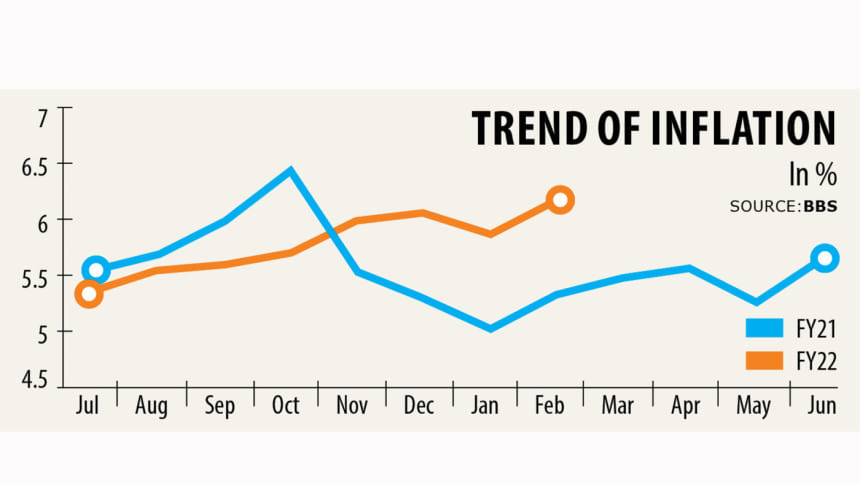

Inflation climbs to 16-month high

Inflation in Bangladesh jumped to 6.17 per cent in February, the highest in 16 months, driven by soaring costs of foods, further eroding the purchasing capacity of consumers.

The higher prices are particularly painful for the low-income groups, many of whom are already being seen queuing for hours to get subsidised foods from the government's open market sales operations.

In February this year, consumers had to spend 6.22 per cent more than a year ago to buy foods, data from the Bangladesh Bureau of Statistics (BBS) showed yesterday.

Non–food inflation, which includes clothing, footwear, fuel, lighting, transport and healthcare, declined 16 basis points to 6.10 per cent in February from the prior month.

The previous high of inflation was reported in October 2020 when it stood at 6.44 per cent.

Economists are, however, sceptical about the BBS estimates of inflation, arguing that it is not reflective of the current prices levels and the rate of changes in prices of goods and services.

On Sunday, the Centre for Policy Dialogue (CPD) said the consumption basket used for calculating overall general inflation was created in 2005 and it does not reflect the current consumption pattern of consumers or the actual prices in the market in 2022.

"Inflation situation is more adverse than the BBS estimate," said Towfiqul Islam Khan, a senior research fellow of the CPD.

Based on the price levels of the fiscal year of 2005-06, the BBS computes the Consumer Price Index (CPI) and inflation for rural areas by taking into account the prices of 318 items and for urban inflation, it considers 422 commodities and services.

The South Asian Network on Economic Modeling (Sanem), another think-tank, earlier said the officially reported food inflation figures were grossly underestimating the actual food inflation faced by financially marginalised households in Bangladesh.

"I think that the BBS's non-food inflation figure is underestimated," Sanem Executive Director Selim Raihan told The Daily Star yesterday.

"We raised this concern a long ago. At least we know the basket of the food items in BBS's calculation of food inflation and the prices of food items we can guess based on our day-to-day encounter in the markets."

"But we don't know what prices of non-food items are considered! For example, if you consider the rent of a house, the question is which category of house and where is it located?" Raihan asked.

"We need more clarity on this and I hope the BBS will help us in this regard."

In a Facebook post yesterday, Raihan, also a professor of the economics department at the University of Dhaka, said poor and many middle-class families were suffering from an unusual spike in the prices of commodities.

"Many families have fallen into poverty for income losses during the pandemic. The price hike has become stumbling blocks for them to recover."

Citing the spiral in the price of import-based commodities, Prof Raihan says the prices climbed much higher than the rational level.

Higher prices in the international market, mismatch in supply and demand, and weak market monitoring have fueled the profiteering tendency among businesses, thus contributing to the unusual price escalation, he added.

He, however, lauded the government efforts aimed at distributing certain commodities among one crore families, but added that many families still remain out of the list.

"The coverage should be expanded," said Prof Raihan, calling on the government to set up sales centres at various places of the country.

"At the same time, the scope for buying commodities at subsidised prices should be continued for those who have not received cards from the Trading Corporation of Bangladesh."

CPD's Khan says inflation is much higher in reality and urged the government to take measures to provide relief to the low-income people.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments