Investors pay the price for brokerage houses’ forgery

Amran Hossain, a private service-holder, invested around Tk 8 lakh in the stock market through Dawn Securities in 2009.

On a morning in 2010, he suddenly came to know that the brokerage firm's trading was halted for fraudulence. He rushed to the office of the company only to find that his shares were sold without his consent and the money was siphoned off.

Rahman turned to the Dhaka Stock Exchange (DSE) and the Central Depository Bangladesh Limited to get back his hard-earned money.

After much effort, the DSE refunded him Tk 2 lakh in 2021. But he was frustrated at the handling of the matter by the stock market and its regulators.

Hossain is not alone.

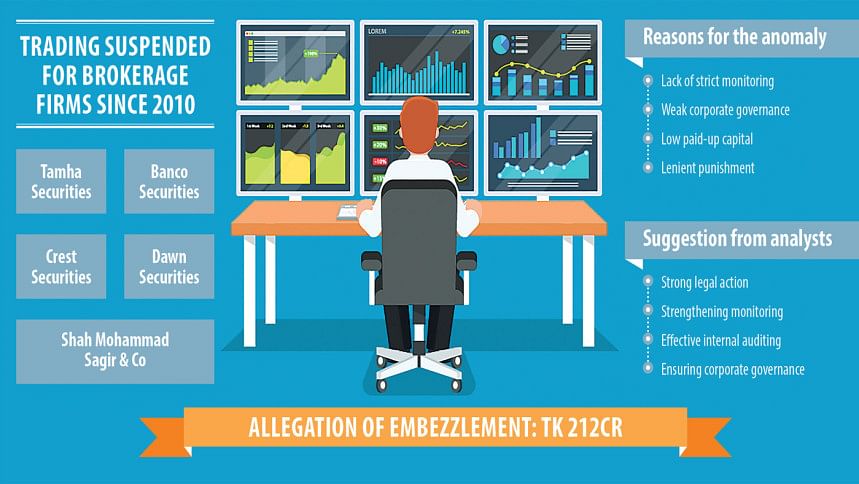

Many investors lost money in the last 12 years from the closure of at least five brokerage houses for selling off investors' shares and not carrying out buy orders despite accepting funds. Embezzlement of funds has intensified in recent years.

Three brokerage houses – Banco Securities, Crest Securities and Tamha Securities—were shut in the last two years for allegedly embezzling around Tk 200 crore of general investors.

The financial crime took place because of the absence of a lack of strict monitoring on the part of the DSE and the Bangladesh Securities and Exchange Commission (BSEC) as well as low paid-up capital and a lack of corporate governance at the firms, market participants and analysts say.

WEAK SYSTEM

Brokerage licences were given to many people who do not have enough fundamental knowledge and financial strength, said KAM Majedur Rahman, a former managing director of the DSE.

In Bangladesh, the number of brokerage houses is higher than required compared to the market size, so fraudulence is common.

The number of trading right entitlement certificate (TREC) holders or brokerage houses of the DSE is now 283, according to the premier bourse.

"Investors rush to them seeing the licence that was given from the regulator," said Rahman.

MANY BROKERAGE HOUSES NON-COMPLIANT

The BSEC had earlier issued directives that brokerage houses must have Tk 15 crore in paid-up capital. However, not all firms have that amount of paid-up capital.

Many stock brokers don't follow the guideline, said a top official of a stock broker, preferring anonymity. The DSE and the BSEC don't monitor them properly as well.

Many brokers kept deficit in their consolidated customers' account, where investors' funds are stored, but they are not handed out exemplary punishment for breaches of laws.

"In most cases, owners of brokerage firms were involved in the fund embezzlement, so the ownership and management should be separated," said Mohammed Rahmat Pasha, chief executive officer of UCB Stock Brokerage.

Stock brokerage owners can withdraw funds deposited by an investor, so the BSEC can analyse how the process can be changed, he said.

"If owners have signatory power, such anomalies can take place."

ANOMALIES: PRESENT AND PAST

The issue came to the fore after the DSE halted the trading of Tamha Securities in December after receiving allegations of embezzling investors' money. The BSEC has unearthed a deficit of Tk 87 crore in the consolidated customers account.

In the middle of 2021, trading activities of Banco Securities were suspended following an allegation of siphoning off Tk 66 crore.

The DSE suspended the trading of Crest Securities in 2020 for embezzling Tk 48 crore.

In 2005 and 2006, the DSE suspended trading of five brokers for similar irregularities and sold their licences to others to refund investors. The brokers were Capital Roops, JR Capital Company, MR Company, T Mushfu & Company, and SPM Ltd.

Despite the cancellation of licences and growing irregularities, new licences are still being given. At least 33 licences were given in the last one year and many applications are in pipeline.

"Exemplary punishment should have been handed out to the dishonest people," said Faruq Ahmad Siddiqi, a former chairman of the BSEC.

"Brokerage houses should ensure corporate governance as they deal with peoples' funds."

Richard D' Rozario, president of the DSE Brokers Association of Bangladesh, says the BSEC is now prompt at punishing culprits and recovering money, which is a positive thing."

"Whenever any anomalies surface, the DSE should take it seriously."

He, however, says brokerage houses are private limited companies, so their ownership and management can't be demutualised.

"Only if they get listed, the separation can be expected."

About the mandatory paid-up capital, Rozario said, the BSEC has extended the time to June to keep the minimum paid-up capital of Tk 15 crore for a full-fledged brokerage firm.

Except some old and small brokerage firms, many companies have the ability to maintain the paid-up capital, he said.

He said there are 250 TREC-holders which are also the shareholders of the DSE.

So, in October 2019 the BSEC halted the trading of Shah Mohammad Sagir & Co when it found that the firm had misappropriated investors' money. What is more, the regulator refunded affected investors by selling its shares in the DSE.

But the new TREC-holders are not shareholders of the bourse. So, these firms may cause the situation to deteriorate, Rozario said.

Majedur Rahman said as brokerage houses deal with public money, there should have strong accountability mechanism, internal audit and corporate governance.

"Many brokerage houses lack them. Therefore, the BSEC and the DSE should monitor them strongly. If any anomaly is found, strict action should be taken."

REGULATORS STEPPING UP

Shaifur Rahman Mazumdar, chief operating officer of the DSE, said the conditions for getting TREC have been tightened.

Applicants now must have at least Tk 5 crore in paid-up capital, up from Tk 1 crore previously as per TREC Rules.

In addition, the BSEC has a capital adequacy directives under which a full-fledged stockbroker needs to keep at least Tk 15 crore in paid-up capital.

"Some stockbrokers reports their activities to us that are not proper. So, we are focusing on a uniform software so that we can track them easily," Mazumdar said.

"Moreover, we have enhanced our supervision for weak stock brokers."

Laws have been tightened to get rid of the anomalies, said Mohammad Rezaul Karim, a spokesperson of the BSEC.

"We have also taken steps so that brokerage houses can raise their capital base. But we also need to give them time to comply."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments