Deposit through agent banking rises 122pc

Deposits collected through agent banking rose a whopping 122 percent last year from the previous year whereas the whole banking sector experienced a fall in deposit growth.

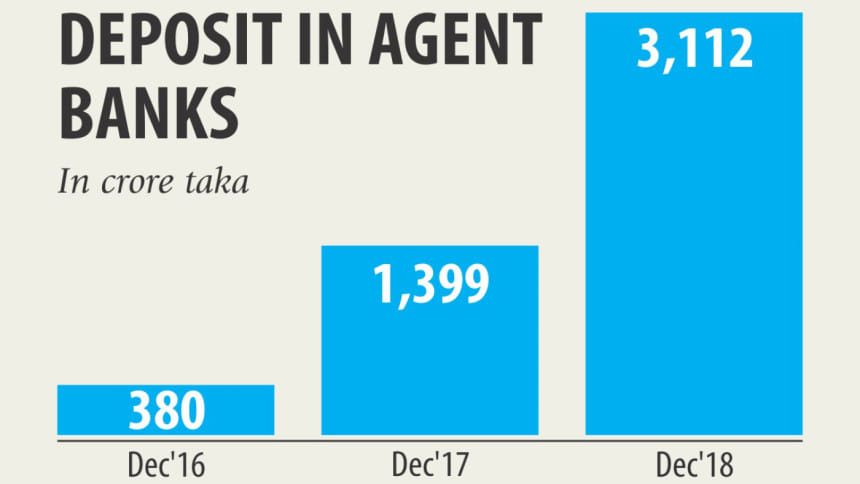

Bangladesh Bank data showed Tk 3,112 crore was deposited through the agent banking channel in 2018, up from Tk 1,399 crore a year ago.

The amount collected by the outlets—which provide banking services on a limited scale—was only Tk 380 crore in 2016. However, the deposit growth of the banking sector fell by 1.22 percentage points year-on-year to 9 percent in 2018.

The impressive performance of the agent banking outlets has given some relief to the private banks from the deposit crisis, industry insiders opined.

The BB issued the agent banking guideline in 2013 but the licensees started full-fledged operation in 2016.

Currently, 19 banks provide agent banking service with Dutch-Bangla Bank Ltd (DBBL) and Bank Asia are leading the pack with a combined 78 percent market share.

The contribution of agent banking in deposit collection is increasing fast as the outlets are hunting the deposits mostly from the remote areas across the country, said Abul Kashem Md Shirin, managing director of DBBL.

Around 5 percent of DBBL's total deposit collection came from the agent banking last year, he said.

"The agent banking has helped villagers develop saving habit. That's why the contribution of the channel to the sector's total deposit collection will increase fast in the days to come."

The number of agent banking accountholders doubled year-on-year to 24.56 lakh last year. Of them, 87 percent were opened in rural areas, through which Tk 2,455 crore was deposited.

DBBL had the highest 48 percent share of the agent banking accounts as of December last year, according to central bank data. Bank Asia stood second with 30 percent share, followed by Al-Arafah Islami Bank with 6 percent and others 16 percent.

In 2018, the number of agent outlets rose 67 percent to hit 6,933, while the number of agents stood at 4,493.

A total of Tk 189 crore was disbursed in loans through the agent banking channel in 2018, according to data of the Bangladesh Bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments