Board recast of closed, poor performing companies paying off

The wheels of the two companies have begun turning again after remaining closed for many years while another firm is moving towards resuming operation – thanks to the restructuring of boards by the Bangladesh Securities and Exchange Commission (BSEC).

Last year, the stock market regulator started recasting the board of a number of listed companies that have either been shut for a long time or failed to pay dividends to shareholders in the preceding two years.

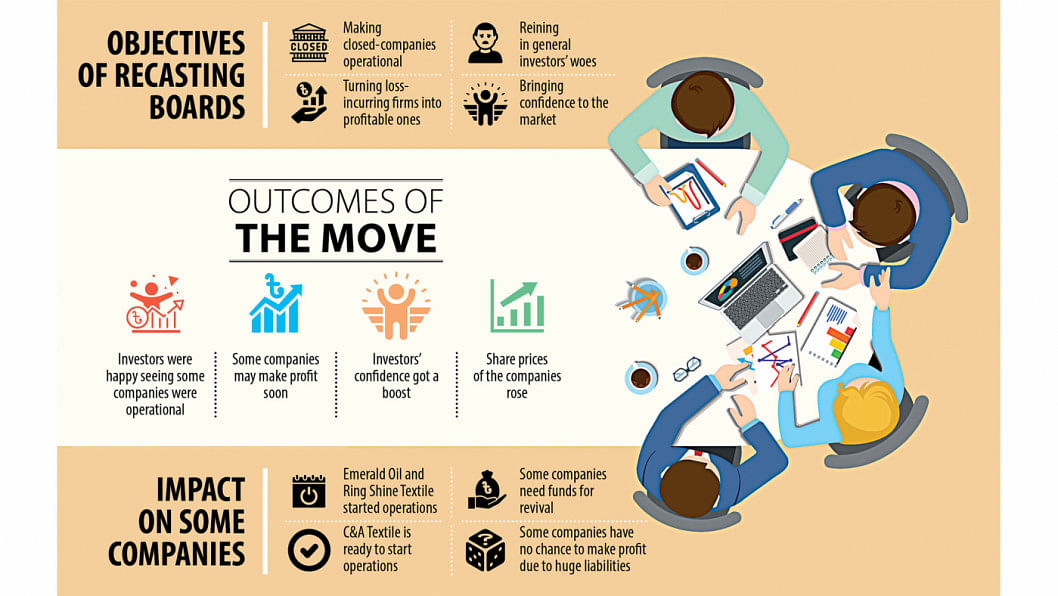

The aim has been to reverse the course of the companies, protect the interests of the investors, and restore confidence in the market.

Initially, the regulator restructured the board of C&A Textiles, Ring Shine Textiles, United Airways, Familytex (BD), Emerald Oil, Fareast Finance, Fareast Islami Life Insurance, FAS Finance, BD Wielding, and Al-haj Textiles.

Of them, Ring Shine Textiles and Emerald Oil have already returned to operation, while C&A Textiles looks to make a comeback.

Some companies need funds to turn around and are trying to attract investments from other companies, at home and abroad, or by way of issuing bonds.

EMERALD OIL

Emerald Oil, which sells rice bran edible oil, went public in 2014 and had been profitable until 2016.

In 2017, the company started making losses and the operation came to a halt due to a shortage of working capital. This was the time when a loan fraud by its founder came to light.

The BSEC restructured its board in March last year. The new board tried to resume the operation of the factory.

Minori Bangladesh Ltd, a Japanese venture, bought 30 per cent shares of the sponsors and another 8 per cent from the capital market.

Emerald Oil said it resumed the commercial production on January 9 this year upon successful completion of the trial production.

RING SHINE

Ring Shine Textiles raised Tk 150 crore from the market in 2019 to purchase machinery and repay bank loans.

It sold shares in the pre-IPO (initial public offering) period free of cost through a private offer, a clear act of forgery, according to a special audit of the BSEC.

On August 27, 2020, the management decided to close the factory for a month due to the coronavirus-induced shortage of imported raw materials.

However, the company was unable to return to operation. The BSEC restructured the board in January 2021.

It resumed production on June 13 last year at 25 per cent of the production capacity and plans to raise it, said Ring Shine Textile recently.

C&A TEXTILES

C&A Textile was downgraded to a junk stock within three years of its listing in 2015 as its commercial operation was suspended and it did not give any dividend.

In June 2017, the textile maker informed investors that it needed to upgrade some of its equipment and bring structural changes to the factory as per recommendations of the Accord and the Alliance, two western buyers' platforms that worked at the time to improve workplace safety in Bangladesh's readymade garment sector.

The production will resume soon after the remediation is carried out, it had said at the time.

On May 1, the company's commercial operation was shut temporarily.

But until 2021, the commercial operation had not begun and there was no update from the company.

This led the BSEC to reconstitute the board in March 2021. After the restructuring, the new board of C&A Textiles confirmed the regularising of gas connections and other utilities after the full payment of all dues.

Alif Group is going to take over the firm and secured approval from the regulator last week to issue bonds to raise Tk 300 crore.

With the bond proceeds, Alif Industries will purchase the shares of C&A Textiles, repay debts, buy machinery and use the funds as working capital.

Shares of C&A Textiles rose 433 per cent after the board restructuring.

However, some companies, weighed down by huge debts and corruption, still don't show signs of returning to normalcy.

UNITED AIRWAYS

United Airways started commercial operation in 2007 and raised Tk 100 crore through an IPO in 2010. It also issued rights shares in 2011 to raise funds of Tk 315 crore.

The airline's operations were suspended in 2016.

In February last year, the BSEC appointed several independent directors, including aviation expert and Editor of Bangladesh Monitor Kazi Wahidul Alam as chairman.

Yesterday, Alam said the board has carried out the audit for the last four years that was not done and performed a technical evaluation of its 10 aircraft.

On the basis of the evaluation, the board talked to foreign investors who are interested in investing in the company.

"However, we have no access to the premises of the company. So, the BSEC is trying to secure the approval from the civil aviation ministry," Alam said.

"The new board is trying to hold the annual general meeting that was not organised in the last four years."

FAS FINANCE

Listed in 2008, FAS Finance & Investments was making profits until 2018. But it was soon in the red for massive corruption after Prashanta Kumar Halder, also known as PK Halder, and his associates swindled Tk 1,300 crore in the name of several companies that exist on paper only, according to a probe carried out by the Anti-Corruption Commission.

In order to save the company, the BSEC recast the board in May of 2021. Mohammed Nurul Amin, a former managing director of NCC Bank and Meghna Bank, was appointed as its chairman.

Speaking to The Daily Star yesterday, Amin said the new board improved governance, cut excess costs and rationalised manpower.

"We are now working for the revival of the NBFI."

The company needs Tk 300 crore to Tk 400 crore in phases to make a comeback, meet the mandatory cash reserve ratio and statutory liquidity ratio, and clear tax and VAT dues.

When asked how the funds would be raised, Amin said it may be through issuing of bonds, loans, equities, or with the government's support.

"We will start the work to mobilise the fund after the current fiscal year ends. If we get it, it will reach break-even within three to four years."

FAREAST FINANCE

The BSEC recast the board of Fareast Finance & Investments as it suffered losses and failed to announce dividends since 2016.

Listed in 2013, the non-bank financial institution (NBFI) has accumulated a loss of Tk 117 crore. It needs funds to make a turnaround.

FAMILYTEX

Listed in 2013, Familytex BD has failed to provide any dividend since 2019 due to losses. As a result, the company was downgraded to the junk category.

In March 2021, the BSEC recast its board. The company is yet to give any disclosure.

AL-HAJ TEXTILES

Listed in 1983, its production was shut on June 25, 2019, and its shares are now traded under the 'Z' category, which groups low-profile and non-performing companies.

In January last year, the regulator appointed three directors to improve the company's condition.

Its earnings per share were Tk 0.20 in the January to March period of 2021, up from Tk 0.18 in the same period a year ago.

BD WIELDING

Listed in 1999, the company failed to provide dividends after 2019 owing to losses. The BSEC recast its board last year.

SAFKO SPINNING

In September last year, the BSEC reconstituted the board as it had been incurring losses since 2019.

In 2019-2020, the spinning mills incurred a loss of Tk 17.05 crore, up from Tk 1.45 crore in the previous fiscal year.

INVESTORS ARE OPTIMISTIC

The resumption of operations of a number of companies has cheered investors.

"It was a great step on the part of the BSEC as it will bring qualitative changes to the market," said Zakir Hossain, a stock investor with investments in C&A Textiles.

Now, he hopes to get back at least some of the fund that has been stuck for more than three years.

"The share price of the company has already started going up and I will be pleased when it becomes operational," said Hossain.

WHAT EXPERTS SAY

Faruq Ahmad Siddiqi, a former chairman of the BSEC, applauded the BSEC steps, saying some investors will benefit if even a single company can be revived.

The BSEC has delisted companies that were found to have no potential.

Shareholders can go to courts seeking the liquidation of low-performing companies, and they may recoup some investments through the process, Siddiqi said.

"If a company suffers losses for any bad intention of sponsors, the BSEC should investigate and punish them."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments