Rising costs erode business competitiveness

Bangladesh, long regarded as a cost-competitive destination and once hailed as the next Asian tiger, is now grappling with mounting pressure as the cost of doing business is rising sharply across key sectors.

What was once considered the country's strongest advantage – a cheap labour pool -- is now being undermined by persistent infrastructural weaknesses, policy unpredictability, and rising input costs.

The World Bank's latest assessment and regional business surveys reveal that while labour costs in Bangladesh remain comparatively lower than in Vietnam and India, the total cost structure -- encompassing logistics, energy, financing, and regulatory compliance -- has become increasingly unfavourable.

The issue has once again come to the spotlight, becoming highly relevant as the US government has raised the tariff on Bangladeshi products to 37 percent from around 15 percent.

Experts believe that shipments of Bangladeshi goods will experience a significant setback, with the possibility of a decline in exports to the US market due to the reduction in competitiveness.

The new US tariff on Bangladeshi products has created uncertainty, which is not helpful for a developing country like Bangladesh.

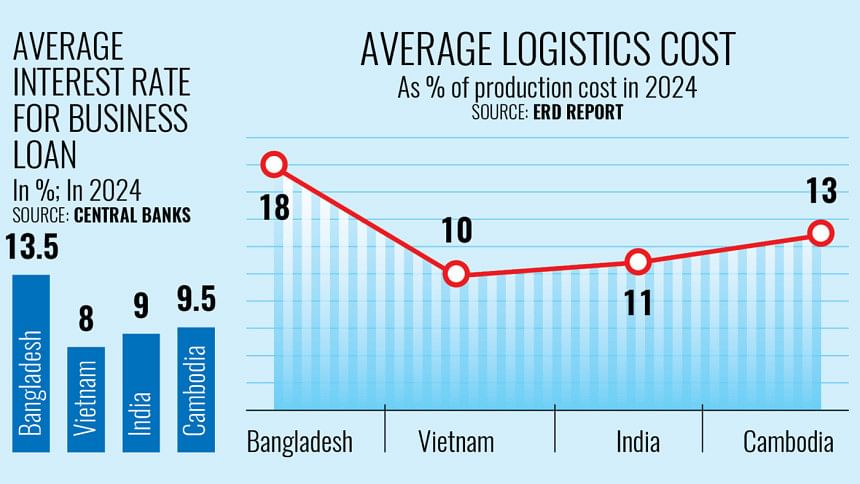

According to the Comprehensive Report on the Logistics Sector of Bangladesh, prepared by the Economic Relations Division of the Bangladesh government, logistics alone account for 15-20 percent of production expenses, significantly higher than Vietnam's 9-11 percent.

This sharp gap is mainly attributed to poor road infrastructure, congestion at major ports such as Chattogram, and outdated logistical facilities.

In contrast, Vietnam's investment in deep-sea ports and modern transport networks has helped reduce delivery times and lower logistics costs, boosting its competitiveness.

Energy is another major hurdle.

Bangladesh's reliance on expensive imported liquefied natural gas (LNG) and furnace oil has exposed businesses to volatile and elevated electricity prices.

Vietnam and India, by comparison, have successfully expanded renewable energy capacity and secured stable, long-term energy supplies, reducing production uncertainty.

Cambodia, despite its economy being smaller, benefits from affordable hydropower imports from its neighbours.

The situation is further aggravated by the rising cost of finance.

The recent adoption of the SMART interest rate regime has driven business lending rates above 13 percent.

In comparison, Vietnamese firms enjoy borrowing rates between 7 to 9 percent, while India's recent monetary easing has brought small and medium enterprise lending rates to around 8 to 10 percent.

Policy inconsistency is also becoming a serious impediment.

Frequent changes to tariff structures, regulatory delays, and a lack of predictability in key business policies have diminished confidence among both foreign and domestic investors.

By contrast, Vietnam and Cambodia have pursued stable, investment-friendly regulatory environments.

A comparative study by the Policy Research Institute (PRI), titled "Vietnam's Superb Export Performance: Lessons for Bangladesh" and conducted in 2021, shows that Vietnam now attracts nearly $27 billion in annual foreign direct investment (FDI).

Meanwhile, Bangladesh struggles to reach even $3 billion.

Even Cambodia, with a far smaller economy, performs better than Bangladesh in FDI inflows per capita.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, observed that Bangladesh was caught in a web of deep-rooted structural problems.

"We are stuck in several fundamental areas," he said. "Logistics, business finance, and the high cost of capital have become significant constraints. Our only sustained advantage has been low labour costs -- and even that is now under threat."

Raihan warned that unless Bangladesh addresses its critical weaknesses in infrastructure, port management, business finance, and skills development, the country's ambitions to diversify beyond ready-made garments would remain elusive.

Raihan said Bangladesh urgently needs policy reforms, robust infrastructure development, and skilled workforce training to enhance its export competitiveness.

It is essential to formulate supportive policies to attract foreign investment and expedite the implementation of free trade agreements (FTAs), he said.

"Efforts should also be undertaken to reduce tariffs and diversify exports. Active participation in bilateral, multilateral, and regional cooperation is crucial for global trade," he said.

He emphasised that immediate initiatives were vital to addressing upcoming challenges following Bangladesh's graduation from least developed country (LDC) status.

M Masrur Reaz, chairman of Policy Exchange Bangladesh, echoed similar concerns.

"The issue is no longer confined to the garment sector. The entire business environment is under pressure due to high costs and structural inefficiencies," he said.

"Geopolitical shifts, rising protectionism, and automation are reshaping global value chains. Countries with stronger fundamentals are taking advantage of this transition, while Bangladesh is falling behind," he said.

Reaz underlined the urgent need for reforms to enhance trade facilitation, modernise logistics, strengthen infrastructure, and build human capital.

"Without timely and coordinated actions, Bangladesh's position as a competitive manufacturing and export hub will continue to weaken," he said.

Adding to these concerns, Asif Ibrahim, a leading exporter of the readymade garments sector, said Bangladesh's exports to the US would face challenges following the hiking of the tariff on imports from Bangladesh.

"This tariff will be a significant burden for Bangladesh's overall exports to the United States, especially when some of the countries that Bangladesh compete with for US market share have been imposed with lesser tariffs," Ibrahim said, referring to India.

He urged policymakers to address this challenge on an urgent basis by reducing import tariff of the main export items of the US to Bangladesh.

"This is crucial for protecting Bangladesh's long-term trade interests and for ensuring sustained economic growth," he added.

With the upcoming LDC graduation in 2026, Bangladesh's competitiveness will be tested further as preferential trade treatments begin to phase out.

Without significant reforms, the rising cost of doing business could become the biggest obstacle to Bangladesh's future growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments