Bad loans surpass Tk 1 lakh crore again

In an upsetting development, default loans in the banking sector in Bangladesh have surpassed Tk 1 lakh crore after more than one and a half years despite a relaxed loan classification policy adopted by the central bank.

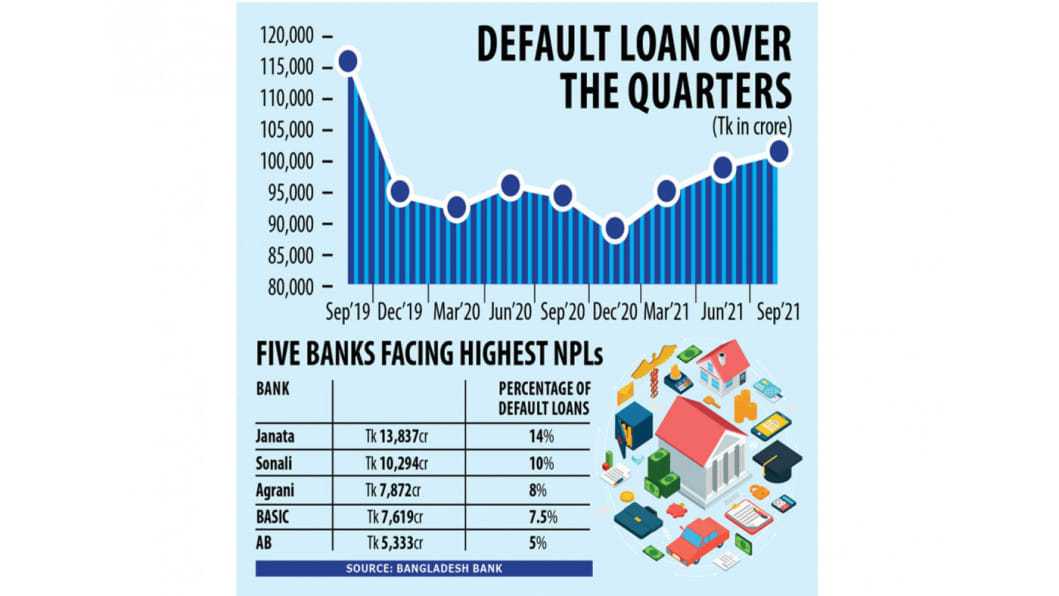

Up until September this year, non-performing loans (NPLs) stood at Tk 101,150 crore, up 14 per cent from nine months earlier and 7.1 per cent year-on-year, Bangladesh Bank data showed. Defaulted loans totaled Tk 116,288 crore in September 2019.

The rise in the NPLs came despite the central bank' relaxed policy, introduced soon after the coronavirus pandemic hit the country in March last year, an ominous sign for the economy.

The central bank had declared a loan moratorium policy last year. The facility has ended as the economy shook off the impacts of the pandemic.

Borrowers can now avert slipping into the defaulted zone by repaying only 25 per cent of their total instalments.

The NPLs also increased 2 per cent in September compared to June when the volume stood at Tk 99,205 crore.

"The pandemic has had an adverse impact on the economy, creating hardship for businesses. But, many clients are also showing unwillingness to repay loans despite managing profits," said Md Arfan Ali, managing director of Bank Asia.

"The tendency not to pay back loans has spread alarmingly," he said, adding that the number of habitual defaulters was on the rise.

The delinquent borrowers think that they will not face any music if they embezzle depositors' money, so the NPLs might increase further once the relaxation is lifted, he said.

The NPLs declined massively in the final quarter of 2019 on the back of another regulatory forbearance extended by the central bank.

The BB had allowed banks to reschedule defaulted loans by accepting a down payment of only 2 per cent of the outstanding amount, way lower than the existing 20-50 per cent.

Both Syed Mahbubur Rahman, managing director of Mutual Trust Bank, and Emranul Huq, managing director of Dhaka Bank, said their banks had recently classified some loans, which were rescheduled based on the relaxed policy in 2019.

"We have taken the decision as there is no ray of hope to realise the funds," said Huq.

Because of the loosening of rules, the delinquent loans did not go past the Tk 1 lakh crore mark between January 2020 and August this year.

The ratio of the default loans declined to 8.12 per cent in September in contrast to 8.18 per cent in June this year. Rahman credited the disbursement of the stimulus loans of the government for the fall.

He said many borrowers were now showing reluctance to repay due to the relaxed policy, pushing up the outstanding loans.

Md Abdus Salam Azad, managing director of Janata Bank, said that the state lender had given all-out efforts in recovering NPLs.

Among all lenders, Janata Bank now faces the highest amount of default loans, amounting to Tk 13,837 crore.

The bank is expected to reschedule the default loans to the tune of Tk 3,500 crore of AnonTex Group within a week or two.

"This will help us bring down the NPLs," said Azad.

BB data showed more than 47 per cent of the defaulted loans were with the nine state-run banks. Their collective defaulted loans increased 0.4 per cent to Tk 47,715 crore in September from three months ago.

Forty-one private banks held defaulted loans of Tk 50,743 crore, up 3.15 per cent from a quarter earlier. NPLs in nine foreign banks rose to Tk 2,691 crore in contrast to Tk 2,492 crore.

A BB official said that the majority of the NPLs had turned into bad loans, which are the worst category of the delinquent loans, towards the end of September.

The bad loans accounted for 89 per cent of the default loans in the banking sector.

As per the central bank rules, term or project loans, with a repayment tenure of more than a year, are considered as bad if borrowers don't pay instalments for 18 months in a row.

Similarly, continuous loans, whose repayment tenure is a maximum of one year, are treated as bad when clients fail to pay any instalment for 12 straight months.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments