Profits jump before listing, fall afterwards

The earnings of 19 out of the 21 textile companies that got listed on the Dhaka bourse between 2010 and 2015 have fallen sharply from the level shown during the initial public offerings.

What is more, four of these companies have become junk because of their poor performance and failure to pay dividends to shareholders.

The scenario is more or less the same for companies that went public in the five years to 2015.

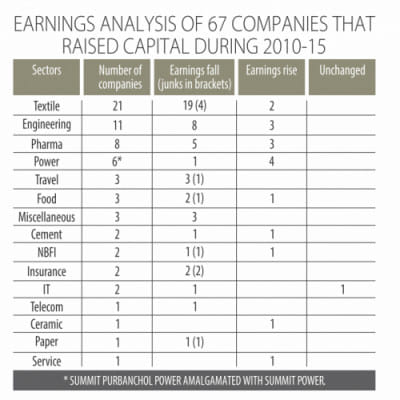

During the period, 67 companies were listed. Of them, the earnings of 48 went lower compared to the prelisting level, according to the latest data of the firms available on the DSE website.

Only 17 were able to make higher earnings per share (EPS) last year compared to the year of the listing. The earnings of one firm remained unchanged while data about one company were not available.

Ten companies were downgraded to the junk shares category while three closed operations.

The Daily Star did not include in the analysis the companies that raised capital after 2015, as a company needs nearly three years to make profit after getting listed on a stockmarket.

The sponsors of most of the companies bring the shares to the market when they think they have no potential to grow, said Abu Ahmed, a former chairman of the economics department of Dhaka University.

The promoters also go for IPOs when they feel the necessity of raising capital to save themselves from bank loans, he said.

“At the time of IPO, some companies exaggerate earnings information to allure investors. Some do not even bother about doing better business. Rather, they mainly focus on doing share trading and making quick bucks.” Industry insiders say issue managers help these low-performing companies get due diligence certificates with inflated data, as the certificates are a must to launch a share.

Among the textile companies, the EPS of Familytex, listed in 2013, has experienced the highest fall of 104 percent: from Tk 0.92 to Tk 0.04 in the negative.

The EPS of Zahintex, which raised capital in 2011, fell 88 percent to Tk 0.73.

Hamid Fabrics followed suit with an 84 percent slide. Generation Next gave up 72 percent while Matin Spinning has seen the lowest fall of 22 percent.

According to DSE data, sponsors hold only 4.16 percent stakes in United Airways while it is 9.99 percent for Shurwid Industries and 12.04 percent for Active Fine Chemicals.

Around 13.82 percent shares of Generation Next belong to its sponsors. It is 21.19 percent for Appollo Ispat, 22.14 percent for Salvo Chemical and 22.43 percent for Familytex.

Since the listing, Shurwid Industries has declared dividend only once and started counting losses the next year, said Jamal Uddin, an official of the company's share department.

“The management of the company have already sold their ownership to a new management.”

He said the company started making losses because of the previous management's poor performance following its listing.

The companies that got listed between 2011 and 2016 used 31 percent of their IPO proceedings for clearing bank loans, according to data of the Bangladesh Securities and Exchange Commission.

It is true that some companies may have entered the market only to make quick gains, said Mohammed Ahsan Ullah, acting president of the Bangladesh Merchant Bankers Association.

“But there are some companies that began incurring losses not for their own fault. They might have been the victim of bad business environment. The stockmarket regulator should investigate and find out the actual reasons.”

The companies that became junk stocks following their public listing between 2010 and 2015 are: United Airways, Padma Life Insurance, Sun Life Insurance, Familytex, Fareast Finance, Emerald Oil, Khulna Printing, Tung Hai Knitting, Shurwid Industries and C&A Textile.

Despite several attempts, this correspondent failed to reach the officials of Tung Hai Knitting and C&A Textile through the phone numbers and email addresses available on the DSE website.

“Our issue managers and auditors should be more careful so that no company can manipulate earnings data when it comes to listing,” said KAM Majedur Rahman, managing director of the DSE.

He said the EPS of a company can fall in the first two years of the listing, but it should go up in the first four years.

Merchant bankers only issue due diligence certificates and can't be held responsible for the companies' poor performance after they are listed, Ahsan Ullah said.

“Moreover, panel auditors remain there to examine the documents companies submit during the IPOs. So, merchant bankers alone can't be blamed for any fake or inflated data.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments