Remittance transfer thru agent banks skyrockets

Agent banking outlets are emerging as a major channel for the distribution of remittance among families of migrant workers thanks to their expanding network at the rural level.

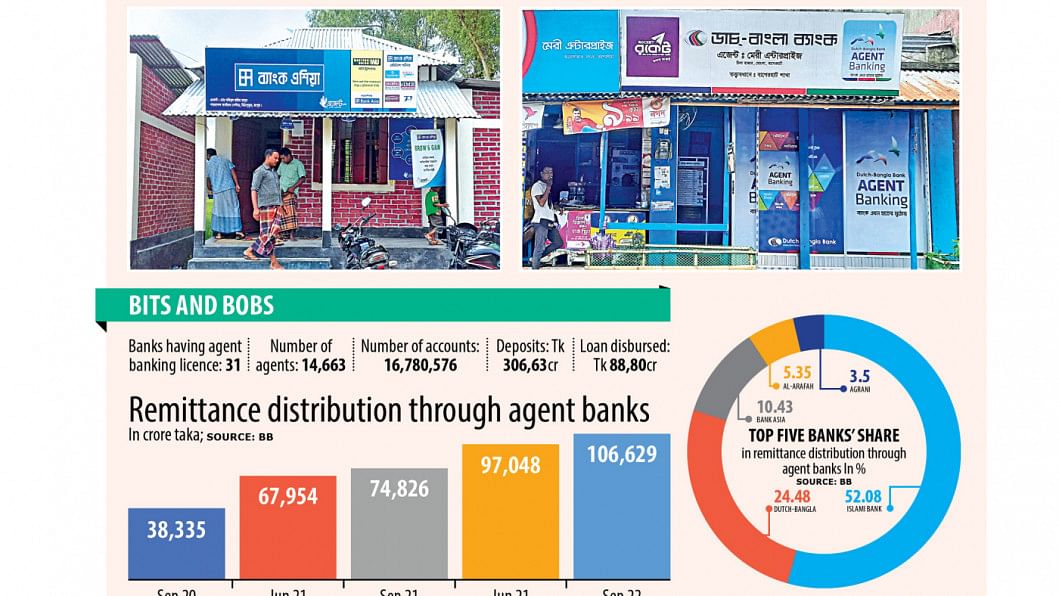

Remittance disbursement through agent banking branches grew 178 per cent to Tk 106,628 crore in the July-September quarter of the current fiscal, up from Tk 38,335 crore during the same period two years ago, showed Bangladesh Bank (BB) data.

"Agent banking outlets perfectly fit the requirements of wage earners who send money from abroad to their families in rural areas. So, the distribution of remittance will grow in days to come," said Mohammad Ziaul Hasan Molla, deputy managing director of Bank Asia.

The private bank is the third largest distributor of inward remittance through its 5,400 agent banking outlets.

Bangladesh Bank said inward remittances distributed by the agent outlets increased 42.5 per cent year-on-year in the July-September quarter.

The distribution of remittances, one of the key pillars of Bangladesh's economy, increased nearly 10 per cent in last quarter from the previous April-June quarter.

"This remarkable increase of remittances channelled through agent banking seems to be a positive outcome of quick delivery of remittances to the doorsteps of beneficiaries," the central bank said in its latest quarterly report on agent banking.

Bangladesh Bank had introduced agent banking in the country in 2013 to provide a safe alternate delivery channel for banking services to the under-served population, who generally live in geographically remote locations that are beyond the reach of formal banking networks.

Since the beginning, the number of agent banking outlets has risen to 20,177 as of September 2022. The amount of deposits and lending through agent banking outlets also rose at the same time.

Molla, also chairman of the Association of Anti Money Laundering Compliance Officers of Banks in Bangladesh (AACOBB), said remittance transfers through formal channels will increase following the latest directive issued by the Bangladesh Financial Intelligence Unit.

The government provides 2.5 per cent incentive for remitters sending money through formal channels to discourage hundi, an illegal cross-border money transfer mechanism.

Bankers said the benefit encourages many migrant workers to send money through the banking system.

"Agents are contributing promisingly in remittance disbursement as customers are likely to get doorstep banking services within the shortest possible time. So, agent banking is becoming a popular channel for inward remittance distribution," Bangladesh Bank said in its report.

Nazrul Islam, senior vice president and head of the brand and communication division of Islami Bank Bangladesh Ltd (IBBL), said the bank is distributing remittances through its 2,700 agent banking outlets.

"We can reach the families of remittance senders directly because of our vast network," he said.

Of the remittances distributed through agent baking outlets in the July-September quarter, IBBL distributed more than half of the total amount.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments