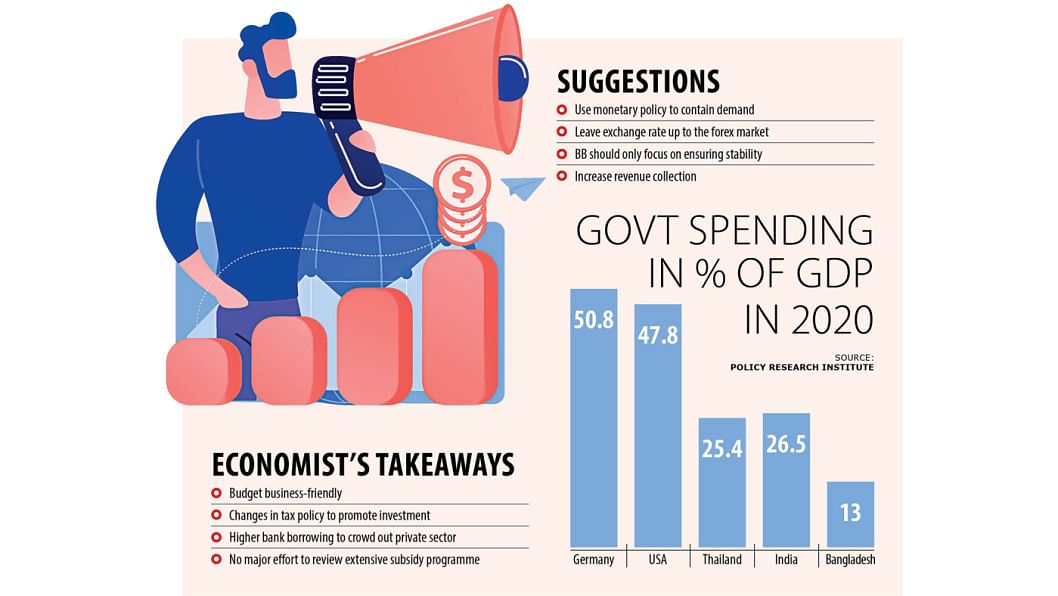

Use monetary policy to contain demand, reduce inflation

The monetary policy must be used as a proper tool to contain demand, reduce inflation, and stabilise the exchange rate in Bangladesh, a noted economist said yesterday.

Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh, a think-tank, said currently, with deposit and lending rates capped, there cannot be any monetary transmission and thus, there is no scope for using the monetary policy for stabilisation purposes.

"Price stability cannot be achieved without the proper use of monetary policy," he said at a post-budget panel discussion at the Sheraton Hotel in Banani, Dhaka. The American Chamber of Commerce in Bangladesh (AmCham) organised the discussion.

In his presentation, Mansur said the economy was passing through a difficult patch due to external sector imbalances and inflationary pressures.

The reduced size of the budget, in relation to GDP, would help reduce domestic demand pressure, although some upfront price adjustments for other products with regulated prices, like the increase in gas prices, would have helped contain demand pressures further.

"The exchange rate should be left with the market and Bangladesh Bank should only focus on ensuring its stability without interfering with its trend. The interbank foreign exchange market must be allowed to work freely (without interference)."

Speaking about the challenges facing the economy, Mansur said there are challenges but they are manageable.

"What is needed is the application of right policy instruments for the right objectives."

He went on to say that the FY23 budget faces three uncertainties: on the revenue side, on managing the ballooning fiscal subsidy, and managing the financing of the growing fiscal deficit.

"Bangladesh's budget size is the smallest of almost all countries. Whether this is a curse or blessing is yet to be determined," Mansur added.

The PRI executive director thinks that Bangladesh requires large government spending to meet the growing needs of the economy.

"But if the resources are not well-spent, economic performance will suffer," he said.

Mansur then raised questions about whether Bangladesh would be able to become an upper-middle-income or high-income country with this kind of small public sector.

Mansur called the budget unveiled for the next fiscal year business-friendly.

"The changes in the tax policy are generally business-friendly and will help promote investment."

He welcomed the reduction in corporate tax rates and lowering of withholding of value-added tax and income tax at sources associated with business transactions.

The former official of the International Monetary Fund argued that more could be done for the poor to overcome inflationary repression.

"Many of the allowance for the elderly, widowed and others remained at only Tk 500 per month for many years. Some modest increases could have protected their real income in part."

Mansur pointed out that the composition of the budget deficit financing was undergoing a major shift.

From the fiscal year of 2009-10 to 2014-15, external financing was sharply declining and the share of high-cost domestic financing was increasing. Since FY20, the dependence on foreign financing has been increasing.

"This is a positive development given the high cost of domestic financing in Bangladesh and the low foreign debt-to-GDP ratio," he said.

On the domestic financing side, borrowing from the banking system is budgeted to be Tk 106,000 crore against Tk 32,000 crore in FY21.

Higher public borrowing is planned although the money market is already tight. As a result, private sector credit will be crowded out, he added.

According to the economist, the Tk 82,000 crore allocation for subsidies is a soft number and likely to increase further if the international prices for fertilizer, primary energy and food increases or remains high.

"No major effort was made to review the extensive subsidy programme despite the surge in subsidy bills," Mansur said.

The revenue generation target for FY23 has been set at Tk 370,000 crore for the National Board of Revenue (NBR).

This means the tax administration will require its collection to raise by about 28 per cent in FY23, compared with the actual growth rates ranging between 13 per cent and 15 per cent per year.

Revenue shortfall in FY23 will be about Tk 40,000 crore, according to Mansur.

Syed Ershad Ahmed, president of AmCham, said the size of the budget might have been larger.

According to him, the biggest issue is revenue collection. "Since our revenue collection is going down, the budget could not be bigger."

As a result, the government has to borrow from the banking system.

"If there is pressure on banks, it also falls on businesspeople. It's a big challenge," Ahmed said, calling on the government to accelerate reforms of the revenue administration to raise more revenue.

The businessman says Bangladesh has a lot of policies but the country can't implement them, so investors do not get benefits.

"If foreign investors are harassed and not given a comfort zone, a red signal goes out of the country," he added.

Planning Minister MA Mannan said the NBR's capacity has to be enhanced to increase revenue collection.

"If the revenue is not increased, all development activities will be stalled."

AB Mirza Md Azizul Islam, a former caretaker government adviser, said although the proposed budget target is acceptable, implementation will be difficult.

He said the allocation for social safety net programmes is very low in proportion to the budget.

"In the wake of the pandemic and Russia-Ukraine war, income inequality in Bangladesh has increased, but there is no roadmap to reducing it in the new budget," Islam added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments