Losses pile up at state entities

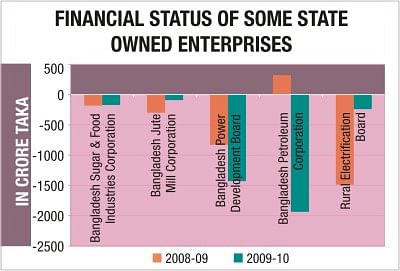

Losses incurred by state-owned enterprises increased by 38 percent to Tk 4,130 crore in the outgoing fiscal year.

The Power Development Board (PDB) and Bangladesh Petroleum Corporation (BPC) accounted for about 86 percent of the total loss.

According to the Economic Review 2010, PDB incurred losses worth Tk 1,428 crore in fiscal 2009-10, which was Tk 828 crore last year.

PDB officials said the power plants in the public sector are run-down and their generation capacity has dropped. "This is not only contributing to the loss, but is also the reason for an increase in load-shedding," said one of the officials.

The government sells electricity at a price lower than production costs. It buys power from rental plants at much higher prices and sells for less, which inflates the loss figures.

PDB plans to buy 1,000-1,200 megawatts of electricity next fiscal year from the rental power plants. The loss will pile further up, the official said.

But the loss may go down, if the government adjusts the price of power, he said.

The Rural Electrification Board (REB) pared down losses: it suffered a loss of Tk 240 crore this fiscal year, down from Tk 1,488 crore a year ago.

BPC incurred the highest loss of Tk 1,936 crore in the current fiscal year, while it made a profit of Tk 322 crore last year.

Officials at the Energy Division said the prices of petroleum products fell on the international market because of global recession, which enabled BPC to profit last fiscal year.

But in the recent times, the prices of petroleum products are increasing and BPC is recording deeper losses.

Officials said BPC would have to supply furnace oil and diesel to the rental power plants at market price. This is a major concern, as it will increase losses, they said.

Of the 46 SOEs, 17 were in the red. The rest made a profit of Tk 4,001 crore in the current fiscal year. BTRC recorded the highest profit of Tk 2,074 crore.

Many state enterprises also failed to pay bank loans. Until February, default loans by the SOEs stood at 7 percent of total outstanding loans. The amount of outstanding loans was Tk 16,208 crore.

Bangladesh Jute Mills Corporation (BJMC) defaulted on Tk 687 crore, a third of its outstanding loans of Tk 2,466 crore. A high official of BJMC said the government has taken massive plans to reorganise the jute sector and if the plans are implemented, loan defaults will drop.

In his budget speech, Finance Minister AMA Muhith said: "To revive the jute sector, BJMC has been given Tk 1,092 crore in funds through cash and bank guarantees in the current fiscal year."

Bangladesh Textile Mills Corporation (BTMC) was second in terms of loan defaults: Tk 272 crore. About 99 percent of BTMC's outstanding loans are default loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments