an IPO to Tk 50,000 in June from Tk 20,000 previously in a bid increase trade in the secondary market and ensure primary shares for people who invest in it.

"The BSEC tightened the IPO market with a good intention of evading IPO hunters to ensure shares for all investors," Rozario said.

However, many investors come to the primary market first and then invest in the secondary market and so, this process will be hampered in the coming days.

Some of the BO accounts were closed in July as investors did not pay their account fees considering the low profit in the primary market, he added.

A merchant banker said many investors are keeping away from trading stocks as they incurred losses over the years in the secondary market.

The number of BO accounts stood at an all-time high of around 32 lakh in 2015.

In addition, the recent decline in major indices are keeping investors at bay as their confidence on the market has hit rock bottom, he added.

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), dropped 1,109 points between January and August this year, according to market data.

The merchant banker went on to say the stringent policies of opening a BO account discourages potential investors while the use of a pro-rata system means that even those who participate in an IPO get a lower number of shares.

"Moreover, shares of many newly listed companies remain low in the secondary market so profit of IPO is narrowed strictly," he added.

For instance, Union Bank debuted on the DSE with an issue price of Tk 10 in January 2022 but was traded at Tk 9.30 yesterday while shares of South Bangla Agriculture & Commerce Bank, which were issued at Tk 10, traded for Tk 10.80 at the same time, DSE data shows.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments