BSEC speeds up IPO approval process

The Bangladesh Securities and Exchange Commission (BSEC) can approve a company's proposal to raise funds from the capital market within two weeks, provided the firms produce the required documents, according to a senior official of the regulator.

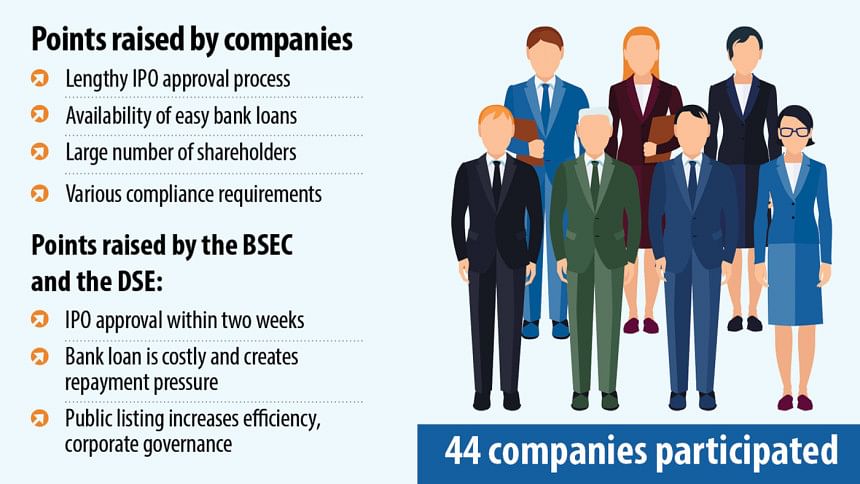

"We have a checklist, and if the issuer companies follow the list and submit the necessary papers accordingly, we can approve their initial public offering (IPO) within two weeks," said Prof Shibli Rubayat-Ul-Islam, chairman of the BSEC.

"We have recently given nod to an IPO within two weeks."

Islam's comments came at a conference on the "Capital Market of Bangladesh: Prospects and Opportunities for the Corporate Entities", at the auditorium of the Dhaka Stock Exchange (DSE) on Tuesday.

"For a sustainable business, entrepreneurs should come to the stock market as it will ensure long-term financing and corporate governance," Islam said.

"Although corporate governance looks tough at first, it is good for the company's long-term existence."

Many corporations in Bangladesh depend on banks for funding. But long-term loans from the financial sector creates problems.

"Banks' liquidity management is falling into crisis as they got funds from short-term deposits. On the other hand, the higher interest rate is creating pressure on entrepreneurs and so, non-performing loans are rising," the BSEC chairman said.

"As a few entrepreneurs may have bad intentions, we remain aware so that they cannot harm our general investors."

Islam thanked the country's premier bourse for organising the programme to invite corporations to the stock market.

Prof Shaikh Shamsuddin Ahmed, a commissioner of the BSEC, said the stock market regulator is open to all entrepreneurs and has introduced many changes.

"Each of our desks is a helpdesk," he said, adding that they want the stock market to be an easy and sustainable source of long-term capital for entrepreneurs.

"Our changes came in efficiency, better processing, and a variety of products," said Tarique Amin Bhuiyan, managing director of the DSE.

He went on to say that they are ensuring the use of better technology so that it becomes easier to get listed with the country's bourses.

"We will meet with big corporations regularly to encourage them to join the market. We will go to the corporations and sit with the top leaders of all sectors separately."

Although there are many opportunities and advantages related to the public listing, the number of listed companies in Bangladesh is very low compared to neighbouring nations.

"Many of them prefer banks for meeting their financing needs," said Shaifur Rahman Mazumdar, chief operating officer of the DSE, while delivering a presentation.

"As our economy is expanding, such dependency on banks cannot be allowed all the time. So, they should prepare to come to the market."

Once, raising capital from the stock market was a lengthy process, and although the situation has changed, many entrepreneurs do not know it, said Md Sabur Khan, chairman of Daffodil International University.

The DSE should especially invite IT-based companies to the market, he added.

Romana Rouf Chowdhury, a director of Bank Asia and an entrepreneur, said many corporations do not want to take the hassle of dealing with a huge number of shareholders.

"On the other hand, people can avail bank loans easily, so they prefer to go to lenders instead of raising funds by offloading shares," she added.

Senior officials of 46 companies attended the event.

Md Shakil Rizvi, a director of the DSE; Mohammad Rezaul Karim, executive director of the BSEC; and ASM Mainuddin Monem, managing director of Abdul Monem Ltd, also spoke as panelists.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments