Hefty incentives for state bank employees

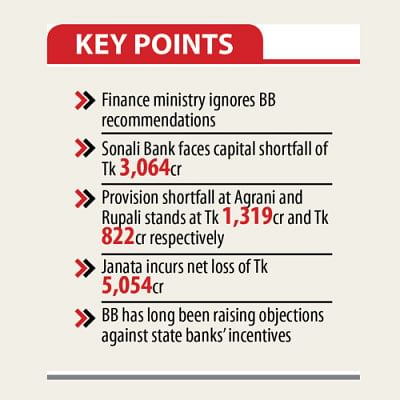

Four state-owned commercial banks (SCBs) have disbursed a huge amount of incentive bonus among their employees despite their weak financial health, ignoring the central bank's recommendation.

In a letter on June 20, the Bangladesh Bank requested the finance ministry to prevent the SCBs – Sonali, Janata, Agrani and Rupali – from paying incentives given their poor financial health and a lack of corporate governance.

But the Financial Institutions Division (FID) of the ministry did not take any initiative to deter the banks from disbursing the bonus based on the business performance of 2020.

Sonali provided four incentive bonuses to its employees, while Agrani gave away three and a quarter. Rupali and Janata paid out three bonuses.

Every incentive bonus equals a basic salary. The banks distributed the incentive before the vacation on the occasion of Eid-ul-Azha, which was celebrated on July 21.

This was not the first time the BB has attempted to stop the financially weak state banks from doling out incentive bonuses.

On several occasions in recent years, the central bank said, in its annual inspection reports, the state banks should not give out any incentive bonus.

June's recommendation from the BB came as the four banks faced either a shortage of required provisioning or capital.

For instance, Sonali Bank faced a capital shortfall of Tk 3,064 crore last year. It did not face any provision shortfall last year and logged a net profit of Tk 338 crore.

But it should have avoided paying the incentive given the large capital shortfall, a BB official said.

The provisioning shortfall at Agrani stood at Tk 1,319 crore and Rupali Bank at Tk 822 crore.

A provision shortfall occurs when a financial obligation exceeds the amount of cash available. It can be temporary, arising out of a unique set of circumstances, or persistent, indicating poor financial management practices.

Janata Bank witnessed a net loss amounting to Tk 5,054 crore last year when its capital shortfall surged to Tk 5,475 crore.

The central bank enacted a guideline on incentive bonuses for state-run banks in 2014, and it was subsequently sent to the finance ministry.

According to the guideline, employees are entitled to an incentive bonus based on the net profit posted.

It also said that banks would be permitted to disburse incentives if they could manage a net profit after keeping required provisioning against the classified loans and other assets.

Default loans at Sonali, Janata, Agrani and Rupali collectively stood at Tk 34,175 crore last year, accounting for 49 per cent of the total non-performing loans in the banking sector.

Depending on the gravity of sour assets, the provisioning ranges from 0.50 per cent to 100 per cent.

The four banks would have faced a net loss worth Tk 18,500 crore in 2019 had their provisioning shortfall been considered. They collectively disbursed Tk 437 crore in the form of incentives in the year. The figure for 2020 was not immediately available.

The central bank letter said that any commercial bank would conduct its operations to clock profit, and the incentive bonus was important to encourage employees such that they feel cheered to do their job efficiently.

But, it is not expected from those that incur a loss, the BB official said.

Md Ashadul Islam, senior secretary of the FID, declined to comment over the mobile phone.

Md Abdus Salam Azad, managing director of Janata Bank, said that an adverse impact would be created among the employees if the tradition of the incentive bonus was discarded suddenly.

"The incentive will motivate employees to perform better."

Mohammad Shams-Ul Islam, managing director of Agrani Bank, said that the lender would not have disbursed the incentive if BB or the finance ministry had imposed any embargo.

"Many of our officials have been carrying out their duties during the pandemic with utmost patience, and they should be recognised."

Salehuddin Ahmed, a former governor of the central bank, said that this was not a good sign for the state lenders as they had been facing challenges for years, including a lack of corporate governance.

"The finance ministry should have taken the initiative in line with the central bank's recommendation," he said.

Banks can provide a festival bonus, but the incentive is not applicable for the state-lenders considering their weak performance, Ahmed said.

BASIC Bank, another state-owned commercial bank, stopped disbursing incentive bonuses in 2013 as it faced a net loss consistently.

Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank – two specialised lenders – adopted the same stance in the fiscal year of 2018-19 to minimise their net loss.

However, most private lenders did not pay out any incentive for 2020 given the ongoing business slowdown, said a managing director of a private bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments