Light commercial vehicle market expanding

The market for light commercial vehicles (LCVs) is growing steadily thanks to the rising number of small and medium enterprises and young entrepreneurs running businesses all over Bangladesh, according to market players.

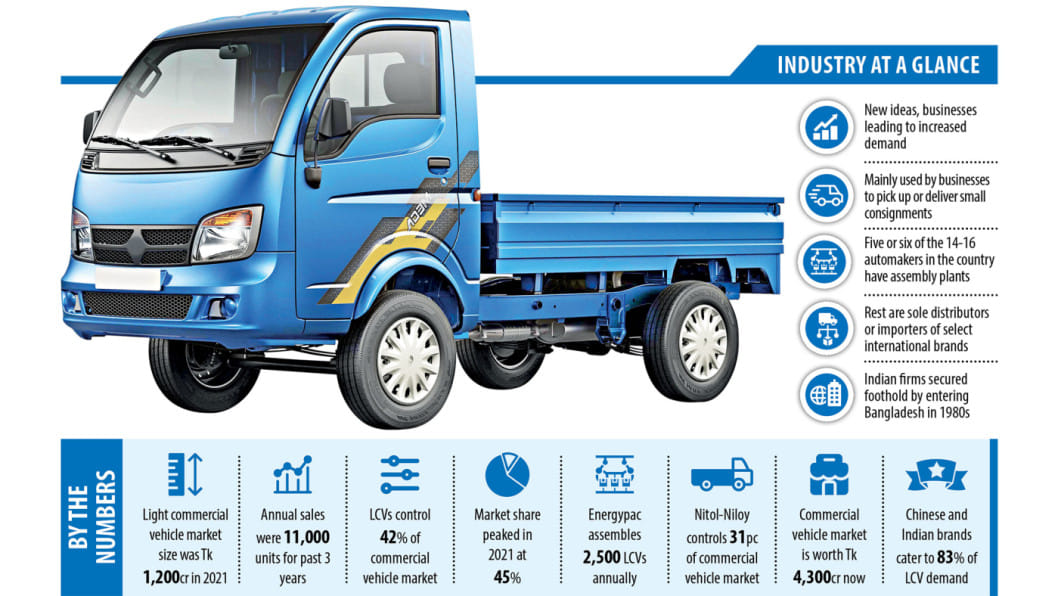

The LCV market size reached about Tk 1,200 crore in 2021 with annual sales averaging 11,000 units for the past three years.

LCVs control 42 per cent of the commercial vehicle market on average, but in 2021, the segment's market share edged up to 45 per cent on the back of 6 per cent growth in sales, industry analysts said.

"The demand for LCVs is growing as the number of SMEs and online businesses in the country has risen in line with the receding pandemic situation," said Humayun Rashid, executive director of Energypac, the sole local distributor of Chinese automaker JAC Motors.

Besides, a number of expatriates who returned home amid the ongoing coronavirus pandemic are purchasing LCVs, such as small covered vans and pickup trucks, to use them for commercial purposes.

"This had led to the increased demand for these vehicles," Rashid added.

Light commercial vehicles are mainly used by businesses to pick up or deliver small consignments but they also double as human haulers.

Rashid went on to say that with the expansion of poultry and agro-based businesses in the northern part of Bangladesh, many entrepreneurs are engaged in either sending their products all over the country or supplying feed and other inputs.

In both cases, the entrepreneurs make use of LCVs to pick up or make deliveries. Energypac's assembly plant cranks out about 1,000 pickup trucks and 1,500 small covered vans per year.

Rashid says JAC Motors manufactures cheaper and more fuel-efficient vehicles thanks to the use of modern engines built by Japanese brand Isuzu Motors. So, customers prefer these vehicles for their superior output and commercial viability.

"The younger generation is doing business with new ideas for different sectors, such as e-commerce and agro products, which are growing rapidly," said Abdul Matlub Ahmad, chairman of Nitol-Niloy Group.

"For this reason, they are purchasing LCVs like one to three-tonne trucks to deliver products."

Nitol-Niloy Group, the sole distributor of India's Tata Motors, leads the domestic commercial vehicle segment with a 31 per cent market share.

Ahmad went on to say that most of the brands are doing well in the LCV segment as there is an emerging trading class in urban and rural areas.

"This trading class is purchasing light commercial vehicles across Bangladesh."

Subrata Ranjan Das, executive director of ACI Motors, which distributes Chinese commercial vehicle brand Foton in Bangladesh, said the demand for LCVs is rising fast riding on growing small businesses and emerging traders in line with steady economic growth.

Regarding the future of LCVs in Bangladesh, he said the gradual development of four and six-lane highways will result in higher sales.

For example, the completion of the Padma Multipurpose Bridge will connect the south-western districts of the country with the northern and eastern regions.

"This will help the LCV market grow," Das said, adding that the new automobile policy should support the industry by setting different rules on emissions, standards, import of reconditioned vehicles, and so on.

Indian automakers such as Tata, Mahindra, Ashok Leyland and Chinese brands like JAC and Foton cater to 83 per cent of the domestic LCV market while other brands cater to the rest.

However, the presence of Japanese and Chinese truck manufacturers is very insignificant as Indian companies gained a foothold in Bangladesh by entering the market back in the 1980s and have since gradually overtaken their Asian and European counterparts.

Most of the demand for commercial vehicles comes from the country's garments industry, which uses a vast number of trucks and other light cargo carriers to transport goods.

The growing cement, steel, and shipbuilding sectors are also making increasing contributions to the commercial vehicle industry as they need to transport heavy raw materials. Moreover, the booming e-commerce industry is fueling the sales of vehicles as they need to transport goods all over the country.

According to Hafizur Rahman Khan, chairman of Runner Group, Bangladesh is a potential market for commercial vehicles as its economy is booming.

There are 14 to 16 large automobile retailers in the country. Of them, five or six have assembly plants while the rest are sole distributors or importers of select international brands.

Ifad Autos, Aftab Automobiles, Navana, Rangs, Rancon Motors, Nitol Motors, Runner Motors, ACI Motors, and Energypac are major distributors of commercial vehicles.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments