A struggle to fix flaws in index

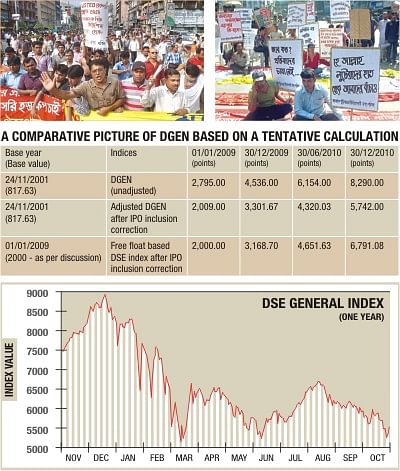

Angry investors take to the streets on Tuesday to protest the continuous downslide in stock prices (top left). Investors take part in a sit-in programme in front of the Dhaka Stock Exchange building on Wednesday (top right).Photo: STAR

Aflashback into November 16, 2009. The day Grameenphone listed its shares on the stockmarket. With the trading debut of the largest mobile phone operator, the benchmark index of the premier bourse skyrocketed by more than 764 points, or over 22 percent, on a single trading day. Of the figures, Grameenphone alone added 717 points.

The out of the ordinary rise could be attributed to a faulty calculation system adopted by the Dhaka Stock Exchange (DSE). The system counted the index on the very first day, adjusting market capitalisation for Grameenphone securities by multiplying the face value with outstanding shares.

What the bourses should have done is to start counting the index points from the second day of Grameenphone's trade, as the debut day does not reflect the real picture. It means the index calculation -- not only in the case of Grameenphone, but also in the case of any new issue -- should be counted from the next day.

Grameenphone emerged as the prime market mover, and it could heavily impact the index. But the situation did not continue for long, as the DSE made amendments to the index calculation method -- and obviously, without adjusting for the error.

The error in index counting first came to light through media reports in October 2010. Later, the Securities and Exchange Commission (SEC), the market regulator, also found that the DSE did not follow the correct method of index calculation while incorporating new securities under direct listing rules.

The shares of Jamuna Oil Company were first traded on January 9, 2008, but were included in the benchmark index on January 13, the third trading day. ACI Formulations and Shinepukur Ceramics experienced the same. The companies were included in the index on their fourth day of trade. Meghna Petroleum and Navana CNG were included in the index on their debut day.

On account of the flaws in index computation, the market watchdog asked the DSE to prepare guidelines for accurate index counts and submit it to the commission.

In response, the Dhaka bourse formed an index development committee led by Professor Mahmood Osman Imam of Dhaka University.

Latest developments

The SEC has formed a three-member committee to introduce flawless index computation methods on the bourses. The committee is being led by SEC Executive Director ATM Tariquzzaman.

The committee has been asked to submit a report to the commission in the next 15 working days, according to an office order that was issued on Wednesday.

The market regulator came up with the body after DSE's index development committee earlier submitted a report on flawless index calculation methods to the commission.

The index development committee in its report said, since 2000 the DSE indices have been reflecting additional (wrong) points.

However, it is worth mentioning that implementation of the reconstruction of the indices would be time-consuming because there are thousands of corrections to be made over the period for all sorts of corporate actions, the report said.

In addition to the faulty steps taken in listing new securities, technical errors have also been made in adjusting the rights shares and bonus shares issued by listed firms.

The DSE adjusted prices after the record date for rights shares and bonus shares. Due to the adjustment, the price level often comes down and leaves a negative impact on the index, but the shares are not added to the exchange until the bonus and rights issue is approved in the annual general meeting (AGM).

The DSE adjusted market capitalisation of the same shares after the AGM that also impacted the index and thus additional points were included in the index.

The general index of the prime bourse (DGEN) was around 1,900 points higher than the amount that should have been up to June this year.

If other technical faults of the counting system are taken into consideration, the additional points would be higher, according to the report.

The DSE also has made mistakes in computing the free-float or tradable shares, especially in the case of counting the shares of sponsor directors. Theoretically, the shares of sponsor directors can be tradable after the lock-in period is withdrawn after a certain period. But, as per securities rules, the sponsor directors must hold a minimum number of shares for lifetime. The DSE counts these non-tradable shares too.

Although the DSE has already made corrections in some cases in counting the index, the previous errors remain in the index.

Now the DSE calculates the impacts of the stocks on the index, taking into account the free float or tradable shares of a listed company. Previously, it considered the total shares of a company in computing the impacts of price movement, up or down, in the index.

Though the method has been changed, the additional points have not been excluded from the index, which gives wrong information to investors, policy makers and users.

The report also made two recommendations on flawless index computation -- the first one is eliminating the wrongly added points from the index, and the second is launching a new index based on free-float shares.

The first recommendation will be difficult to implement, while the second will be easier and more market friendly to put into place, the report said.

Confusion may arise on the “track of investment from inference in index magnitude with the downward adjustments,” the report said. “It might rather lead to a feeling among investors in general that the market is not much overheated as of today,” the report added.

“The best option is to start a new free-float market capitalisation based index, replacing the old one with a new base. It can avoid required corrections of the distortions in indices and consequently huge time-consumption and hence can start instantaneously,” it said.

Talking to The Daily Star recently, Imam of Dhaka University said it would be better to introduce a new index, considering the complexities in the existing ones.

“As the market was more or less stable in early 2009, we have recommended taking 2009 as the base year and 2,000 points as the base level,” he said.

Presently, each bourse has three types of indices. The DSE introduced the general index on November 27, 2001, with a base of 817.62 points. The index, which excludes 'Z' category companies, is calculated on the basis of individual stock price movement under the 'A', 'B', 'G' and 'N' categories.

Previously, there was only one index that included all the securities of the stock exchange. Starting with a base of 350 points, the index rose as high as 3,648.75 points on November 5, 1996, when the market witnessed a 'bubble and bust'.

The broader DSE All Share Price Index was reintroduced on March 28, 2005, and the DSE-20 was introduced on January 1, 2001.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments