Scams, higher expenses keep 9 banks in the red

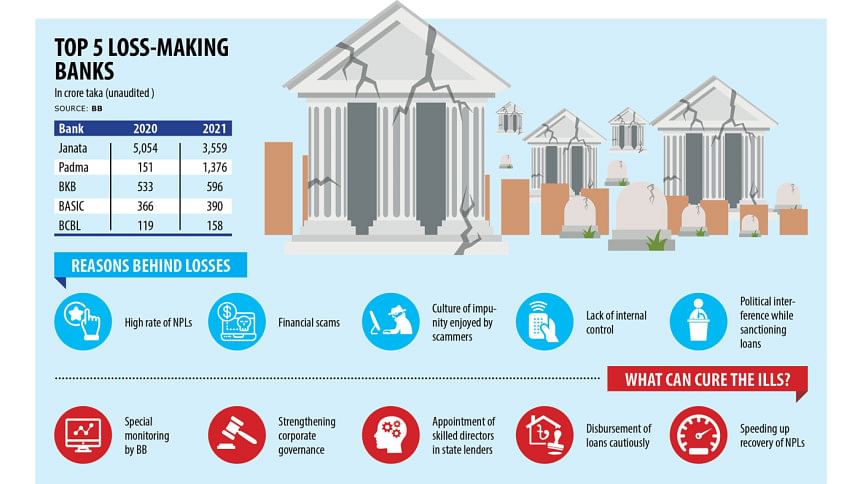

Nine banks, including four state lenders, suffered net losses in 2021, largely as a consequence of financial scams that forced them to set aside higher provisioning.

The banks are Janata, Padma, Bangladesh Krishi Bank (BKB), BASIC, Rajshahi Krishi Unnayan, Bangladesh Commerce, ICB Islamic, Bengal Commercial Bank, and the local operations of Pakistan's Habib Bank, according to the unaudited data submitted by the lenders to the Bangladesh Bank.

The high prevalence of non-performing loans, corruption, a culture of impunity enjoyed by fund embezzlers, and political interference in the sanctioning of loans are responsible for the net losses faced by the banks.

The net loss refers to a company's financial position when total expenses exceed total revenues.

Of the nine lenders, Janata Bank faced the highest amount of net loss amounting to Tk 3,559 crore last year. It incurred a net loss of Tk 5,054 crore in 2020.

Md Abdus Salam Azad, managing director of the lender, blamed the high default loan for the large net loss.

The financial health of the bank, however, has improved as the net loss is shrinking riding on the rescheduling of the default loans, which stood at Tk 12,137 crore last year, or 19 per cent of the outstanding loans.

Some errant persons and business groups, including AnonTex Group and Crescent Group, siphoned off a large amount of money from Janata Bank.

The bank has recently rescheduled Tk 5,000 crore of default loans faced by AnonTex.

Default loans involving Tk 1,200 crore of the group are set to be rescheduled this month, which will help Janata Bank narrow the net loss further, Azad said.

He, however, admits the bank is struggling to reschedule Crescent Group's bad loans of Tk 3,500 crore due to the poor response of the business entity.

The net loss of Padma Bank, which was renamed from The Farmers Bank to leave behind its legacy of corruption, escalated to Tk 1,376 crore last year from Tk 151 crore the year before.

Tarek Reaz Khan, managing director of Padma Bank, says the bank did not deduct the provisioning while calculating the net loss for 2020.

But it took into account the provisioning to compute the net loss for last year, sending the net loss to high, he said.

Padma Bank is trying to attract foreign investors in a bid to strengthen its capital base.

The central bank has recently allowed the lender to remove the net loss from its balance sheets, allowing it to show it as intangible assets until 2032, Khan said.

The cumulative net loss of the bank stands at around Tk 2,100 crore.

The net loss at BASIC Bank was Tk 390 crore last year compared to Tk 366 crore in 2020.

The net loss would have increased to a large extent had it not stepped up the recovery efforts, said Md Anisur Rahman, managing director of BASIC Bank.

At least Tk 4,500 crore was swindled out of the bank through irregularities, where a number of senior officials and board members, including former chairman Sheikh Abdul Hye Bacchu, were allegedly involved.

Rahman said that the bank managed a net profit of Tk 8 crore in the January-March quarter, improving from a net loss of Tk 125 crore during the same period a year ago.

BKB's net loss widened to Tk 596 crore in 2021 from Tk 533 crore in 2020.

"We give out loans to farmers without imposing any service charge. So, we have hardly managed to make any profit in recent years," said Md Ismail Hossain, managing director of BKB.

Salehuddin Ahmed, a former governor of the central bank, says that some banks have been facing net losses for years due to a lack of corporate governance.

"The central bank should pressurise the banks to beef up their efforts to recover NPLs and compel them to follow internal control and compliance strictly."

Fahmida Khatun, executive director of the Centre for Policy Dialogue, says that some of the banks were forced to approve loans on political considerations.

"Both the central bank and the government should protect the banks from the political intervention."

Appointment of skilled directors at the state lenders is essential to improve their financial health, the economist said, adding that the central bank should pay special heed to the banks.

Bengal Commercial Bank, which started its operation last year, suffered a net loss of Tk 18.8 crore in the year.

Md Jashim Uddin, chairman of the bank, says that the bank has just commenced its business and is still opening new branches.

"As we are expanding, the net loss is not unusual."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments