Pubali Bank to expand horizon

Pubali Bank has undertaken massive expansion drives to cope with growing demand and become more competitive.

The largest private sector bank plans to expand its exchange houses to net more remittance and open offshore banking units and Islamic banking segments for the first time. The bank has also taken a move to automate its 386 branches to render faster services to clients.

The bank will also boost its security trading business.

“The plans are part of efforts to turn Pubali into a highly competitive and technology driven bank of international standards," said Helal Ahmed Chowdhury, the bank's managing director.

The bank recently got permission from Bangladesh Bank to open two exchange houses -- one in the United Kingdom and the other in Malaysia -- owned fully by the bank. The bank however had applied for seven exchange houses in seven countries. The other countries it wished to expand to are Italy, USA, UAE, Spain and Singapore.

Pubali expects the central bank nod for the other five exchange houses, its MD said.

Currently, the bank is linked with 60 exchange houses in different countries and has corresponding banking facilities with around 300 banks across the globe, to channel remittance from Bangladeshi expatriates. Pubali also subscribes to Western Union, a money transfer service company.

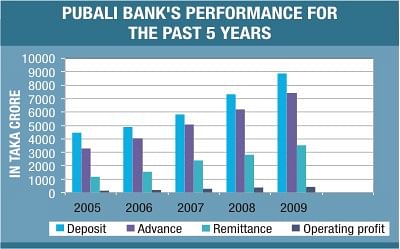

In 2009, the bank channelled Tk 3,525 crore as remittance, a 25 percent growth from the previous year.

“Arrangements have been made to introduce Islamic banking at two branches -- one in Dhaka and the other in Sylhet -- by this month,” said Chowdhury, who has over three decades of banking experience.

Islamic banking is growing faster than conventional banking in Bangladesh. As many as seven commercial banks operate now as full-fledged Islamic banks in the country and nearly a dozen banks have Islamic banking segments.

For the first time, Pubali allowed opening of two offshore banking branches in Gulshan in Dhaka and Agrabad in Chittagong, by which the bank will be able to lend in foreign currencies.

Nearly 20 banks, including foreign banks in Bangladesh, have now offshore banking licences.

Bankers think rising reserves and remittance are the decisive factors for the local banks to peg offshore banking business, once dominated by a few foreign banks.

Pubali is also working in full swing to automate its huge network of 386 branches.

“One hundred branches will come online by this year,” said the bank boss. Those branches have already been connected with internet, Chowdhury added.

After launching automation services, the bank will move to introduce phone and SMS banking by this year, he said.

Bengali entrepreneurs established Pubali Bank in 1959 in the then Pakistan. After independence in 1971, like others, the bank was taken over by the government. In the early 1980s, the bank was again handed over to the private sector.

At the end of 2009, the bank's deposits stood at Tk 8,889.54 crore, while advances (investments) reached Tk 7,420 crore. The operating profit rose to Tk 412 crore in 2009 from Tk 365 crore a year ago.

Non-performing loans of the bank came down to just 2.96 percent at the end of 2009 from 18.40 percent in 2004.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments