Rubber producers hit by price slump, security strains

Bangladesh's natural rubber industry, once a bright spot in the economy, is losing its lustre as slumping demand and volatile law and order in the greater Chittagong Hill Tracts (CHT) send prices tumbling.

Over the past six months, domestic rubber prices have dropped sharply – from Tk 280 per kilogramme to below Tk 220 – leaving growers and investors grappling with mounting losses.

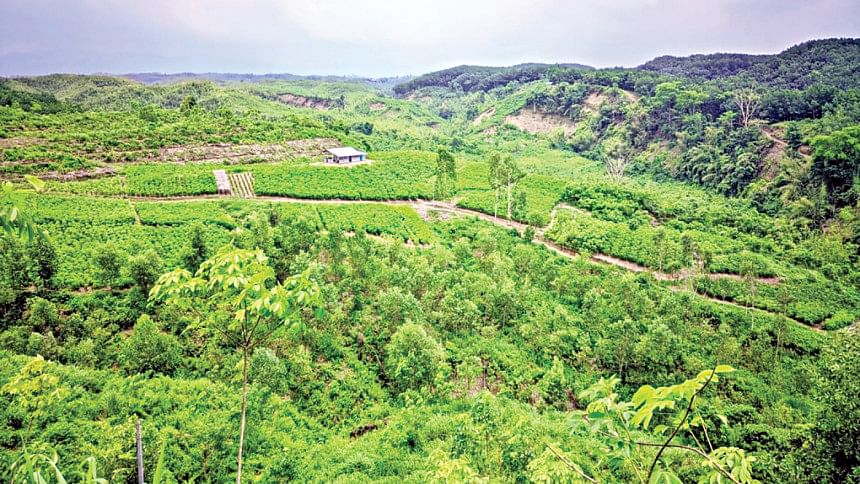

Most plantations are concentrated in the CHT, where security risks and political instability have further dented confidence in a sector that supports thousands of jobs, according to Syed Moazzam Hossain, chairman of Lama Rubber Industry Ltd.

He said, "Producers are struggling to survive. Without immediate government intervention, the industry could suffer long-term damage."

Thanks to reduced local consumption, rubber exports increased year-on-year to $34.93 million from $25.93 million during the July-February period of the current fiscal year.

Hossain said that Gazi Tyre, a major buyer of natural rubber, reduced its purchases significantly after its factory was set ablaze following the political changeover in August last year.

The factory, owned by former Awami League minister Golam Dastagir Gazi, was targeted after the previous regime was ousted by a mass uprising.

Gazi Tyre consumed 60 to 65 percent of the natural rubber produced in the country, Hossain said, adding that the company would buy around 25 tonnes of natural rubber daily before its factory was burnt down.

According to the Bangladesh Rubber Board (BRB), around 140,000 acres of land are currently dedicated to rubber plantations, with annual natural rubber production standing at 67,939 tonnes. Private operators run 1,304 gardens while state agencies run 28 gardens. Most of these are located in the greater Chattogram region.

Hossain added that local sales of raw rubber amount to around Tk 1,200 crore annually.

Although no accurate data is available, it is estimated that at least Tk 2,500 crore has been invested to establish the gardens, creating around 150,000 jobs.

According to Hossain, weak law and order and security concerns in the Chittagong Hill Tracts (CHT) have become a major deterrent for plantation maintenance and expansion.

He alleged that extortion by different political parties in the CHT region has increased at an alarming rate following the political changeover last year.

Due to instability and recurring conflicts, plantation owners face difficulties in ensuring the safety of their workers and protecting their estates from illegal encroachment, he said.

"Security issues have discouraged many from proper maintenance, affecting both yield and quality. If this continues, the supply chain will be disrupted, causing further economic setbacks."

Moreover, Hossain said they have informed the authorities about the problems but have yet to find a solution.

"We would like to urge the government to take immediate action to protect the industry, stabilise rubber prices, and create a secure environment for plantation owners and workers," he said. "Otherwise, Bangladesh risks losing valuable revenue."

Samir Datta Chakma, president of the Indigenous Rubber Garden Owners Association in Khagrachhari, said rubber producers in the district never receive fair prices.

Before the political changeover in August last year, plantations used to sell natural rubber for Tk 180 per kg, but now the price has plummeted to Tk 120.

Middlemen make more profit than producers, leaving small farmers struggling, he added.

Chakma claimed that a syndicate controls the prices, with the presence of a limited number of processing firms failing to bring about fair competition.

He also said rubber plantations are more profitable than fruit gardens due to low maintenance costs, providing sustainable income for around 100 rubber garden owners in the district.

Mohammad Kamal Uddin, president of the Bangladesh Rubber Garden Owners' Association, pointed out that one of the primary reasons for the price decline was Gazi Tyre significantly reducing its purchases.

However, Uddin remains optimistic about the industry's future. He believes that overall demand for natural rubber will rise as the economy grows.

Additionally, he expects Gazi Tyre to resume purchasing at previous levels once a new factory is operational. He mentioned that the other big player in the market, Meghna Group, which produces bicycles, was unaffected.

"Currently, there are only two major consumers of rubber in Bangladesh, making the industry highly dependent on their operations. Once both are back in full production, we will see positive changes," he added.

Mustafizur Rahman, assistant general manager (commercial marketing) of Gazi Tyre, said they were currently processing rubber on a limited scale for future use.

He added that they were aiming to resume production by August.

"We are currently preserving processed rubber and will start production once our financiers approve refinancing," he said.

If banks approve loans to reestablish the tyre factory, it will take a maximum of four months to restart operations, Rahman said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments