Broad reform agenda vital to restore trust in banks: CPD

The Centre for Policy Dialogue (CPD) yesterday urged the government to reduce bad loans and establish good governance in the banking sector as part of its suggestions aimed at healing the persisting ills of the key sector.

"A comprehensive reform agenda should be devised and implemented to overcome the banking sector's ongoing challenges," it said.

The think-tank's recommendations came at a dialogue titled "What Lies Ahead for the Banking Sector in Bangladesh?" at the Lakeshore Hotel in the capital.

The CPD said commercial banks need to be strengthened, the independence of the Bangladesh Bank should be upheld, a conducive legal environment must be created, and a banking commission needs to be set up.

In Bangladesh, non-performing loans (NPLs) have more than tripled in the last one decade, it said. The high concentration of NPLs is not only a problem for state-run banks but also for private lenders.

The increase in the share of NPLs at private banks shows that their performance has worsened substantially over time.

Bangladesh Bank's Financial Stability Report showed that gross NPL totalled Tk 120,649 crore in 2022. If written-off and rescheduled loans are taken into account, the figure goes up to Tk 377,922 crore.

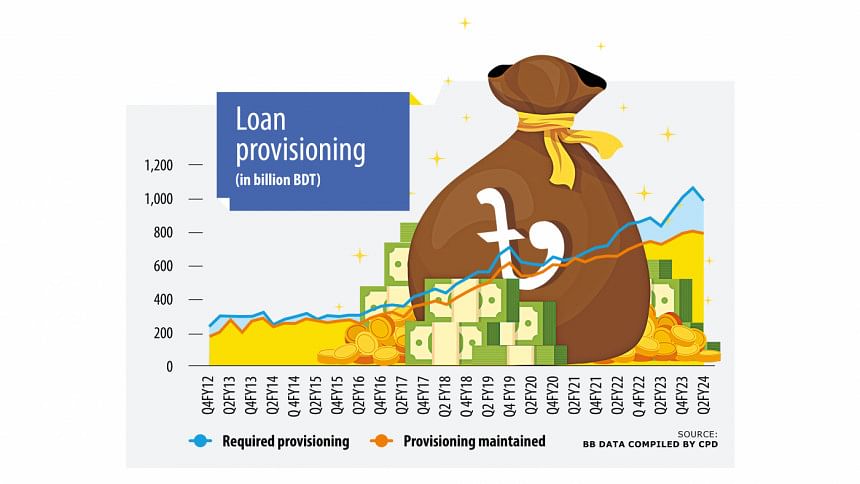

As of the second quarter of the current fiscal year of 2023-24, the required loan loss provisioning was Tk 98,941 crore whereas banks collectively set aside Tk 79,679 crore to cover the bad debts.

"There has been an erosion of public trust in the banking sector due to the continuous deterioration of the health and inadequate measures taken by the policymakers," said Fahmida Khatun, executive director of the CPD, while making a presentation.

"NPLs should be brought down through a comprehensive framework because sporadic measures have not been successful. The nature and depth of the problem require broad due diligence and structural reforms."

She said since reforms will face resistance from vested interest groups, the changes must be backed by political will.

The CPD made some specific recommendations about commercial banks, the central bank, and a banking commission.

Commercial banks

Commercial banks need to be strengthened and the appointment of board members should be depoliticised and made based on their qualifications and experiences, the CPD said.

Loans should be sanctioned in line with the central bank's rules, it said.

"The single borrower exposure limit should be strictly enforced, and banks should permanently stop repeated rescheduling and write-offs of NPLs. The internal control and compliance departments should be revitalised, and effective internal audits should be put in place."

The think-tank requested the central bank appoint courageous administrators to oversee the operation of troubled banks.

Bangladesh Bank

The autonomy of the central bank must be upheld, the CPD said.

The recapitalisation of poorly governed banks with public money should be stopped, and an exit policy for troubled banks should be formulated by protecting depositors' interests, it said.

No licences for new banks should be given on political grounds and without pragmatic assessment of the needs of the economy, it said.

"A single individual or group of individuals must not be allowed to obtain the majority ownership of more than one commercial bank."

Legal environment

A conducive legal environment has to be created to bring back governance to the banking sector, said Fahmida.

"The Banking Companies Act should be amended to reduce the number of members on the board from a single family and the tenure of each director to enhance transparency and accountability."

She called for raising the number of judges at money loan courts to ensure speedy disposal of cases and reduce the backlog.

The Bankruptcy Act needs to be amended to remove mortgage-related loopholes that cause delays in settling cases, said the think-tank, adding that efforts should be initiated to recover NPLs through out-of-court procedures such as alternative dispute resolution.

The CPD said all banks should be obliged to make mandatory disclosures under BASEL III in a timely fashion and loans should be classified as per international standards.

"A comprehensive risk management policy should be implemented at banks to detect and deter frauds, forgeries, fake companies, false identities, and other malpractices."

It called for setting up a goal-specific, time-bound, unbiased, and independent citizen's commission on banking.

"The commission will have to work to improve the prevailing situation, identify the root causes of the manifest problems, and suggest credible measures."

The think-tank said NPLs must be brought down through a comprehensive framework. Mergers can proceed only after proper auditing of weak banks.

Directors of weak banks can't be allowed to sit on the board of strong banks after the merger, the CPD said.

It urged the government not to inject any capital into the proposed public asset management company (AMC) to buy NPLs since it has already supported weak banks using taxpayers' money. International AMCs may be invited to resolve the NPL problem.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments