Leather losing its shine in exports

Rising local value addition, poor compliance with international standards, and buyers shifting to other countries have thwarted exports of leather, which was once among Bangladesh's three main export items.

The relocation of tanneries from Hazaribagh in Dhaka to the Savar Tannery Industrial Estate (STIE) in 2017 and the severe fallout of the Covid-19 pandemic and Russia-Ukraine war are other major reasons for declining leather exports.

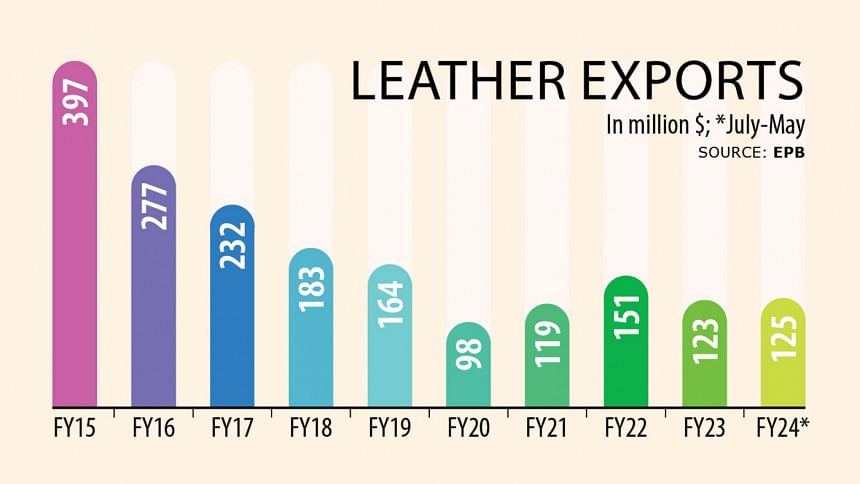

In the face of such challenges, leather exports have declined by more than half over the past decade.

In fiscal year 2022-23, leather exports amounted to $123.44 million, down sharply from $397.54 million in FY14, according to data from the Export Promotion Bureau (EPB).

In the July-May period of the outgoing fiscal year, leather exports stood at $125.72 million, EPB data showed.

The rise in value addition means the number of factories, be it for domestic or export purposes, has increased, thereby increasing domestic consumption of tanned leather.

The significant rise in consumption of tanned leather and subsequent value addition can also be gauged from Bangladesh's exports of leather and leather goods.

In FY15, exports of leather and leather goods amounted to $1.13 billion and it has stayed above the billion-dollar mark for the past decade.

In FY23, exports of leather and leather goods brought in $961.49 million.

Exports of jute, tea and leather, once considered the most valuable products of Bangladesh, have been fading either due to loss of competitiveness globally or owing to rising consumption in domestic markets.

For instance, in the case of tea, the consumption in the domestic market increased over the years. At the same time, jute has failed to grab a bigger share as it competes with low-priced plastic.

Even 25 years ago, leather contributed more than 75 percent of the total exports of leather and leather goods, according to Md Saiful Islam, former president of the Leathergoods and Footwear Manufacturers & Exporters Association of Bangladesh.

But its share has now declined to nearly 13 percent, which indicates that local value addition has increased, he said.

Moreover, poor compliance with environmental standards in tanneries and the tannery estate at Savar is a major reason for lower exports of leather. Those factors also lead to lower prices from international buyers, Islam told The Daily Star over the phone.

Md Shakawat Ullah, general secretary of Bangladesh Tanners Association (BTA), echoed those sentiments.

He said local exporters cannot sell tanned hides to renowned international retailers in Europe, North America or other major destinations due to poor compliance at the STIE.

The poor compliance has barred tanners from obtaining a Leather Working Group (LWG) certification, a vital recognition for doing business, he said.

As a result, local exporters are having to send 65 percent of the tanned leather to China, which pays nearly 60 percent lower compared to international prices, he added.

Apart from China, some leather is shipped to India and a few other countries, he added.

Furthermore, around 15 percent of tanned leather is used by local leather and leather goods companies.

The BTA general secretary also said three to four tanners are currently eligible to obtain the LWG certification.

However, because of poor compliance at the central effluent treatment plant (CEPT) at the STIE, those four tanneries are unable to secure it, he said.

Md Diljahan Bhuiyan, senior vice-chairman of Bangladesh Finished Leather, Leathergoods and Footwear Exporters' Association, said leather exports may decline even further because many buyers have shifted to other countries due to the relocation of tanneries from Hazaribagh.

Many tanneries are not operating because of some challenges. Before the introduction of the LWG certification in 2005, some countries like Italy used to import leather from Bangladesh, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments