Budget to shrink amid fiscal strain

Bangladesh's interim government is preparing to unveil a rare contractionary budget on June 2, driven by a sharp rise in interest payment that is crowding out fiscal space and forcing spending cuts.

The national budget for fiscal year 2025-26 is set at Tk 7,90,000 crore -- Tk 7,000 crore lower than the original outlay for the current year -- marking the first time in recent memory that the overall budget will shrink.

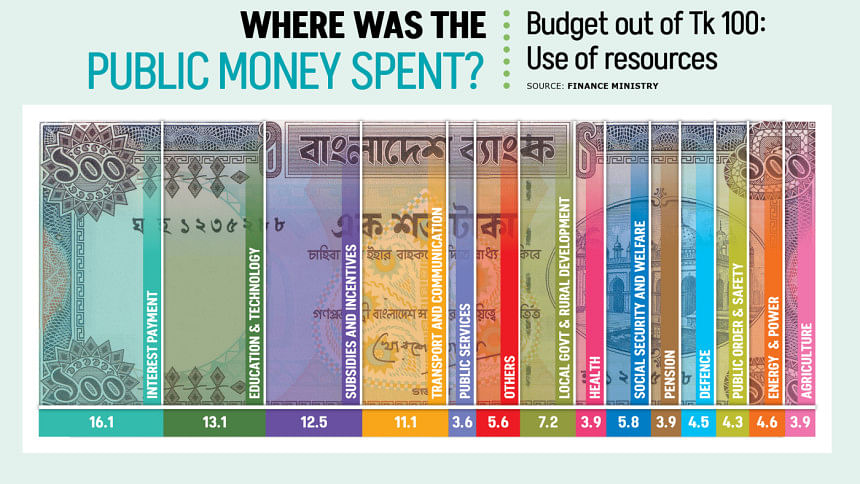

In the current fiscal year, Tk 1,13,500 crore was earmarked for interest payments. With the continued devaluation of the local currency taka, this figure is expected to climb. Finance ministry officials say interest payments alone could rise by Tk 20,000 crore, pushing the total to over Tk 1,33,000 crore, or 16.8 percent of the proposed budget. The burden will rise further once principal repayments are included.

The mounting cost of debt servicing has left little room for discretionary spending. The development budget is expected to be slashed by Tk 35,000 crore to Tk 2,30,000 crore, while the non-development or operating budget will rise to Tk 5,60,000 crore, an increase of Tk 28,000 crore.

Core revenue expenditures, such as salaries, allowances, and subsidies, will remain unchanged, while the budget deficit is expected to stay below 5 percent of GDP.

Despite the tight fiscal envelope, the interim government aims to use the budget as a platform for structural reform. Finance Adviser Salehuddin Ahmed, who will present the budget in a televised address, said this would not be a routine fiscal exercise.

"This budget is meant to leave a footprint for the next government," he said during recent pre-budget consultations. "We aim to leave behind a legacy of reform."

At the heart of the proposed reforms is an effort to boost domestic revenue, rather than expand spending. One key initiative is the separation of tax policy and tax administration within the National Board of Revenue (NBR), a move intended to minimise conflicts of interest and reduce corruption and abuse of power. The reform is also expected to improve institutional efficiency and reduce taxpayer harassment.

The government is also planning to broaden the application of the standard 15 percent value-added tax (VAT) rate, which is currently applied unevenly. Tax exemptions will be scaled back, with the NBR targeting an additional Tk 30,000 crore in revenue through new tax measures and administrative improvements.

For the fiscal year 2025-26, the NBR's revenue collection target has been set at Tk 4,99,000 crore, representing a 7.6 percent increase from the revised target for the current fiscal year.

Bangladesh's tax-to-GDP ratio remains one of the lowest in the world, at just 7.4 percent. The World Bank's latest Bangladesh Development Update warned that this low revenue mobilisation undermines the government's capacity to fund essential public investment. "This low collection has significantly constrained the ability of the government to fund critical public investments," the report said.

The World Bank has recommended a series of institutional and policy reforms, including a transparent tax expenditure framework, a uniform VAT rate, improved compliance, and reductions in tariff and non-tariff barriers under the National Tariff Policy.

Uncertainty remains over the future of the ongoing $4.7 billion loan programme by the International Monetary Fund (IMF) to Bangladesh, given the tough reform conditions set by the multilateral lender. But finance ministry officials said the government intends to proceed with key reforms, with or without formal endorsement from the IMF.

The upcoming budget will also include a special allocation to support reform in the fragile banking sector. The IMF, World Bank, and Asian Development Bank are expected to provide technical and financial assistance linked to this agenda.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments